4582, Michigan Business Tax Penalty and Interest Computatino for Underpaid Estimated Tax 4582, Michigan Business Tax Penalty and 2021

Understanding the 4582 Form

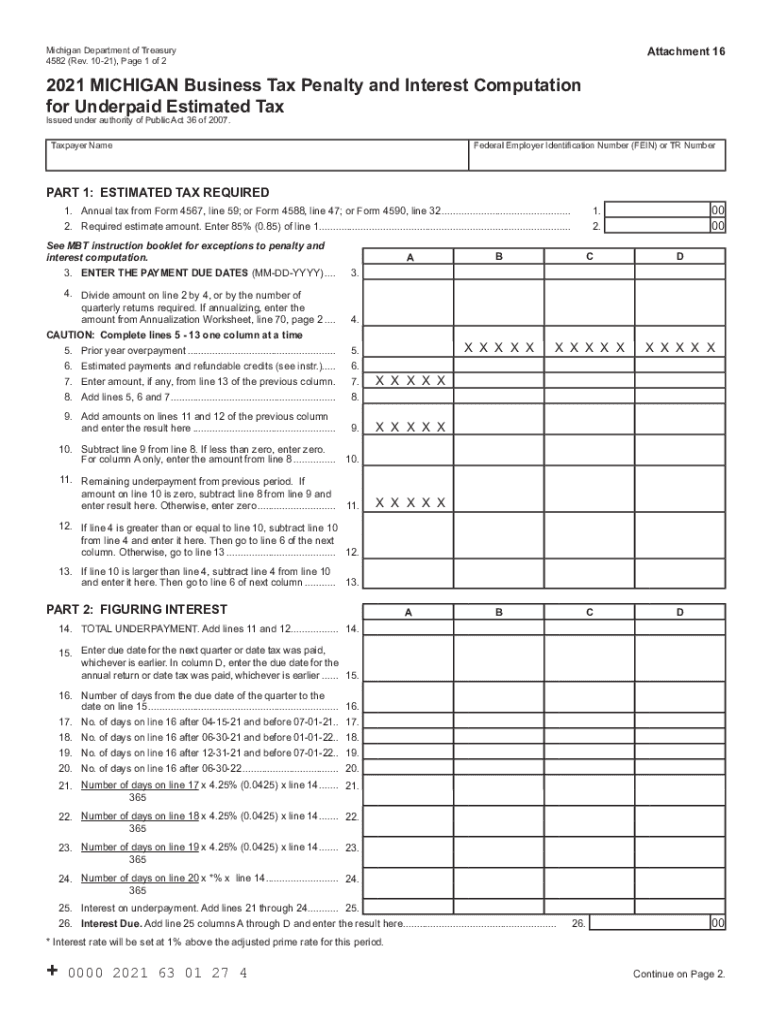

The 4582 form, also known as the Michigan Business Tax Penalty and Interest Computation for Underpaid Estimated Tax, is essential for businesses in Michigan to report and calculate penalties and interest associated with underpaid estimated taxes. This form is particularly relevant for entities subject to the Michigan Business Tax, ensuring compliance with state tax obligations. By accurately completing the 4582 form, businesses can avoid unnecessary penalties and maintain good standing with the state tax authorities.

Steps to Complete the 4582 Form

Filling out the 4582 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate the estimated tax due for the current year, considering any changes in income or deductions. Then, determine the amount of estimated tax that has already been paid. The difference will help identify any underpayment. Finally, input all relevant information into the form, including calculations for penalties and interest, and review the completed form for accuracy before submission.

Legal Use of the 4582 Form

The 4582 form serves a critical legal function in the realm of Michigan tax compliance. It must be completed and submitted accurately to avoid penalties associated with underpayment of estimated taxes. The form is recognized by the Michigan Department of Treasury and is essential for businesses to demonstrate compliance with state tax laws. Utilizing this form correctly ensures that businesses can defend against potential audits and maintain their legal obligations under Michigan tax statutes.

Filing Deadlines for the 4582 Form

Timely submission of the 4582 form is crucial for avoiding penalties. The form must be filed by the due date for the business's estimated tax payments, typically aligned with quarterly tax deadlines. Failure to file on time can result in additional penalties and interest. It is advisable for businesses to keep track of these deadlines to ensure compliance and avoid unnecessary financial burdens.

Key Elements of the 4582 Form

Understanding the key elements of the 4582 form is vital for accurate completion. The form includes sections for reporting the total estimated tax due, amounts already paid, and calculations for any penalties or interest incurred. Additionally, businesses must provide identifying information, such as their tax identification number and business name. Each section must be filled out carefully to ensure that the form reflects the business's true tax situation.

Examples of Using the 4582 Form

The 4582 form can be utilized in various scenarios. For instance, a business that has experienced a decline in revenue may find itself underpaying estimated taxes. In such cases, completing the 4582 form allows the business to calculate the penalties incurred and address them appropriately. Another example is a business that has made late estimated tax payments; the 4582 form helps quantify the interest owed, ensuring that the business can manage its tax liabilities effectively.

Quick guide on how to complete 4582 michigan business tax penalty and interest computatino for underpaid estimated tax 4582 michigan business tax penalty and

Complete 4582, Michigan Business Tax Penalty And Interest Computatino For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle 4582, Michigan Business Tax Penalty And Interest Computatino For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And on any platform using the airSlate SignNow Android or iOS applications and simplify any document-focused process today.

How to modify and eSign 4582, Michigan Business Tax Penalty And Interest Computatino For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And with ease

- Find 4582, Michigan Business Tax Penalty And Interest Computatino For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Decide how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 4582, Michigan Business Tax Penalty And Interest Computatino For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4582 michigan business tax penalty and interest computatino for underpaid estimated tax 4582 michigan business tax penalty and

Create this form in 5 minutes!

People also ask

-

What is an 4582 form and how can it be used with airSlate SignNow?

The 4582 form is a document often used for various business transactions, and airSlate SignNow allows you to easily send and eSign this form. With our user-friendly platform, you can complete, sign, and manage the 4582 form efficiently, saving you time and effort in document handling.

-

How does airSlate SignNow ensure the security of the 4582 form?

At airSlate SignNow, we prioritize your data security. When handling the 4582 form, we use advanced encryption methods and secure cloud storage to protect your documents, ensuring that only authorized individuals can access and eSign these sensitive forms.

-

Can I customize the 4582 form in airSlate SignNow?

Yes, you can easily customize the 4582 form using airSlate SignNow. Our platform allows you to add fields, modify text, and adjust layouts as needed, enabling you to tailor the form to meet your specific requirements perfectly.

-

What are the pricing options for using airSlate SignNow for the 4582 form?

AirSlate SignNow offers competitive pricing plans designed to fit various business needs. Whether you’re handling a few 4582 forms a month or needing unlimited signatures, our pricing options ensure that you only pay for what you use with no hidden fees.

-

Can I integrate third-party apps with airSlate SignNow while working on the 4582 form?

Absolutely! airSlate SignNow supports various third-party integrations, allowing you to streamline your workflow when managing the 4582 form. This means you can connect with tools such as CRM systems and cloud storage services to facilitate easy document management.

-

What are the main benefits of using airSlate SignNow for the 4582 form?

Using airSlate SignNow for the 4582 form offers numerous benefits, including increased efficiency and reduced turnaround times. It simplifies the signing process, minimizes paperwork, and enhances tracking capabilities, allowing you to focus on your core business tasks.

-

Is there a mobile app for airSlate SignNow to manage the 4582 form on-the-go?

Yes, airSlate SignNow provides a mobile app that allows you to manage the 4582 form anytime, anywhere. With the app, you can send, receive, and eSign documents right from your mobile device, making it convenient for busy professionals.

Get more for 4582, Michigan Business Tax Penalty And Interest Computatino For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And

- Letter from tenant to landlord with demand that landlord repair plumbing problem north dakota form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497317511 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring north dakota form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings north dakota form

- Nd tenant landlord form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles north dakota form

- Letter from tenant to landlord about landlords failure to make repairs north dakota form

- North dakota notice form

Find out other 4582, Michigan Business Tax Penalty And Interest Computatino For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation