4582, Michigan Business Tax Penalty and Interest Computation for Underpaid Estimated Tax 4582, Michigan Business Tax Penalty and 2022

Understanding the 4582 Form for Michigan Business Tax Penalty

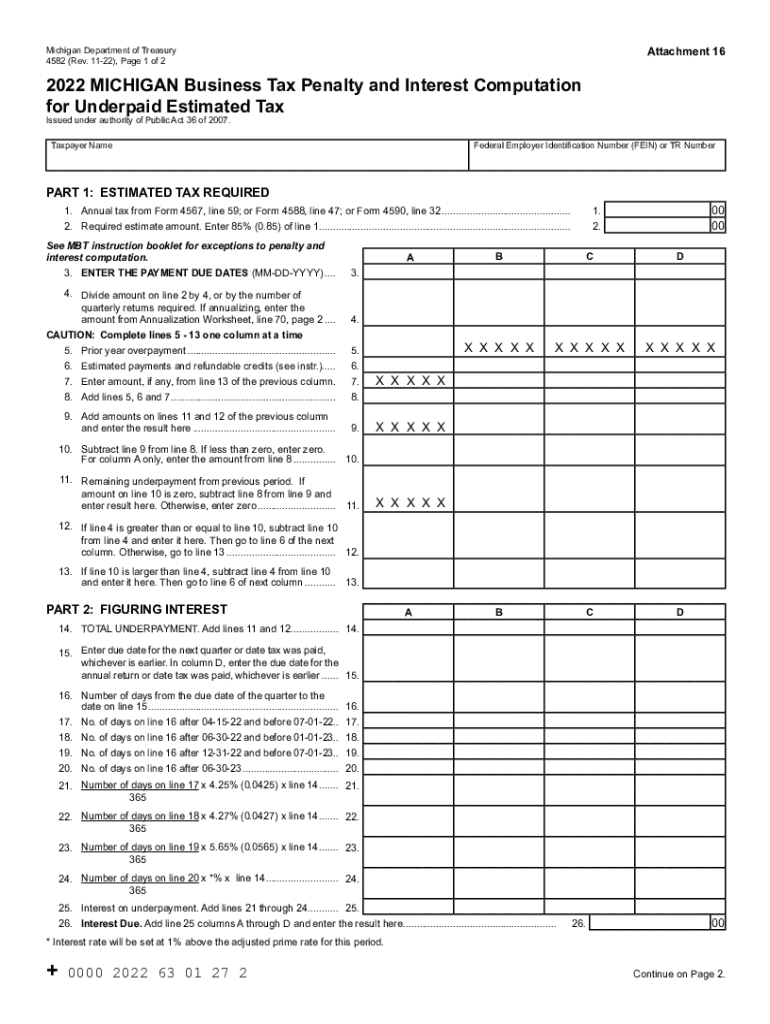

The 4582 form, officially known as the Michigan Business Tax Penalty and Interest Computation for Underpaid Estimated Tax, is a critical document for businesses in Michigan. It is used to calculate penalties and interest associated with underpayment of estimated taxes. Understanding this form is essential for ensuring compliance with state tax laws and avoiding unnecessary penalties. The form details how to compute the penalty based on the amount of tax owed and the duration of the underpayment.

Steps to Complete the 4582 Form

Completing the 4582 form involves several key steps:

- Gather necessary financial documents, including previous tax returns and estimated tax payments.

- Determine the total amount of tax owed for the year based on your business income.

- Calculate the estimated tax payments made throughout the year.

- Use the form’s guidelines to compute any penalties or interest incurred due to underpayment.

- Review the completed form for accuracy and ensure all calculations are correct.

Legal Use of the 4582 Form

The 4582 form serves a legal purpose in the context of Michigan tax law. It is essential for businesses to accurately report any penalties and interest due to underpaid estimated taxes. Proper completion of this form ensures that the business complies with state regulations, which can help avoid legal disputes or additional penalties. The form must be submitted to the Michigan Department of Treasury as part of your business tax obligations.

Filing Deadlines and Important Dates

Timely submission of the 4582 form is crucial to avoid further penalties. Typically, the form must be filed by the due date of your annual business tax return. It is important to keep track of any changes in deadlines that the Michigan Department of Treasury may announce, especially during tax season. Missing these deadlines can result in additional charges or complications in your tax filings.

Key Elements of the 4582 Form

Several key elements are included in the 4582 form that businesses must be aware of:

- Identification of the taxpayer, including business name and tax identification number.

- Details of estimated tax payments made during the tax year.

- Calculation of penalties based on the amount underpaid and the length of time the payment was overdue.

- Interest computation based on the underpayment amount.

Examples of Using the 4582 Form

Businesses may find various scenarios where the 4582 form is applicable. For instance, a small business that underestimated its tax liability and made lower estimated payments may need to file this form to calculate the penalties incurred. Another example is a corporation that faced unexpected expenses and could not meet its estimated tax obligations. In both cases, the 4582 form helps determine the financial repercussions of these underpayments.

Quick guide on how to complete 4582 2022 michigan business tax penalty and interest computation for underpaid estimated tax 4582 2022 michigan business tax

Prepare 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And effortlessly on any device

Web-based document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents promptly without any delays. Manage 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And with ease

- Find 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Choose how you prefer to send your form—via email, text (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4582 2022 michigan business tax penalty and interest computation for underpaid estimated tax 4582 2022 michigan business tax

Create this form in 5 minutes!

How to create an eSignature for the 4582 2022 michigan business tax penalty and interest computation for underpaid estimated tax 4582 2022 michigan business tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 4582?

The form 4582 is a specialized document designed for electronic signatures and seamless document management. With airSlate SignNow, users can easily create, send, and eSign the form 4582, streamlining administrative processes and ensuring compliance.

-

How does airSlate SignNow simplify the process of using form 4582?

airSlate SignNow simplifies the process of using form 4582 by providing an intuitive interface for creating and sending documents. Users can quickly input required information, set up template fields for signatures, and manage the entire signing process in one place.

-

What are the pricing options for airSlate SignNow that includes form 4582?

airSlate SignNow offers various pricing plans that cater to different business needs, all of which include the capability to handle form 4582. Options range from individual to enterprise solutions, providing flexibility for every budget.

-

Can I integrate form 4582 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows users to integrate form 4582 with numerous applications, enhancing workflow efficiency. Popular integrations include cloud storage services and CRM platforms, ensuring a seamless document signing experience.

-

What are the key benefits of using airSlate SignNow for form 4582?

The key benefits of using airSlate SignNow for form 4582 include time savings, increased efficiency, and enhanced security. Businesses can quickly get documents signed, reducing delays and keeping operations running smoothly.

-

Is form 4582 legally compliant when signed through airSlate SignNow?

Yes, the form 4582 signed through airSlate SignNow is compliant with electronic signature laws, including the ESIGN Act and UETA. This ensures that your electronically signed documents are legally binding and enforceable.

-

Can I customize form 4582 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize templates for form 4582 to meet specific needs. You can add logos, set signature fields, and modify text to create a tailored document experience.

Get more for 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And

- City of bellingham b o form

- Air liquide fillable credit application form

- Sr 22 form pdf 21994321

- Marriage certificate victoria form

- Instanet forms

- Faststart direct deposit fiscal treasury gov form

- Burial at sea request form for veterans and civilians

- Pay delivery worksheet department of defense form

Find out other 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile