Form RI 1040X R Tax Ri 2014

What is the Form RI 1040X R Tax Ri

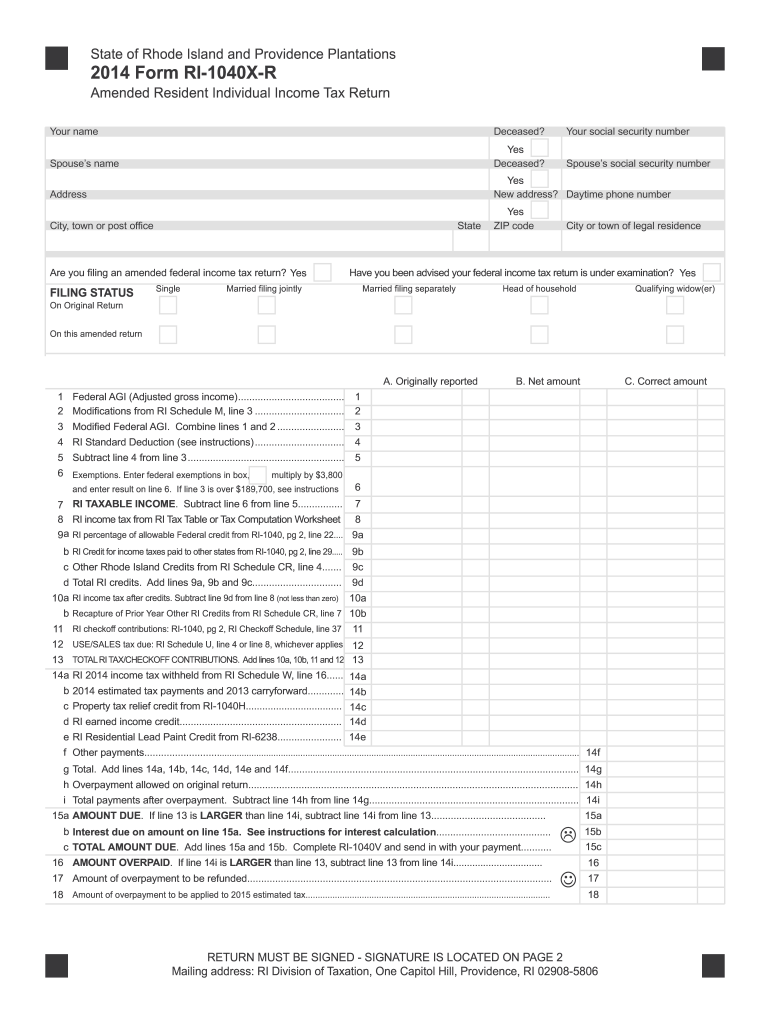

The Form RI 1040X R Tax Ri is a tax amendment form used by residents of Rhode Island to correct errors on their previously filed state income tax returns. This form allows taxpayers to make adjustments to their income, deductions, or credits, ensuring that their tax obligations are accurate. It is essential for individuals who have discovered mistakes after submitting their original returns, as it provides a legal avenue to rectify these errors and potentially claim refunds or reduce tax liabilities.

How to use the Form RI 1040X R Tax Ri

Using the Form RI 1040X R Tax Ri involves several steps. First, obtain the form from the Rhode Island Division of Taxation website or other authorized sources. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Clearly indicate the changes being made compared to your original return, and provide explanations for each amendment. Finally, sign and date the form before submitting it to the appropriate tax authority.

Steps to complete the Form RI 1040X R Tax Ri

Completing the Form RI 1040X R Tax Ri requires careful attention to detail. Follow these steps for accurate completion:

- Gather your original tax return and any relevant documentation.

- Clearly state the tax year for the return you are amending.

- List the changes you are making, including any additional income or deductions.

- Provide a detailed explanation for each change in the designated section.

- Calculate any new tax amounts owed or refunds due based on the amendments.

- Sign and date the form to validate your submission.

Legal use of the Form RI 1040X R Tax Ri

The legal use of the Form RI 1040X R Tax Ri is governed by state tax regulations. This form is recognized as a legitimate document for amending tax returns, provided it is completed accurately and submitted within the appropriate time frame. Taxpayers must ensure that all information is truthful and complete, as inaccuracies could lead to penalties or legal consequences. It is advisable to keep copies of the amended return and any supporting documents for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Form RI 1040X R Tax Ri are crucial for compliance. Generally, the form must be submitted within three years from the original due date of the return being amended or within one year of the date the tax was paid, whichever is later. Taxpayers should be aware of these timelines to avoid penalties and ensure that any potential refunds are claimed promptly.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form RI 1040X R Tax Ri through various methods. Typically, the form can be mailed to the Rhode Island Division of Taxation. Some taxpayers may have the option to file electronically through authorized e-filing services. It is essential to check the latest guidelines from the Rhode Island Division of Taxation to determine the available submission methods and any specific requirements for each.

Quick guide on how to complete 2014 form ri 1040x r tax ri

Effortlessly prepare Form RI 1040X R Tax Ri on any device

The management of documents online has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to quickly create, edit, and electronically sign your documents without delays. Handle Form RI 1040X R Tax Ri on any platform using the airSlate SignNow apps available for Android or iOS, and simplify any document-related process today.

How to edit and electronically sign Form RI 1040X R Tax Ri easily

- Obtain Form RI 1040X R Tax Ri and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious searches for forms, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form RI 1040X R Tax Ri and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form ri 1040x r tax ri

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

I haven't filled the tax forms for 2011, 2012, and 2013 and Glacier Tax Preparation only allows me to do so for 2014. I entered the USA in 2011. How can I file those now?

I don't think you can file taxes for 2011 and 2012 this year.But as you did not have any income in those two years. It is fine even if you dont file taxes.Study how to file taxes, how to determine residency status and which forms you should submit when you are in F1 VisaF1(CPT, OPT), J1, M1 Visa tax returns filing : All information IRS wants you to know - Grad Schools BlogThough I am not expert in tax laws, I figured this from my case and few other friends.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the 2014 form ri 1040x r tax ri

How to create an electronic signature for your 2014 Form Ri 1040x R Tax Ri online

How to make an electronic signature for your 2014 Form Ri 1040x R Tax Ri in Google Chrome

How to make an electronic signature for putting it on the 2014 Form Ri 1040x R Tax Ri in Gmail

How to create an electronic signature for the 2014 Form Ri 1040x R Tax Ri right from your smartphone

How to generate an electronic signature for the 2014 Form Ri 1040x R Tax Ri on iOS

How to create an electronic signature for the 2014 Form Ri 1040x R Tax Ri on Android

People also ask

-

What is Form RI 1040X R Tax RI and who needs it?

Form RI 1040X R Tax RI is an amended tax return form used by residents of Rhode Island to correct errors on previously filed state income tax returns. If you have made mistakes on your original Form RI 1040, you will need to file the 1040X R to ensure your tax records are accurate.

-

How can airSlate SignNow assist with completing Form RI 1040X R Tax RI?

airSlate SignNow simplifies the process of filling out Form RI 1040X R Tax RI by providing users with intuitive templates and eSignature capabilities. You can easily edit, sign, and send the form directly from the platform, ensuring that your amended tax return is processed quickly.

-

Is there a fee for using airSlate SignNow for Form RI 1040X R Tax RI?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including a cost-effective solution for processing Form RI 1040X R Tax RI. Users can choose from monthly or annual subscriptions that provide access to all features without hidden fees.

-

What are the key features of airSlate SignNow for handling Form RI 1040X R Tax RI?

Key features of airSlate SignNow for managing Form RI 1040X R Tax RI include drag-and-drop document upload, customizable templates, secure eSigning, and seamless integration with other software. These features make the tax amendment process smooth and efficient.

-

Can I integrate airSlate SignNow with my accounting software for Form RI 1040X R Tax RI?

Yes, airSlate SignNow integrates with various accounting software solutions, allowing you to connect and manage your financial documents, including Form RI 1040X R Tax RI, seamlessly. This integration helps streamline your workflow, saving you time and effort.

-

What are the benefits of using airSlate SignNow for Form RI 1040X R Tax RI?

Using airSlate SignNow for Form RI 1040X R Tax RI provides benefits such as increased efficiency, improved accuracy, and enhanced security for your sensitive tax information. The platform's user-friendly interface allows you to complete your amendments quickly, minimizing delays.

-

Is airSlate SignNow suitable for businesses of all sizes handling Form RI 1040X R Tax RI?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an ideal choice for handling Form RI 1040X R Tax RI. Whether you're a small business or a large enterprise, the platform scales to your needs and helps manage tax documentation efficiently.

Get more for Form RI 1040X R Tax Ri

- State of michigan file no probate court letters of form

- Hawaiiinternal revenue service form

- Form it 641 manufacturers real property tax credit tax year

- Form packetsdomestic violence restraining order without

- Ok form ef 2019 2022 fill out tax template online

- Form it 212 investment credit tax year 2022

- 2022 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

- Hawaii income tax forms by tax year e file your taxes

Find out other Form RI 1040X R Tax Ri

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word