El102 2015-2026

What is the El102

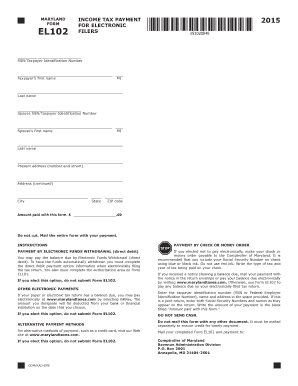

The El102 is a tax form used by Maryland residents to report income and calculate their tax obligations. Specifically, this form is essential for individuals who qualify as Maryland el filers, allowing them to submit their income information electronically. The El102 serves as a streamlined method for taxpayers to fulfill their reporting requirements while ensuring compliance with state tax laws.

How to use the El102

Using the El102 involves several straightforward steps. First, gather all necessary financial documents, including W-2s and 1099s, which detail your income. Next, access the El102 form through the Maryland State Comptroller's website or a trusted eSignature platform. Fill out the form accurately, ensuring that all income sources are reported. Once completed, submit the form electronically for faster processing and confirmation.

Steps to complete the El102

Completing the El102 requires careful attention to detail. Follow these steps:

- Review your income sources and collect relevant documents.

- Access the El102 form online.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all income accurately, ensuring you include any deductions or credits you may qualify for.

- Review the completed form for accuracy.

- Submit the form electronically and save a copy for your records.

Legal use of the El102

The El102 is legally binding when completed and submitted according to Maryland state regulations. To ensure its legality, the form must be signed electronically, complying with the ESIGN and UETA acts. This means that the electronic signature used must meet specific criteria to be considered valid in a court of law. Utilizing a reliable eSignature solution can help maintain compliance and enhance the integrity of your submission.

Filing Deadlines / Important Dates

Timely filing of the El102 is crucial to avoid penalties. Generally, the deadline for submitting the El102 aligns with the federal tax filing deadline, which is typically April 15. However, it is advisable to check for any specific state extensions or changes in deadlines each tax year. Marking these dates on your calendar can help ensure that you remain compliant with Maryland tax laws.

Required Documents

To complete the El102, certain documents are necessary. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources

- Documentation for any deductions or credits claimed

Having these documents ready will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to submit the El102 on time or inaccuracies in reporting can lead to penalties. Maryland imposes fines for late filings and may charge interest on any unpaid taxes. It is essential to file accurately and on time to avoid these financial repercussions. Understanding the potential penalties can motivate timely and correct submissions.

Quick guide on how to complete el102

Prepare El102 effortlessly on any device

Virtual document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without interruptions. Handle El102 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to alter and eSign El102 with ease

- Obtain El102 and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to missing or mislaid documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device you prefer. Modify and eSign El102 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct el102

Create this form in 5 minutes!

How to create an eSignature for the el102

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow for Maryland EL filers?

airSlate SignNow is a digital document signing platform that simplifies the signing process for Maryland EL filers. It enables businesses to send and eSign documents seamlessly, ensuring compliance with state regulations. With its user-friendly interface, users can easily navigate through their tasks, making it an ideal choice for Maryland EL filers.

-

How does airSlate SignNow benefit Maryland EL filers?

Maryland EL filers can benefit from airSlate SignNow by streamlining their document workflows and reducing the time spent on paperwork. The platform ensures secure and legally binding electronic signatures, which enhances the efficiency of filing processes. Additionally, its integration with other software solutions can help Maryland EL filers automate their workflows.

-

What features does airSlate SignNow offer for Maryland EL filers?

airSlate SignNow offers a variety of features tailored for Maryland EL filers, including customizable templates, team collaboration tools, and detailed status tracking. The platform also provides advanced security measures to protect sensitive information during the signing process. These features empower Maryland EL filers to manage their documents efficiently.

-

What are the pricing options for Maryland EL filers using airSlate SignNow?

airSlate SignNow offers competitive pricing plans suitable for Maryland EL filers, including options for individuals and businesses. Users can choose from monthly or annual subscriptions based on their needs. Additionally, airSlate SignNow often provides promotional discounts, making it cost-effective for Maryland EL filers.

-

Can Maryland EL filers integrate airSlate SignNow with other software?

Yes, Maryland EL filers can integrate airSlate SignNow with various software applications, including CRM systems and accounting tools. This integration facilitates a smoother workflow and ensures that all document-related tasks are connected. Such capabilities make it easier for Maryland EL filers to manage their operations more effectively.

-

Is airSlate SignNow compliant with Maryland state regulations for electronic signatures?

airSlate SignNow is compliant with Maryland state regulations regarding electronic signatures, ensuring that Maryland EL filers can use it confidently. The platform adheres to the ESIGN and UETA acts, which govern the legality of electronic signatures across the nation. This compliance is critical for Maryland EL filers seeking reliable solutions.

-

Does airSlate SignNow provide support for Maryland EL filers?

Yes, airSlate SignNow offers dedicated support for Maryland EL filers to assist them in using the platform effectively. Support options include live chat, email, and a comprehensive knowledge base. This ensures that Maryland EL filers can get help whenever they encounter challenges.

Get more for El102

Find out other El102

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors