Instructions for Submitting Forms 1099 and W 2G Tax Maine Gov Maine 2019

What is the Instructions For Submitting Forms 1099 And W-2G Tax Maine gov Maine

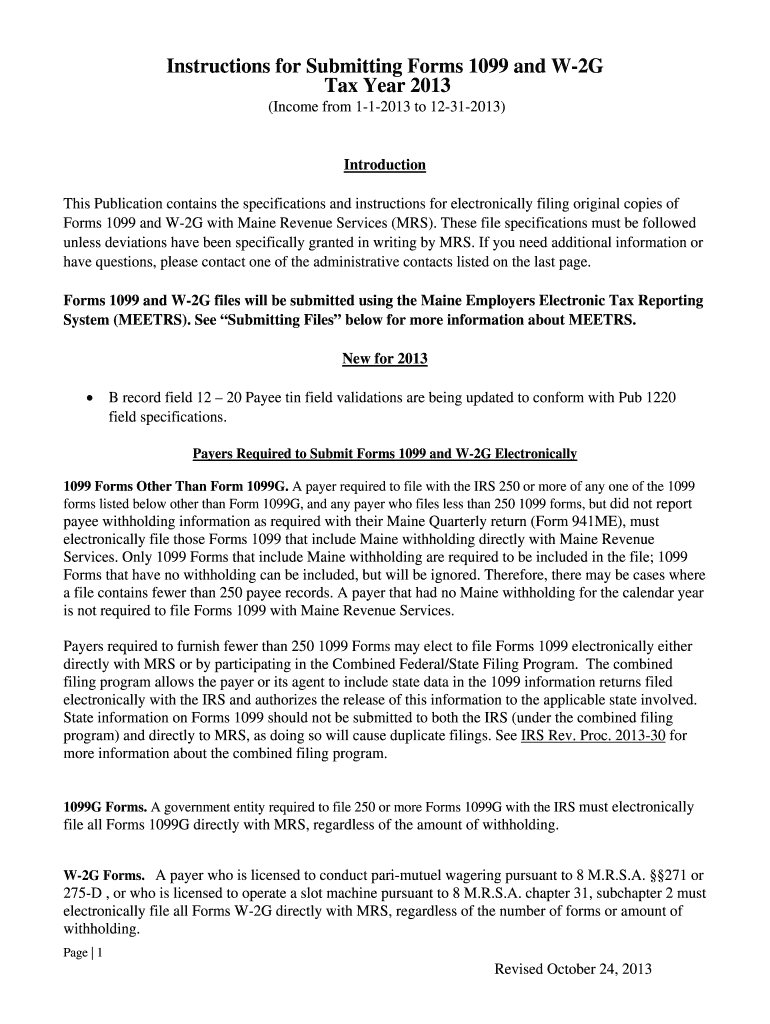

The Instructions for Submitting Forms 1099 and W-2G Tax Maine gov Maine provide essential guidelines for individuals and businesses in Maine who need to report income from various sources. Form 1099 is typically used to report income other than wages, salaries, and tips, while Form W-2G is specifically for reporting gambling winnings. Understanding these forms is crucial for maintaining compliance with federal and state tax regulations.

Steps to complete the Instructions For Submitting Forms 1099 And W-2G Tax Maine gov Maine

Completing the Instructions for Submitting Forms 1099 and W-2G involves several key steps:

- Gather necessary information, including taxpayer identification numbers, income amounts, and any relevant deductions.

- Choose the correct form based on the type of income being reported.

- Fill out the forms accurately, ensuring all information is correct to avoid delays or penalties.

- Review the completed forms for accuracy before submission.

- Submit the forms by the specified deadlines, either electronically or via mail.

Legal use of the Instructions For Submitting Forms 1099 And W-2G Tax Maine gov Maine

To ensure the legal use of the Instructions for Submitting Forms 1099 and W-2G, it is important to adhere to the guidelines set forth by the IRS and the state of Maine. This includes using the correct forms, providing accurate information, and meeting submission deadlines. Compliance with these regulations helps avoid potential legal issues and penalties.

Filing Deadlines / Important Dates

Filing deadlines for Forms 1099 and W-2G are critical for compliance. Typically, these forms must be submitted to the IRS by January thirty-first of the year following the tax year in question. If filing electronically, the deadline may extend to March thirty-first. It is advisable to check the Maine state tax website for any specific state deadlines that may differ from federal requirements.

Form Submission Methods (Online / Mail / In-Person)

Forms 1099 and W-2G can be submitted through various methods:

- Online: Many taxpayers choose to file electronically through the IRS e-file system or approved software.

- Mail: Paper forms can be mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Some individuals may opt to deliver forms directly to local IRS offices, although this is less common.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting Forms 1099 and W-2G. These guidelines cover everything from the types of income that must be reported to the specific information required on each form. Adhering to IRS guidelines is essential for ensuring that submissions are accepted and processed without issues.

Quick guide on how to complete instructions for submitting forms 1099 and w 2g tax mainegov maine

Prepare Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features needed to create, edit, and eSign your documents swiftly without delays. Manage Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

The easiest way to edit and eSign Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine with no hassle

- Locate Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you choose. Edit and eSign Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for submitting forms 1099 and w 2g tax mainegov maine

Create this form in 5 minutes!

How to create an eSignature for the instructions for submitting forms 1099 and w 2g tax mainegov maine

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What are the Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine?

The Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine provide detailed guidance on how to properly file these forms for state tax purposes. These instructions include essential information like submission methods and deadlines, which are crucial for compliance and avoiding penalties.

-

How does airSlate SignNow simplify the process of submitting forms 1099 and W 2G?

airSlate SignNow simplifies the process of submitting forms 1099 and W 2G by allowing users to electronically sign and send documents securely. This not only speeds up the submission process but also ensures that all tax documents are signed in compliance with the Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine.

-

What features does airSlate SignNow offer for tax form submissions?

airSlate SignNow offers features such as customizable templates, secure e-signature capabilities, and audit trails which are essential for submitting forms like the 1099 and W 2G. These features help ensure that users meet the specific Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine requirements efficiently.

-

Is there any cost associated with using airSlate SignNow for tax form submissions?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. This cost-effective solution allows businesses to submit forms 1099 and W 2G while also adhering to the Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine without incurring high expenses.

-

Can airSlate SignNow integrate with other software for tax filing?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and tax filing software, allowing businesses to streamline their tax form submissions. This integration supports adherence to the Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine by ensuring that all data flows smoothly into the necessary systems.

-

What are the benefits of using airSlate SignNow over traditional methods for tax submissions?

Using airSlate SignNow offers numerous benefits over traditional methods, such as increased efficiency, reduced paperwork, and enhanced security. With airSlate SignNow, businesses can follow the Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine with ease while ensuring a more streamlined and professional submission process.

-

How can I ensure compliance with the Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine using airSlate SignNow?

To ensure compliance, users can leverage airSlate SignNow's comprehensive features including real-time tracking and notifications for document completion. By following the provided guidelines from the Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine, users can confidently submit their tax forms without fear of oversight.

Get more for Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine

- Affidavit information 92816848

- Trip cost report form

- Blank welding certificate form

- Great treasure hunt iowa form

- Abandoned vehicle letter to owner form

- Laser hair removal facility certificate of registration application instructions form

- Add a category or sub category uk part 66 aircraft form

- Proof of degree form do not send us your original

Find out other Instructions For Submitting Forms 1099 And W 2G Tax Maine gov Maine

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free