Md Return Tax Property Form 2021

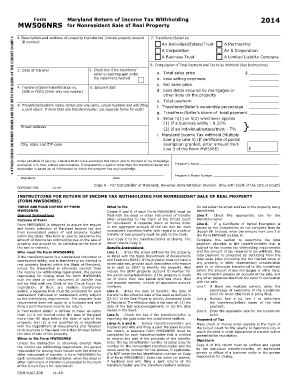

What is the Md Return Tax Property Form

The Md Return Tax Property Form is a document used by property owners in Maryland to report property taxes. This form is essential for ensuring compliance with state tax regulations and is typically required for both residential and commercial properties. It captures key information about the property, including its assessed value, ownership details, and any exemptions that may apply. Understanding this form is crucial for property owners to accurately fulfill their tax obligations.

How to use the Md Return Tax Property Form

Using the Md Return Tax Property Form involves several steps. First, property owners need to gather relevant information, such as the property’s assessed value and ownership details. Next, they should accurately fill out the form, ensuring all required sections are completed. After completing the form, it can be submitted either electronically or via traditional mail, depending on the county's submission guidelines. Familiarizing oneself with the form’s layout and requirements can streamline the process and reduce the risk of errors.

Steps to complete the Md Return Tax Property Form

Completing the Md Return Tax Property Form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including previous tax returns and property assessments.

- Fill in the property identification section with accurate details.

- Provide information about any exemptions or deductions applicable to your property.

- Review the form for accuracy and completeness before submission.

- Submit the form according to your local jurisdiction's guidelines.

Legal use of the Md Return Tax Property Form

The Md Return Tax Property Form holds legal significance as it is used to report property tax information to the Maryland state government. Proper completion and submission of this form are necessary to avoid penalties and ensure compliance with local tax laws. Additionally, the information provided can be used in legal proceedings related to property ownership and tax assessments, making accuracy and honesty in reporting essential.

Filing Deadlines / Important Dates

Filing deadlines for the Md Return Tax Property Form are critical for property owners to observe. Generally, the form must be submitted by a specific date each year, often aligned with the property tax assessment cycle. Missing the deadline can result in penalties or interest charges on unpaid taxes. Property owners should check with their local tax authority for exact dates and any changes that may occur annually.

Form Submission Methods (Online / Mail / In-Person)

Property owners have multiple options for submitting the Md Return Tax Property Form. These methods may include:

- Online submission through the local tax authority's website, which often provides a faster and more efficient process.

- Mailing the completed form to the designated tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at local tax offices, which can be beneficial for those seeking assistance or clarification on the form.

Quick guide on how to complete 2014 md return tax property form

Complete Md Return Tax Property Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and safely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Md Return Tax Property Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and electronically sign Md Return Tax Property Form with ease

- Locate Md Return Tax Property Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key parts of the documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Md Return Tax Property Form to ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 md return tax property form

Create this form in 5 minutes!

How to create an eSignature for the 2014 md return tax property form

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Md Return Tax Property Form?

The Md Return Tax Property Form is a document required by the state of Maryland for reporting property tax information. This form is essential for property owners to accurately declare their property tax obligations and ensure compliance with state regulations.

-

How can airSlate SignNow help with the Md Return Tax Property Form?

airSlate SignNow simplifies the process of handling the Md Return Tax Property Form by allowing users to easily fill out, sign, and send the document electronically. Our platform ensures secure storage and quick access to your forms, making tax season stress-free.

-

Is there a cost associated with using the Md Return Tax Property Form on airSlate SignNow?

Yes, while airSlate SignNow offers a variety of plans, users can benefit from a free trial to explore features, including those for the Md Return Tax Property Form. Pricing plans are designed to be cost-effective for businesses of all sizes.

-

What features does airSlate SignNow offer for filling out the Md Return Tax Property Form?

airSlate SignNow provides several features for the Md Return Tax Property Form, such as customizable templates, eSignature capabilities, and easy document sharing. These tools enhance efficiency and reduce the potential for errors.

-

Can I integrate airSlate SignNow with other applications for managing the Md Return Tax Property Form?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to manage workflows associated with the Md Return Tax Property Form seamlessly. This ensures that you can align your document management system with your existing tools.

-

What are the benefits of using airSlate SignNow for tax forms like the Md Return Tax Property Form?

Using airSlate SignNow for tax forms like the Md Return Tax Property Form provides businesses with streamlined processes, reduced paper usage, and enhanced security. Users can complete their forms quickly and efficiently, saving time and minimizing the risk of delays.

-

Is airSlate SignNow compliant with Maryland state regulations for the Md Return Tax Property Form?

Yes, airSlate SignNow is designed to comply with all legal requirements, including those pertaining to the Md Return Tax Property Form. Our platform maintains high standards for security and data protection to ensure that your information is handled correctly.

Get more for Md Return Tax Property Form

Find out other Md Return Tax Property Form

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy