Wisconsin Sales and Use Tax Exemption Form 2018

What is the Wisconsin Sales and Use Tax Exemption Form

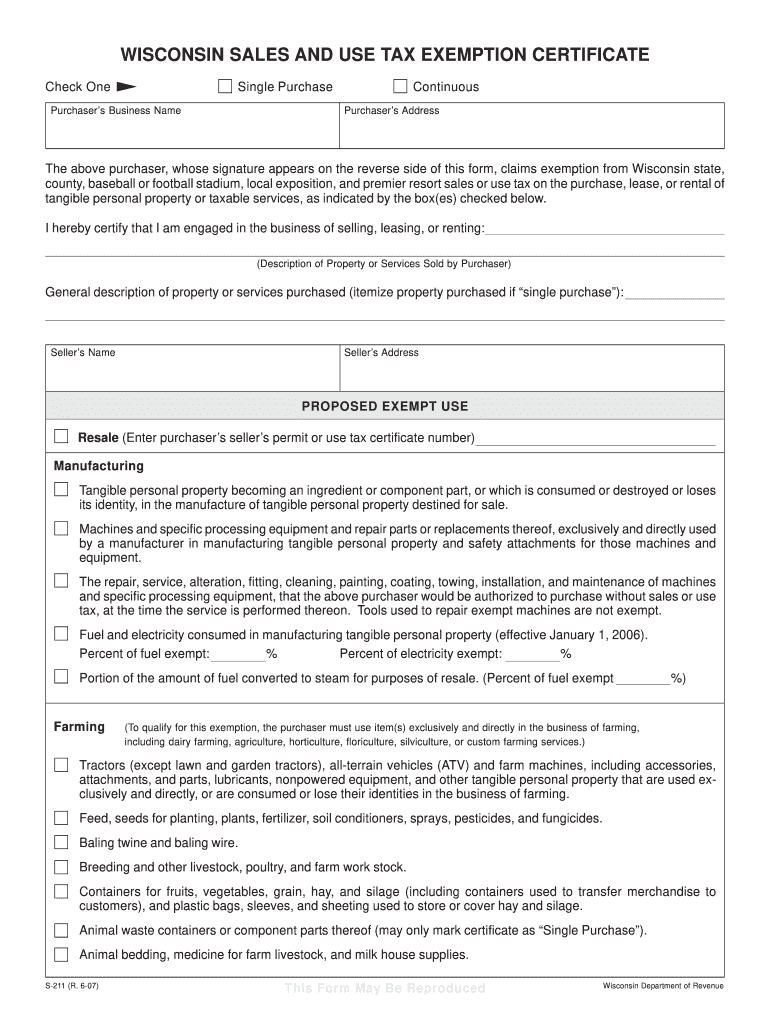

The Wisconsin Sales and Use Tax Exemption Form is a crucial document that allows eligible purchasers to claim exemption from sales and use tax on specific purchases. This form is primarily used by organizations and individuals who meet certain criteria, such as non-profit organizations, government entities, and certain businesses. By submitting this form, eligible parties can avoid paying sales tax on qualifying items, thus reducing their overall costs.

How to Use the Wisconsin Sales and Use Tax Exemption Form

To effectively use the Wisconsin Sales and Use Tax Exemption Form, individuals or organizations must first determine their eligibility for tax exemption. Once eligibility is established, the form must be filled out accurately, providing necessary details such as the purchaser's name, address, and the nature of the exempt purchase. After completing the form, it should be presented to the seller at the time of purchase to validate the exemption. It is essential to retain a copy for record-keeping purposes.

Steps to Complete the Wisconsin Sales and Use Tax Exemption Form

Completing the Wisconsin Sales and Use Tax Exemption Form involves several key steps:

- Obtain the form from the appropriate state resources or authorized providers.

- Fill in the required information, including your name, address, and the reason for the exemption.

- Specify the items being purchased that qualify for the exemption.

- Sign and date the form to certify its accuracy.

- Present the completed form to the seller at the time of purchase.

Key Elements of the Wisconsin Sales and Use Tax Exemption Form

The Wisconsin Sales and Use Tax Exemption Form includes several key elements that must be accurately completed for the form to be valid. These elements typically include:

- Purchaser Information: Name and address of the individual or organization claiming the exemption.

- Seller Information: Name and address of the seller from whom the purchase is being made.

- Exemption Reason: A clear statement of the reason for the exemption, such as non-profit status or government purchase.

- Item Description: A detailed description of the items being purchased that qualify for the exemption.

- Signature: The signature of the purchaser or an authorized representative, along with the date.

Legal Use of the Wisconsin Sales and Use Tax Exemption Form

The legal use of the Wisconsin Sales and Use Tax Exemption Form is governed by specific state regulations. To ensure compliance, it is important to understand the legal implications of using this form. The form must be used only for eligible purchases, and providing false information can lead to penalties. Additionally, sellers are required to keep the form on file for their records, as it serves as proof of the tax-exempt status of the sale.

Eligibility Criteria

Eligibility for using the Wisconsin Sales and Use Tax Exemption Form is defined by specific criteria set forth by state law. Generally, the following entities may qualify:

- Non-profit organizations recognized under IRS regulations.

- Government agencies at the federal, state, or local level.

- Certain educational institutions.

- Businesses purchasing items for resale.

It is essential for applicants to verify their eligibility before submitting the form to avoid complications during the purchasing process.

Quick guide on how to complete wisconsin sales and use tax exemption form

Complete Wisconsin Sales And Use Tax Exemption Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle Wisconsin Sales And Use Tax Exemption Form on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to modify and electronically sign Wisconsin Sales And Use Tax Exemption Form effortlessly

- Locate Wisconsin Sales And Use Tax Exemption Form and then click Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Wisconsin Sales And Use Tax Exemption Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin sales and use tax exemption form

Create this form in 5 minutes!

How to create an eSignature for the wisconsin sales and use tax exemption form

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Wisconsin sales and use tax exemption form?

The Wisconsin sales and use tax exemption form is a document that allows eligible businesses to claim exemption from paying sales tax on certain purchases. By submitting this form, businesses can ensure they are complying with state tax laws while maximizing their savings on taxable items. This form is essential for organizations seeking to manage their expenses effectively.

-

How can airSlate SignNow help with the Wisconsin sales and use tax exemption form?

airSlate SignNow provides an easy-to-use platform for businesses to fill out, sign, and send the Wisconsin sales and use tax exemption form. Our digital solution streamlines the process, reducing the need for paperwork and ensuring signatures are collected securely and efficiently. This helps businesses save time and stay organized.

-

Is airSlate SignNow cost-effective for submitting the Wisconsin sales and use tax exemption form?

Yes, airSlate SignNow offers a cost-effective solution to manage and submit your Wisconsin sales and use tax exemption form. Our pricing plans are designed to fit various budget needs, ensuring that businesses of all sizes can access our platform without breaking the bank. The savings on postage and paper will further enhance your cost efficiency.

-

What features does airSlate SignNow offer for tax exemption forms?

airSlate SignNow provides several features tailored to the management of the Wisconsin sales and use tax exemption form, including customizable templates, secure eSigning, and real-time tracking of document status. These tools enhance compliance and streamline the process, making it hassle-free for businesses to obtain necessary approvals.

-

Are there any integrations available for managing the Wisconsin sales and use tax exemption form?

Absolutely! airSlate SignNow integrates seamlessly with various platforms and applications, enabling users to manage the Wisconsin sales and use tax exemption form within their existing workflow. Popular integrations include CRM software, accounting tools, and cloud storage services, maximizing efficiency and collaboration across departments.

-

Can I store my Wisconsin sales and use tax exemption form securely with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and offers robust document storage solutions for your Wisconsin sales and use tax exemption form. All documents are encrypted, ensuring that sensitive information remains confidential and accessible only to authorized users. This helps protect your business from potential data bsignNowes.

-

How does eSigning the Wisconsin sales and use tax exemption form work?

eSigning the Wisconsin sales and use tax exemption form with airSlate SignNow is simple and intuitive. After preparing your form, you can invite signers via email to review and provide their electronic signatures securely. Once completed, all parties receive a final copy, ensuring that everyone has a record of the approved document.

Get more for Wisconsin Sales And Use Tax Exemption Form

- Form 3 medicaid transportation

- Cp58 excel form

- Professional tax form 5 in gujarati format

- Ptax 340 tazewell co illinois form

- Bescheinigung fr die notwendigkeit der fahrzeugnutzung form

- Worksheet 2 past continuous resuelto form

- Dl 101 100295058 form

- Exceptions to recommendation of support master form

Find out other Wisconsin Sales And Use Tax Exemption Form

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease