Real Estate Withholding Certificate 593 C Form 2019

What is the Real Estate Withholding Certificate 593 C Form

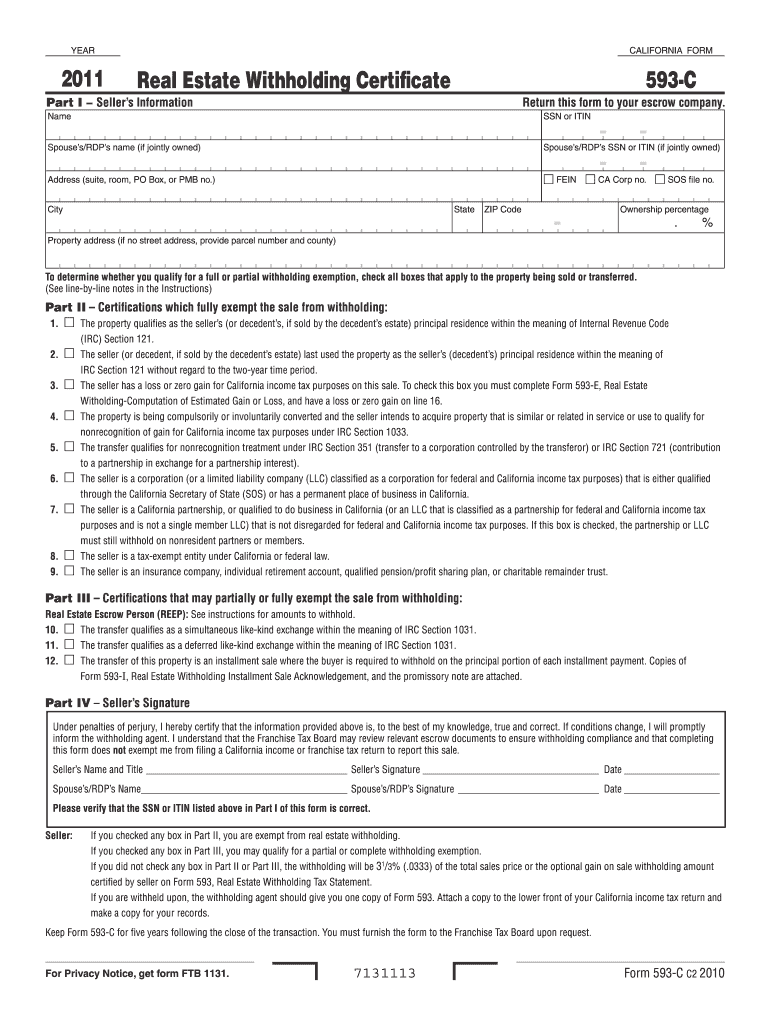

The Real Estate Withholding Certificate 593 C Form is a crucial document used in the context of real estate transactions in the United States. It is primarily utilized by the California Franchise Tax Board to ensure that taxes are withheld on the sale of real estate by non-resident sellers. This form serves to certify the seller's withholding status and provides necessary information regarding the transaction, including the seller's details and the amount being withheld. By completing this form, sellers can comply with state tax regulations and avoid potential penalties associated with non-compliance.

Steps to complete the Real Estate Withholding Certificate 593 C Form

Completing the Real Estate Withholding Certificate 593 C Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the seller's name, address, and taxpayer identification number. Next, provide details about the property being sold, including its address and sale price. After filling in the required information, review the form for any errors or omissions. It is also essential to sign and date the form to validate it. Finally, submit the completed form to the appropriate tax authority, either electronically or via mail, depending on the specific requirements.

How to obtain the Real Estate Withholding Certificate 593 C Form

The Real Estate Withholding Certificate 593 C Form can be obtained directly from the California Franchise Tax Board's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, some tax preparation software may offer this form as part of their services, allowing users to complete it digitally. Ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Legal use of the Real Estate Withholding Certificate 593 C Form

The legal use of the Real Estate Withholding Certificate 593 C Form is essential for ensuring that both buyers and sellers meet their tax obligations during real estate transactions. When a non-resident seller sells property in California, the withholding certificate helps determine the appropriate amount of tax to be withheld from the sale proceeds. Failure to use this form correctly can result in penalties for both the seller and the buyer, making it vital to understand and follow the legal requirements associated with this document.

Key elements of the Real Estate Withholding Certificate 593 C Form

The Real Estate Withholding Certificate 593 C Form includes several key elements that are critical for its completion and legal validity. These elements typically consist of the seller's personal information, such as name and address, as well as the property's details, including its sale price and location. Additionally, the form requires the seller to indicate their residency status and the amount of tax to be withheld. Accurate completion of these elements ensures compliance with tax laws and facilitates a smooth transaction process.

Filing Deadlines / Important Dates

Filing deadlines for the Real Estate Withholding Certificate 593 C Form are crucial for compliance with state tax regulations. Generally, the form must be submitted at the time of the sale, along with the payment of any withholding tax due. It is important to be aware of specific deadlines, as failure to file on time can lead to penalties and interest charges. Keeping track of these important dates ensures that sellers and buyers can fulfill their tax obligations without complications.

Quick guide on how to complete real estate withholding certificate 593 c 2011 form

Effortlessly prepare Real Estate Withholding Certificate 593 C Form on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly replacement for conventional printed and signed papers, allowing you to obtain the necessary form and store it securely online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Manage Real Estate Withholding Certificate 593 C Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Real Estate Withholding Certificate 593 C Form with ease

- Locate Real Estate Withholding Certificate 593 C Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes a few seconds and has the same legal validity as a traditional signature with wet ink.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form—via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from your preferred device. Edit and eSign Real Estate Withholding Certificate 593 C Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real estate withholding certificate 593 c 2011 form

Create this form in 5 minutes!

How to create an eSignature for the real estate withholding certificate 593 c 2011 form

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the Real Estate Withholding Certificate 593 C Form?

The Real Estate Withholding Certificate 593 C Form is a tax form used in California for the withholding of taxes from the sale of real estate. This certificate ensures that the appropriate amount of tax is withheld from the seller's proceeds. It's essential for real estate transactions involving sellers who are not residents of California.

-

How do I complete the Real Estate Withholding Certificate 593 C Form?

Completing the Real Estate Withholding Certificate 593 C Form involves providing information about the seller, the property, and the withholding calculations. The form must be filled out accurately to avoid any delays in the transaction. Assistance from a tax professional or real estate agent is recommended for proper completion.

-

What are the benefits of using airSlate SignNow for the Real Estate Withholding Certificate 593 C Form?

Using airSlate SignNow for the Real Estate Withholding Certificate 593 C Form streamlines the signing process, making it quicker and more efficient. It allows for secure eSigning, reduces paperwork, and provides a clear digital audit trail. These features enhance compliance and help to ensure a smooth closing process.

-

Are there any costs associated with the Real Estate Withholding Certificate 593 C Form?

While the Real Estate Withholding Certificate 593 C Form itself does not have a fee, there might be costs involved with eSigning and processing documents using platforms like airSlate SignNow. Their pricing is designed to be cost-effective for businesses, ensuring you only pay for what you use.

-

Can I integrate airSlate SignNow with other tools for handling the Real Estate Withholding Certificate 593 C Form?

Yes, airSlate SignNow offers various integrations with popular tools and platforms, enhancing your ability to manage the Real Estate Withholding Certificate 593 C Form efficiently. Integrations with CRM systems, cloud storage, and email applications help streamline workflows and improve document management.

-

How does airSlate SignNow ensure the security of the Real Estate Withholding Certificate 593 C Form?

AirSlate SignNow prioritizes the security of your documents, including the Real Estate Withholding Certificate 593 C Form, through encryption and secure access protocols. All documents are stored in a protected environment, ensuring that sensitive information remains confidential and safe from unauthorized access.

-

What features does airSlate SignNow offer for signing the Real Estate Withholding Certificate 593 C Form?

AirSlate SignNow provides features such as customizable workflows, automated reminders, and multi-party signing, making it easy to manage and sign the Real Estate Withholding Certificate 593 C Form. Users can track the status of each document in real-time, ensuring a seamless signing experience.

Get more for Real Estate Withholding Certificate 593 C Form

Find out other Real Estate Withholding Certificate 593 C Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors