Form 3805V Net Operating Loss NOL Computation and NOL 2019

What is the Form 3805V Net Operating Loss NOL Computation And NOL

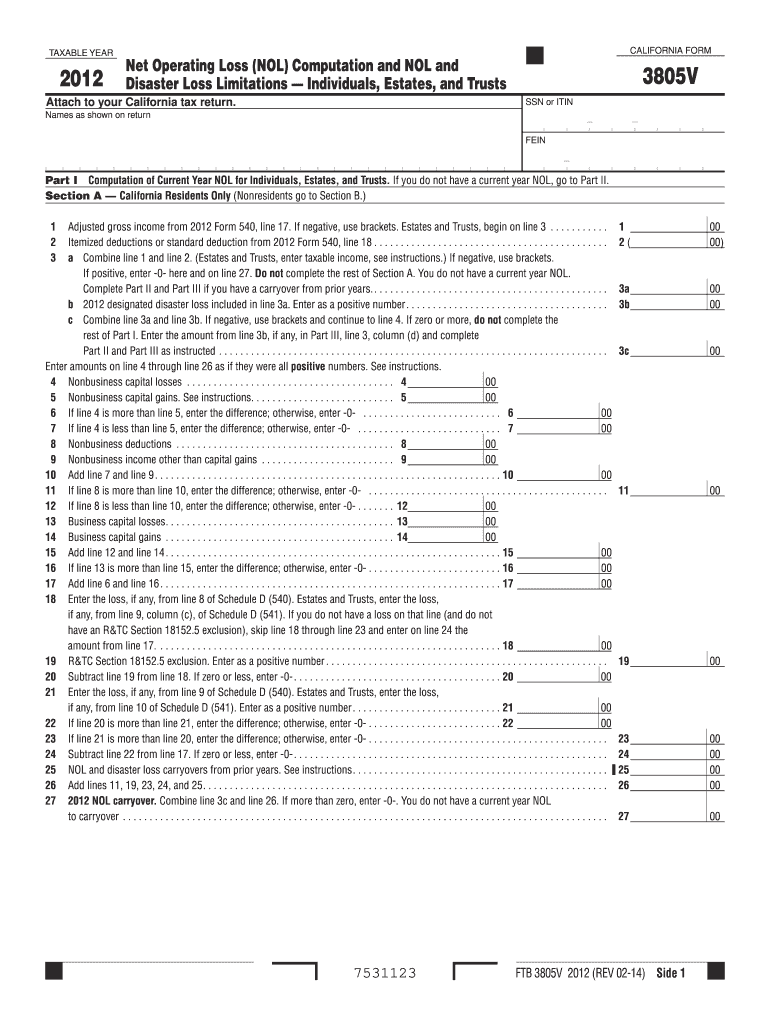

The Form 3805V is specifically designed for calculating net operating losses (NOL) for tax purposes. This form allows taxpayers to determine the amount of loss that can be carried back or forward to offset taxable income in other tax years. Understanding the details of this form is crucial for individuals and businesses that have experienced financial losses, as it can significantly impact their tax liabilities. The form includes sections that require detailed financial information, ensuring accurate computation of the NOL.

How to use the Form 3805V Net Operating Loss NOL Computation And NOL

Using the Form 3805V effectively involves understanding its structure and the information required. Taxpayers should begin by gathering all relevant financial documents, including income statements and expense reports. The form guides users through various calculations to determine the NOL, which can be applied to previous or future tax returns. It is essential to follow the instructions closely to ensure compliance with IRS regulations and to maximize potential tax benefits.

Steps to complete the Form 3805V Net Operating Loss NOL Computation And NOL

Completing the Form 3805V involves several key steps:

- Gather financial documentation, including income and expense records.

- Fill out the initial sections of the form, providing basic taxpayer information.

- Calculate total income and allowable deductions to determine the NOL.

- Complete the sections that detail how the NOL will be applied to other tax years.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 3805V Net Operating Loss NOL Computation And NOL

The legal use of the Form 3805V is governed by IRS regulations, which dictate how NOLs can be reported and utilized. To ensure that the form is legally valid, it must be completed accurately and submitted within the designated time frames. The IRS allows taxpayers to carry back NOLs to offset income in previous years or carry them forward to future tax years, providing flexibility in tax planning. Adhering to these guidelines is essential for maintaining compliance and avoiding penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3805V vary depending on the tax year and the taxpayer's situation. Generally, taxpayers must file the form by the due date of their tax return, including any extensions. It is crucial to be aware of these deadlines to avoid late penalties and ensure that the NOL is applied correctly. Keeping track of important dates can help taxpayers maximize their tax benefits and maintain compliance with IRS requirements.

Eligibility Criteria

Eligibility for using the Form 3805V is primarily determined by the presence of a net operating loss. Taxpayers must have incurred a loss in their business or personal finances to qualify for this form. Additionally, there are specific income thresholds and types of income that may affect eligibility. Understanding these criteria is essential for taxpayers seeking to utilize the NOL effectively and ensure compliance with IRS regulations.

Quick guide on how to complete 2018 form 3805v net operating loss nol computation and nol

Complete Form 3805V Net Operating Loss NOL Computation And NOL effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents efficiently without delays. Manage Form 3805V Net Operating Loss NOL Computation And NOL on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 3805V Net Operating Loss NOL Computation And NOL with ease

- Locate Form 3805V Net Operating Loss NOL Computation And NOL and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Decide how you want to send your form—by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Form 3805V Net Operating Loss NOL Computation And NOL to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 3805v net operating loss nol computation and nol

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 3805v net operating loss nol computation and nol

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2012 nol in the context of airSlate SignNow?

The 2012 nol refers to a specific version of the Notice of Loss form necessary for various legal and business processes. With airSlate SignNow, users can easily eSign and manage the 2012 nol form digitally, streamlining document workflows.

-

How does airSlate SignNow's pricing structure accommodate businesses needing the 2012 nol?

airSlate SignNow offers flexible pricing plans designed for businesses of all sizes, ensuring easy access to essential features, including managing the 2012 nol. This allows teams to scale their eSigning solutions as needed without breaking the bank.

-

What features does airSlate SignNow provide for handling the 2012 nol?

airSlate SignNow offers robust features such as customizable templates, automatic reminders, and secure cloud storage specifically for documents like the 2012 nol. These tools enhance productivity and ensure compliance during the signing process.

-

What are the benefits of using airSlate SignNow for the 2012 nol?

Using airSlate SignNow for the 2012 nol helps reduce turnaround time and eliminates the hassle of paper-based processes. The eSigning platform enhances collaboration and provides audit trails, ensuring transparency and security.

-

Is there integration support for airSlate SignNow with other applications when handling the 2012 nol?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Workspace and Microsoft Office, allowing users to manage the 2012 nol more effectively. These integrations foster streamlined workflows and enhance overall productivity.

-

Can airSlate SignNow assist with mobile eSigning of the 2012 nol?

Absolutely! airSlate SignNow provides a mobile-friendly platform enabling users to eSign the 2012 nol from anywhere at any time. This flexibility supports remote work and facilitates quick document handling on the go.

-

How secure is the process of eSigning the 2012 nol with airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption methods and compliance with industry standards for eSigning the 2012 nol. Users can trust that their sensitive information is protected throughout the signing process.

Get more for Form 3805V Net Operating Loss NOL Computation And NOL

- Vacation request form 35958216

- Bop visitation form

- Marine corps letterhead form

- Sample cms 1500 claim form blue cross and blue shield of south

- Boscovs return policy form

- Ftra form

- Department of the army unit letterhead wamc amedd army form

- Flow sheet for measuring symptoms for opiate withdrawals over a period of time form

Find out other Form 3805V Net Operating Loss NOL Computation And NOL

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF