Taxes Why Am I Being Charged MI 2210 Penalty and Interest? 2019

What is the Taxes Why Am I Being Charged MI 2210 Penalty And Interest?

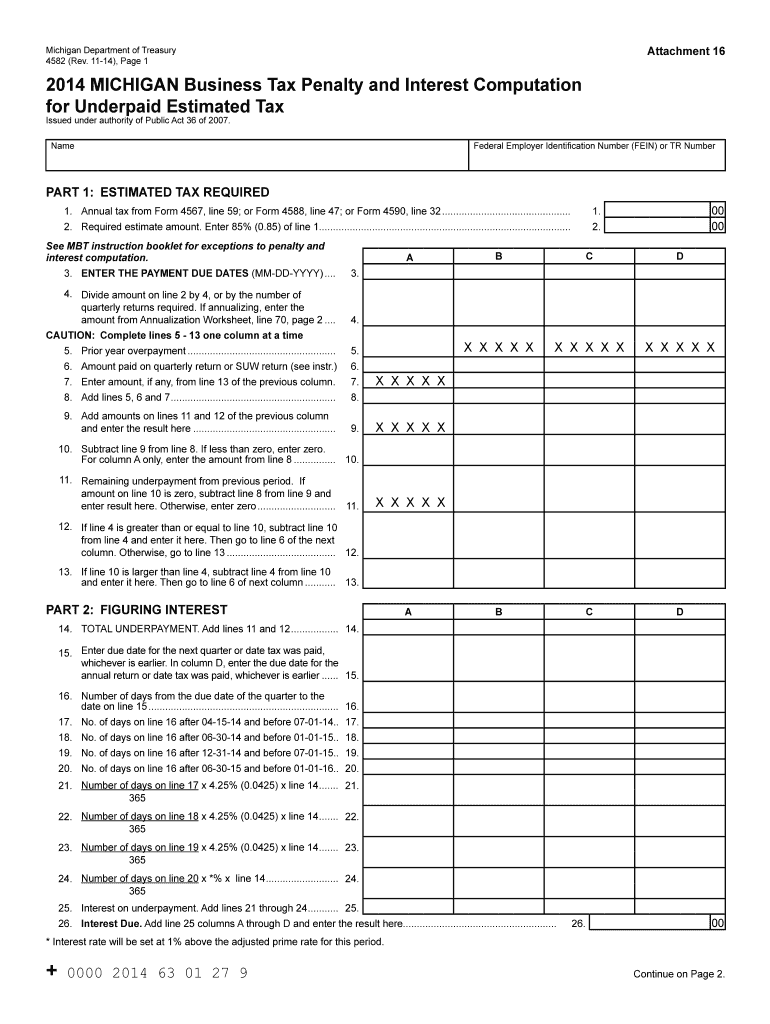

The MI 2210 form is used by taxpayers in Michigan to report underpayment of estimated tax. If you receive a notice regarding the MI 2210 penalty and interest, it indicates that you have not paid enough tax throughout the year, leading to a penalty. This penalty is assessed when your total tax payments fall short of the required amount, which can result in additional interest charges. Understanding the specifics of this form is crucial for managing your tax obligations effectively.

Steps to complete the Taxes Why Am I Being Charged MI 2210 Penalty And Interest?

Completing the MI 2210 form involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year to determine if you have underpaid.

- Fill out the MI 2210 form accurately, providing all required information, including your income and tax payments.

- Review the form for accuracy before submission to avoid further penalties.

- Submit the completed form to the Michigan Department of Treasury by the specified deadline.

Legal use of the Taxes Why Am I Being Charged MI 2210 Penalty And Interest?

The MI 2210 form is legally binding and must be completed in accordance with Michigan tax laws. When filing this form, it is important to ensure compliance with all relevant regulations to avoid additional penalties. E-signatures are accepted, provided they meet the legal requirements under the ESIGN and UETA acts. Utilizing a secure platform for electronic submissions can enhance the legal standing of your documents.

IRS Guidelines

While the MI 2210 form is specific to Michigan, it is essential to be aware of IRS guidelines regarding estimated tax payments. The IRS requires taxpayers to pay a certain percentage of their total tax liability throughout the year. If you fail to meet these requirements, you may face penalties at the federal level as well. It is advisable to keep abreast of both state and federal tax regulations to ensure compliance.

Penalties for Non-Compliance

Failing to comply with the requirements of the MI 2210 form can result in significant penalties. These may include:

- A penalty for underpayment of estimated tax, calculated based on the amount owed.

- Interest charges on the unpaid tax amount, which accrue over time.

- Potential additional penalties if the form is not submitted by the deadline.

Understanding these penalties can help you take proactive measures to avoid them in the future.

Who Issues the Form

The MI 2210 form is issued by the Michigan Department of Treasury. This department is responsible for administering tax laws in the state, including the assessment of penalties and interest for underpayment of taxes. It is important to refer to their official communications for any updates or changes regarding the form and its requirements.

Quick guide on how to complete taxes why am i being charged mi 2210 penalty and interest

Complete Taxes Why Am I Being Charged MI 2210 Penalty And Interest? effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Taxes Why Am I Being Charged MI 2210 Penalty And Interest? on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Taxes Why Am I Being Charged MI 2210 Penalty And Interest? with ease

- Locate Taxes Why Am I Being Charged MI 2210 Penalty And Interest? and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your needs in document management in just a few clicks from any device you prefer. Edit and eSign Taxes Why Am I Being Charged MI 2210 Penalty And Interest? and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxes why am i being charged mi 2210 penalty and interest

Create this form in 5 minutes!

How to create an eSignature for the taxes why am i being charged mi 2210 penalty and interest

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the MI 2210 Penalty and Interest?

The MI 2210 Penalty and Interest refers to penalties and interest charges imposed by the Michigan Department of Treasury for underpayment of estimated taxes. If you're asking, 'Taxes Why Am I Being Charged MI 2210 Penalty And Interest?', it’s important to review your estimated tax payments to ensure they meet the required thresholds to avoid these charges.

-

How can airSlate SignNow help me manage my tax documents?

airSlate SignNow provides an easy-to-use platform for sending and eSigning tax documents securely. This ensures that all your tax-related paperwork is organized and accessible, helping you avoid penalties like the MI 2210 Penalty and Interest. By streamlining these processes, you can focus more on your financial management.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to fit various business needs. Whether you are a small business or a larger organization, you can find a plan that meets your requirements while providing value for managing documents related to taxes, including potential MI 2210 Penalty and Interest issues.

-

Does airSlate SignNow integrate with tax management software?

Yes, airSlate SignNow integrates with various tax management and accounting software. These integrations can simplify the handling of your tax documents, making it easier to understand charges like the MI 2210 Penalty and Interest. By automating workflows, you can reduce the risk of errors in your tax submissions.

-

What features does airSlate SignNow offer to ensure secure transactions?

airSlate SignNow features robust security measures, including encryption and secure authentication, to protect your documents and sensitive information. This is crucial for managing taxes and understanding the implications of any MI 2210 Penalty and Interest. You can trust that your documents are safely handled on our platform.

-

Can I track the status of my documents with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your documents in real-time. This feature helps you stay informed and avoid any surprises concerning your taxes, including potential MI 2210 Penalty and Interest charges. You'll know when your documents are viewed, signed, and completed.

-

Is there customer support available for tax-related questions?

Yes, airSlate SignNow provides dedicated customer support to assist you with any queries, including those about tax documents and the MI 2210 Penalty and Interest. Our team is knowledgeable in the intricacies of document management and can help clarify any concerns you may have.

Get more for Taxes Why Am I Being Charged MI 2210 Penalty And Interest?

- Calculating your paycheck piecework production 1 answer key form

- Pipeliners local 798 form

- Holt mcdougal mathematics grade 6 answer key pdf form

- Chemical peel consent form 41382293

- Prettyboy reservoir boat permit form

- Ca 7a form

- City of mercer island rfp response form doc image mercergov

- Ltp reg form doc community services department sportscenter escondido

Find out other Taxes Why Am I Being Charged MI 2210 Penalty And Interest?

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed