M941 Form

What is the M941

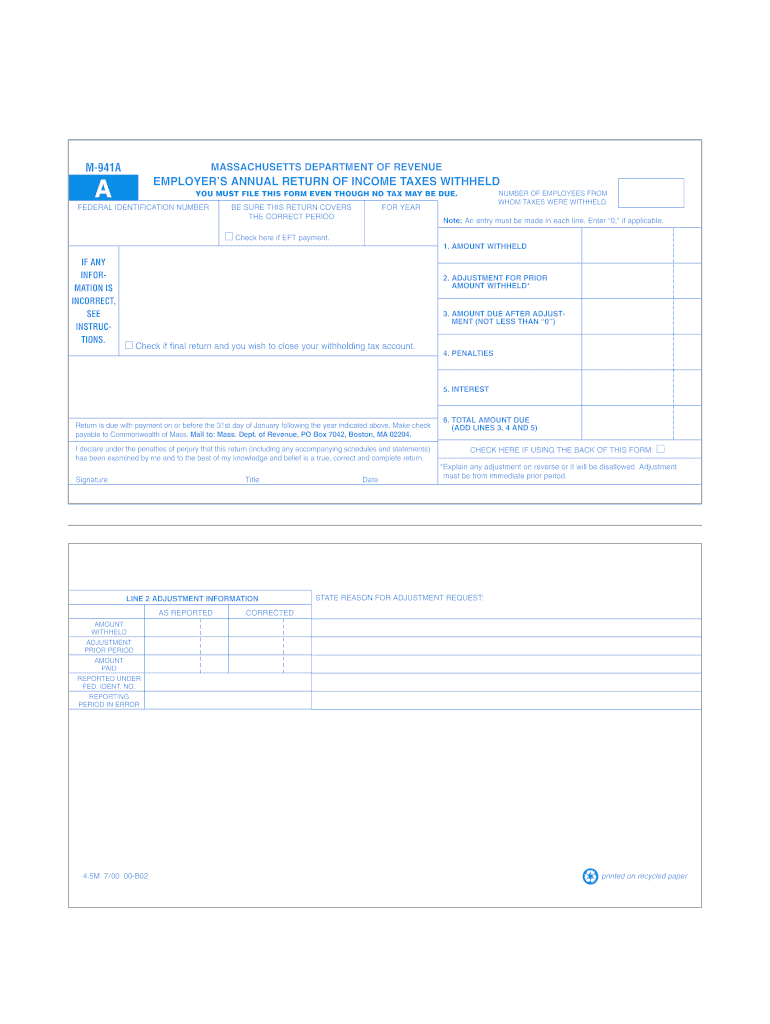

The M941, commonly referred to as the 941a annual form, is a tax document used by employers in the United States to report income taxes withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax regulations. It provides the Internal Revenue Service (IRS) with crucial information regarding the amount of wages paid and the taxes withheld, thereby contributing to accurate tax reporting and collection.

Steps to complete the M941

Completing the M941 involves several important steps to ensure accuracy and compliance. First, gather all necessary payroll records, including employee wages and tax withholdings. Next, accurately fill out the form, ensuring that all sections, such as total wages and taxes withheld, are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the M941 is crucial for compliance. Employers must file the M941 annually, typically by January 31 of the following year. It is important to keep track of these dates to avoid late fees and penalties. Additionally, employers should be aware of any changes in deadlines due to holidays or IRS announcements.

Legal use of the M941

The legal use of the M941 is governed by IRS regulations. Employers are required to file this form to report tax withholdings accurately. Failure to do so can result in penalties and interest charges. It is essential for employers to maintain accurate records and ensure that the form is completed in compliance with IRS guidelines to avoid legal issues.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the M941. These guidelines include instructions on how to report wages, calculate taxes withheld, and the importance of accurate record-keeping. Employers should familiarize themselves with these guidelines to ensure they meet all requirements and avoid potential audits or penalties.

Required Documents

To complete the M941, employers must gather several required documents. These typically include payroll records that detail employee wages, tax withholding amounts, and any other relevant financial information. Having these documents readily available ensures that the form can be completed accurately and submitted on time.

Form Submission Methods (Online / Mail / In-Person)

The M941 can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient method, allowing for quicker processing times. For those who prefer traditional methods, mailing the completed form to the appropriate IRS address is also acceptable. In-person submissions may be made at local IRS offices, though this option may be less common.

Quick guide on how to complete m941

Complete M941 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage M941 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign M941 seamlessly

- Find M941 and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your files or redact sensitive data with tools specifically designed for that function by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to secure your modifications.

- Choose how you want to deliver your document, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign M941 while ensuring effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m941

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Massachusetts Revenue 941A and how does it relate to airSlate SignNow?

The Massachusetts Revenue 941A is a tax form used by businesses to report and pay certain state payroll taxes. With airSlate SignNow, you can easily eSign and submit this form electronically, ensuring compliance and streamlining your tax processes.

-

How can airSlate SignNow help me manage my Massachusetts Revenue 941A filings?

airSlate SignNow provides tools to automate and securely manage your Massachusetts Revenue 941A filings. Businesses can create templates, collect signatures, and store completed forms, making tax compliance simpler and more efficient.

-

Is airSlate SignNow pricing competitive for businesses dealing with Massachusetts Revenue 941A?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes. Our pricing plans are designed to accommodate those who need to file forms like Massachusetts Revenue 941A without breaking the bank.

-

What features does airSlate SignNow offer for handling Massachusetts Revenue 941A documents?

airSlate SignNow includes features such as customizable templates, in-app signing, secure cloud storage, and automated reminders. These tools will help ensure that your Massachusetts Revenue 941A documents are signed and processed on time.

-

Can I integrate airSlate SignNow with other software for my Massachusetts Revenue 941A processing?

Absolutely! airSlate SignNow integrates seamlessly with several business applications, including accounting and ERP systems. This allows for a streamlined workflow when managing your Massachusetts Revenue 941A and other essential documents.

-

What are the benefits of using airSlate SignNow for Massachusetts Revenue 941A forms?

Using airSlate SignNow improves accuracy and efficiency when processing Massachusetts Revenue 941A forms. The platform reduces paperwork, minimizes the risk of errors, and accelerates the filing process, which helps your business stay compliant.

-

Is airSlate SignNow secure for submitting Massachusetts Revenue 941A documents?

Yes, airSlate SignNow prioritizes security, utilizing top-notch encryption and compliance with legal standards. You can confidently submit your Massachusetts Revenue 941A documents, knowing that sensitive information is well protected.

Get more for M941

Find out other M941

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe