Instructions for Submitting Forms 1099 and W2G Tax Year Income from 112015 to 12312015 Introduction This Publication Cont 2015

Understanding the Instructions for Submitting Forms 1099 and W-2G

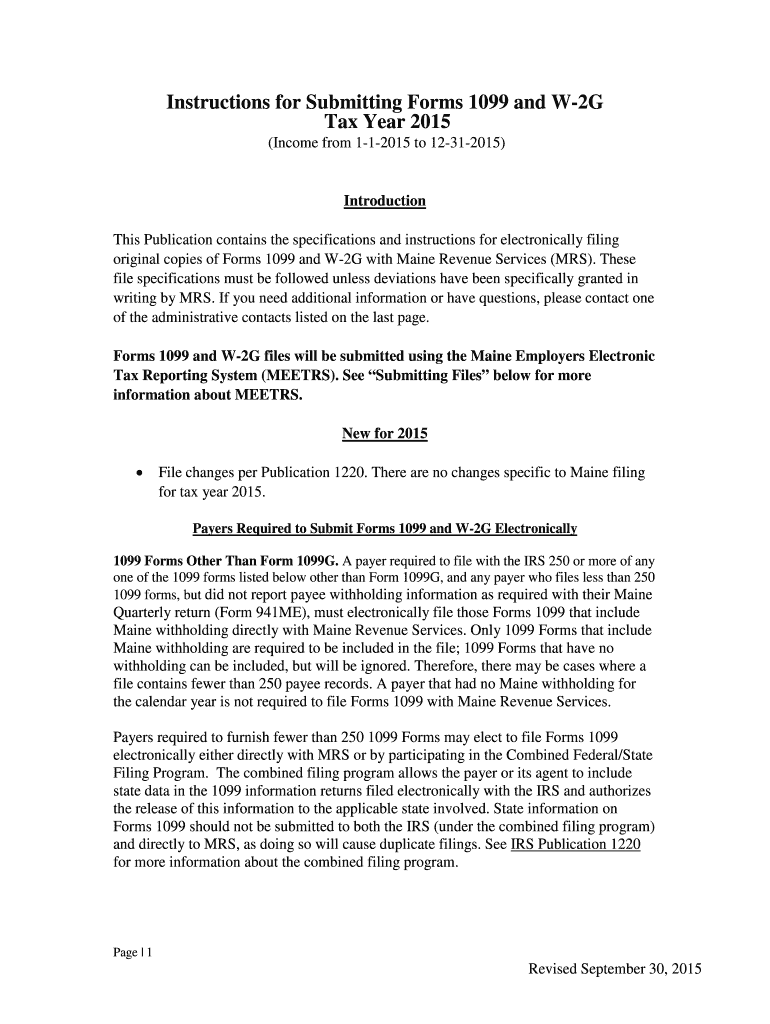

The Instructions for submitting forms 1099 and W-2G for the tax year 2015 provide essential guidance for taxpayers and businesses. These forms are used to report various types of income, including gambling winnings and other miscellaneous income. Understanding these instructions is crucial for ensuring accurate reporting and compliance with IRS regulations. The forms help the IRS track income that may not be reported on traditional wage statements, making them an important part of the tax filing process.

Steps to Complete the Instructions for Submitting Forms 1099 and W-2G

Completing the forms involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any relevant financial records. Next, follow the specific guidelines outlined in the instructions for each form. This includes entering the correct taxpayer identification numbers, income amounts, and any applicable withholding information. Double-check for any errors or omissions before submission to avoid potential penalties.

Filing Deadlines and Important Dates

Timely submission of forms 1099 and W-2G is critical to avoid penalties. For the tax year 2015, the deadline for submitting these forms to the IRS was typically January 31 of the following year. However, if filing electronically, the deadline may vary slightly. It's important to stay informed about any changes in deadlines each tax year to ensure compliance.

Form Submission Methods

There are several methods for submitting forms 1099 and W-2G. Taxpayers can choose to file electronically through the IRS e-file system, which is often the fastest and most efficient method. Alternatively, forms can be mailed directly to the IRS. When submitting by mail, ensure that the forms are sent to the correct address and that they are postmarked by the filing deadline. In-person submission is generally not available for these forms.

Legal Use of the Instructions for Submitting Forms 1099 and W-2G

The legal validity of the instructions for submitting forms 1099 and W-2G is grounded in IRS regulations. These forms must be filled out accurately to ensure compliance with federal tax laws. Failure to adhere to these guidelines can result in penalties, including fines and interest on unpaid taxes. Utilizing electronic submission methods, such as those provided by trusted platforms, can enhance the security and legality of the filing process.

Key Elements of the Instructions for Submitting Forms 1099 and W-2G

Key elements of the instructions include detailed explanations of the information required on each form, including payer and recipient details, income types, and tax withholding amounts. Additionally, the instructions outline the importance of accurate reporting and the consequences of errors. Understanding these elements is essential for ensuring that all necessary information is provided correctly.

Quick guide on how to complete instructions for submitting forms 1099 and w2g tax year 2015 income from 112015 to 12312015 introduction this publication

Complete Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 Introduction This Publication Cont effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 Introduction This Publication Cont on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

Steps to modify and eSign Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 Introduction This Publication Cont with ease

- Find Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 Introduction This Publication Cont and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 Introduction This Publication Cont and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for submitting forms 1099 and w2g tax year 2015 income from 112015 to 12312015 introduction this publication

Create this form in 5 minutes!

How to create an eSignature for the instructions for submitting forms 1099 and w2g tax year 2015 income from 112015 to 12312015 introduction this publication

How to create an electronic signature for your Instructions For Submitting Forms 1099 And W2g Tax Year 2015 Income From 112015 To 12312015 Introduction This Publication in the online mode

How to create an eSignature for the Instructions For Submitting Forms 1099 And W2g Tax Year 2015 Income From 112015 To 12312015 Introduction This Publication in Google Chrome

How to create an electronic signature for signing the Instructions For Submitting Forms 1099 And W2g Tax Year 2015 Income From 112015 To 12312015 Introduction This Publication in Gmail

How to create an eSignature for the Instructions For Submitting Forms 1099 And W2g Tax Year 2015 Income From 112015 To 12312015 Introduction This Publication straight from your smartphone

How to generate an eSignature for the Instructions For Submitting Forms 1099 And W2g Tax Year 2015 Income From 112015 To 12312015 Introduction This Publication on iOS devices

How to create an eSignature for the Instructions For Submitting Forms 1099 And W2g Tax Year 2015 Income From 112015 To 12312015 Introduction This Publication on Android OS

People also ask

-

What are the Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015?

The Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 provide detailed guidelines on how to properly fill out and submit these tax forms. Adhering to these instructions ensures compliance with federal regulations and accurate reporting of income received during the specified period. It's essential for both businesses and individuals who have received related income to familiarize themselves with the publication.

-

How can airSlate SignNow help with completing tax forms like 1099 and W2G?

airSlate SignNow offers a user-friendly platform to streamline the process of completing tax forms such as 1099 and W2G. With features like customizable templates and electronic signature capabilities, users can fill out these tax forms efficiently while ensuring they comply with the Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015. This makes tax season less stressful and more organized.

-

What is the pricing structure for using airSlate SignNow?

airSlate SignNow offers a competitive pricing structure designed to suit various business needs. There are several plans available, including options for individuals and teams, making it easy to find a plan that aligns with your budget. By using airSlate SignNow, you gain access to valuable features that can simplify the process outlined in the Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015.

-

Are there any specific features for tax document management in airSlate SignNow?

Yes, airSlate SignNow includes several features specifically designed for tax document management. Users can easily upload, fill, and sign tax documents while ensuring that they comply with the Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015. Additionally, the platform offers tracking and storage solutions to keep documents organized and accessible.

-

Can I integrate airSlate SignNow with other software tools I use?

Absolutely! airSlate SignNow provides integrations with a variety of software tools, enhancing your workflow and document management processes. By integrating with accounting or other business software, you can simplify the preparation and submission of documents in accordance with the Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015.

-

Is it safe to use airSlate SignNow for submitting sensitive tax documents?

Yes, airSlate SignNow prioritizes security and confidentiality when handling sensitive tax documents. The platform utilizes advanced encryption and secure storage measures, ensuring your information is protected while you complete the necessary steps as laid out in the Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015. Rest assured that your data remains private and secure.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation provides several benefits, including improved efficiency, reduced paperwork, and easier collaboration. By following the Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015, users can navigate the tax process smoothly. The electronic signing feature also accelerates the approval process, helping you meet deadlines effortlessly.

Get more for Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 Introduction This Publication Cont

- Texas department of agriculture direct supervision affidavit texasagriculture form

- Quotations formet for pest control wood sit

- Dads form 3724

- Dads or hhsc form the texas department of aging and dads state tx 16874138

- Temporary licensepermit application packet texas alcoholic tabc state tx form

- Form c 220 tabc 2011

- Dars form 2013

- Ex parte temporary restraining order texas attorney general oag state tx form

Find out other Instructions For Submitting Forms 1099 And W2G Tax Year Income From 112015 To 12312015 Introduction This Publication Cont

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple