Mw506nrs Form 2021

What is the Mw506nrs Form

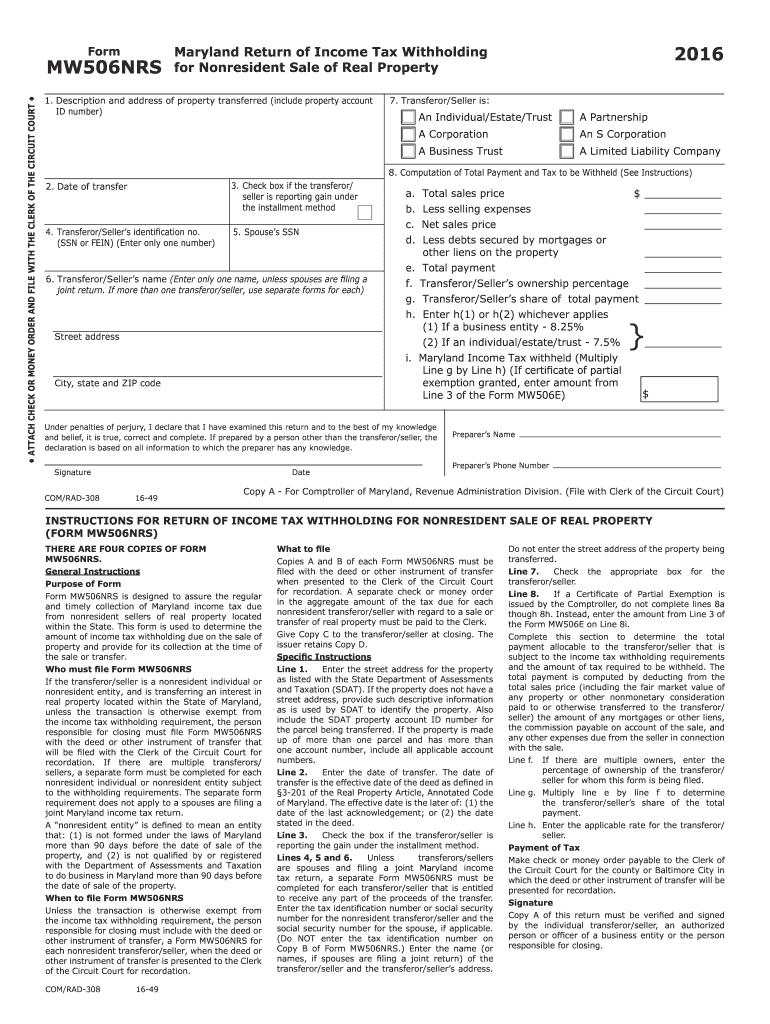

The Mw506nrs Form is a specific document used in the United States, primarily for tax purposes. It is designed for businesses and individuals to report certain types of income and deductions accurately. Understanding the purpose of this form is essential for compliance with tax regulations and to avoid potential penalties. The Mw506nrs Form is often required by state tax authorities and serves as an important tool for maintaining transparent financial records.

How to use the Mw506nrs Form

Using the Mw506nrs Form involves several key steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. Depending on the requirements, the Mw506nrs Form can be submitted electronically or via mail, ensuring it reaches the appropriate tax authority by the specified deadline.

Steps to complete the Mw506nrs Form

Completing the Mw506nrs Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Begin filling out the form, starting with your personal information, including name, address, and Social Security number.

- Enter your income details accurately, ensuring you include all sources of income.

- List any deductions you are eligible for, providing supporting documentation as necessary.

- Review the completed form for accuracy, checking for any missing information or errors.

- Submit the form according to the guidelines provided, either electronically or by mail.

Legal use of the Mw506nrs Form

The Mw506nrs Form is legally binding when completed and submitted according to the relevant tax laws. It must be filled out truthfully and accurately to comply with IRS regulations. Failure to provide correct information can result in penalties, including fines or audits. It is crucial to understand the legal implications of the form and ensure that all entries are supported by appropriate documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Mw506nrs Form are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth for individual taxpayers. However, specific deadlines may vary based on the type of income reported or the taxpayer's circumstances. It is advisable to check the latest guidelines from the state tax authority to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Mw506nrs Form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the state tax authority. Options include:

- Online Submission: Many states offer electronic filing options for the Mw506nrs Form, allowing for quick and secure submission.

- Mail: Taxpayers can print the completed form and send it via postal mail to the designated tax office.

- In-Person: Some individuals may choose to submit the form in person at local tax offices, providing an opportunity to ask questions if needed.

Quick guide on how to complete 2016 mw506nrs form

Complete Mw506nrs Form easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Mw506nrs Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Effortless methods to edit and eSign Mw506nrs Form

- Find Mw506nrs Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Mw506nrs Form and ensure effective communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 mw506nrs form

Create this form in 5 minutes!

How to create an eSignature for the 2016 mw506nrs form

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Mw506nrs Form and why is it important?

The Mw506nrs Form is a crucial document for businesses in Maryland that need to report income tax withholding for non-resident employees. Understanding its significance can help ensure compliance with tax regulations, avoiding potential penalties. airSlate SignNow simplifies the process of filling out and submitting the Mw506nrs Form electronically.

-

How can airSlate SignNow help with the Mw506nrs Form?

airSlate SignNow offers a user-friendly platform to complete the Mw506nrs Form efficiently. By utilizing our eSignature capabilities, you can easily send the form for signature and ensure it is returned quickly, streamlining the entire process. Additionally, our templates help minimize errors when filling out the Mw506nrs Form.

-

What are the costs associated with using airSlate SignNow for the Mw506nrs Form?

airSlate SignNow provides cost-effective solutions for businesses, with pricing plans designed to fit various needs. Our plans include features that support the preparation and electronic signing of the Mw506nrs Form. You'll find that our pricing is competitive, especially given the efficiencies gained in document management.

-

Can I integrate airSlate SignNow with other tools while completing the Mw506nrs Form?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing your workflow while managing the Mw506nrs Form. You can connect with tools like Google Drive, Dropbox, and many CRM systems to streamline your document handling. This ensures you have all necessary resources at your fingertips.

-

What security measures does airSlate SignNow implement for the Mw506nrs Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption and best practices to protect your data while completing the Mw506nrs Form. With features such as audit trails and secure storage, you can trust that your documents are safe and compliant with regulations.

-

What features does airSlate SignNow provide for managing the Mw506nrs Form?

airSlate SignNow offers a suite of features tailored for efficient document management of the Mw506nrs Form. You can create, edit, and send the form for eSignature, all in one platform. Additionally, features like reminders and notifications help ensure timely completion.

-

Is training available for using airSlate SignNow with the Mw506nrs Form?

Yes, we provide comprehensive resources and training to help users effectively utilize airSlate SignNow for the Mw506nrs Form. Our support team is also available to assist you with any specific questions. You'll find that getting started is straightforward, thanks to our intuitive interface.

Get more for Mw506nrs Form

Find out other Mw506nrs Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT