Illinois Itr Form

What is the Illinois ITR?

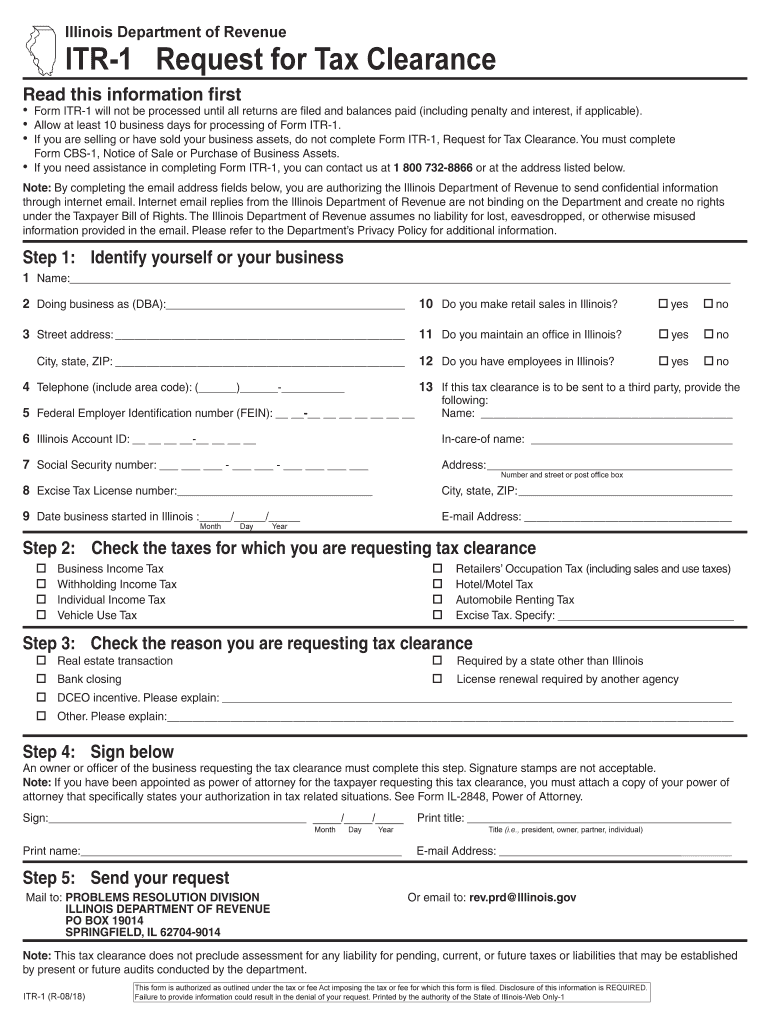

The Illinois ITR, or Illinois Tax Request, is a form used by individuals and businesses to request a tax clearance certificate from the Illinois Department of Revenue. This document confirms that all tax obligations have been met, which is essential for various transactions, such as selling property or applying for loans. The ITR is crucial for maintaining compliance with state tax regulations and ensuring that taxpayers can conduct their business without legal hindrances.

Steps to Complete the Illinois ITR

Completing the Illinois ITR involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information, including your Social Security number or Employer Identification Number.

- Fill out the ITR form accurately, ensuring all details are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online through the Illinois Department of Revenue website or by mailing it to the appropriate office.

Following these steps carefully will help streamline the process and minimize potential delays.

Legal Use of the Illinois ITR

The Illinois ITR has specific legal implications. It serves as proof that a taxpayer has settled all tax liabilities, making it a vital document for legal transactions. When presented to lenders, buyers, or government entities, the ITR verifies compliance with state tax laws. Failure to provide a valid ITR can result in legal complications, including fines or restrictions on business operations.

Required Documents

To successfully complete the Illinois ITR, certain documents are necessary. These may include:

- Previous tax returns filed with the Illinois Department of Revenue.

- Proof of payment for any outstanding taxes.

- Identification documents, such as a driver’s license or state ID.

- Any correspondence from the Illinois Department of Revenue regarding tax status.

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

The Illinois ITR can be submitted through various methods, offering flexibility to taxpayers. The available submission methods include:

- Online submission via the Illinois Department of Revenue’s official website.

- Mailing the completed form to the designated office.

- In-person submission at local Department of Revenue offices.

Choosing the right submission method depends on personal preference and urgency.

Penalties for Non-Compliance

Non-compliance with the Illinois ITR requirements can lead to several penalties. Taxpayers may face:

- Fines for failing to file the ITR on time.

- Increased scrutiny from the Illinois Department of Revenue.

- Potential legal action for unresolved tax obligations.

Understanding these penalties emphasizes the importance of timely and accurate submission of the ITR.

Quick guide on how to complete illinois itr

Complete Illinois Itr effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Illinois Itr on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Illinois Itr with ease

- Find Illinois Itr and click on Get Form to begin.

- Use the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Modify and eSign Illinois Itr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois itr

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is an ITR 1 request in airSlate SignNow?

An ITR 1 request in airSlate SignNow refers to the process of initiating the electronic signing of tax documents. With our platform, businesses can efficiently manage their ITR 1 requests, ensuring that all necessary signatures are obtained quickly and securely.

-

How does airSlate SignNow simplify the ITR 1 request process?

AirSlate SignNow simplifies the ITR 1 request process by providing an intuitive interface that allows users to share documents with signers effortlessly. Additionally, automated reminders and tracking features ensure that your ITR 1 requests do not get delayed.

-

What are the pricing options for airSlate SignNow when handling ITR 1 requests?

AirSlate SignNow offers various pricing plans designed to accommodate different business sizes and needs regarding ITR 1 requests. Depending on your selected plan, you can benefit from features such as unlimited eSignatures, document templates, and advanced security options.

-

Can I integrate airSlate SignNow with other software for managing ITR 1 requests?

Yes, airSlate SignNow supports integrations with popular applications such as Google Drive, Dropbox, and Salesforce. This functionality allows users to streamline their workflow and enhance the management of their ITR 1 requests without switching between multiple platforms.

-

What security measures does airSlate SignNow implement for ITR 1 requests?

AirSlate SignNow takes the security of your ITR 1 requests seriously by implementing advanced encryption and secure access controls. Our platform complies with industry standards to ensure that all documents are protected during the signing process.

-

How can airSlate SignNow improve the efficiency of handling ITR 1 requests?

By using airSlate SignNow, businesses can signNowly improve the efficiency of handling ITR 1 requests through features like bulk sending, real-time tracking, and automated workflows. This streamlining reduces administrative time and accelerates the overall process.

-

What benefits does airSlate SignNow offer for businesses processing ITR 1 requests?

Businesses using airSlate SignNow for ITR 1 requests can enjoy benefits such as lower operational costs, faster turnaround times, and enhanced document visibility. Our solution empowers teams to focus more on strategic tasks rather than administrative paperwork.

Get more for Illinois Itr

- Wellstar discharge papers form

- Function notation and evaluating functions practice worksheet form

- Schengen visa questionnaire form

- Police letter of good conduct form

- Medibank postal address form

- Cvs caremark appeals department form

- Hsmv 87244 form

- Application for notary public for the state of tennessee form

Find out other Illinois Itr

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document