4582, Michigan Business Tax Penalty and Interest Computation for Underpaid Estimated Tax 4582, Michigan Business Tax Penalty and 2019

Understanding the 4582 Form for Michigan Business Tax

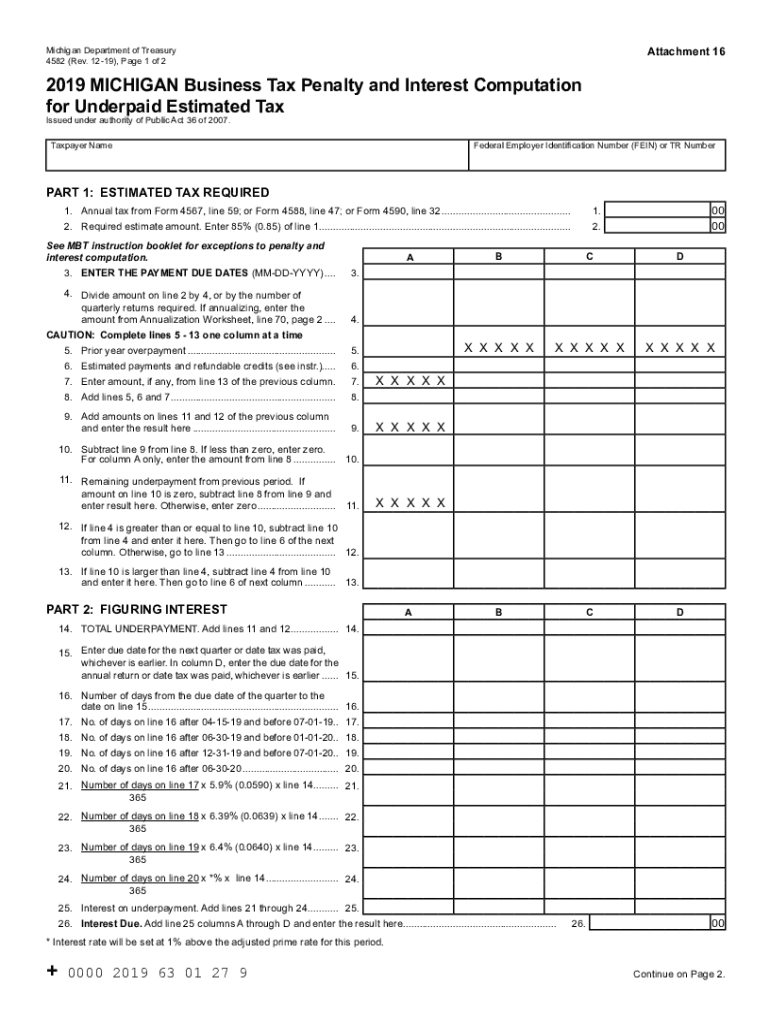

The 4582 form, officially known as the Michigan Business Tax Penalty and Interest Computation for Underpaid Estimated Tax, is a critical document for businesses operating in Michigan. This form is designed to calculate any penalties and interest that may apply if a business has underpaid its estimated tax obligations. Understanding the nuances of this form is essential for compliance and financial planning.

Steps to Complete the 4582 Form

Filling out the 4582 form requires careful attention to detail to ensure accuracy. Here are the steps to follow:

- Gather necessary financial documents, including prior tax returns and estimated tax payments.

- Calculate the total estimated tax due for the year.

- Determine the amount of tax already paid through estimated payments.

- Use the form to compute any penalties or interest based on the difference between the estimated tax due and the amounts paid.

- Review the completed form for accuracy before submission.

Legal Use of the 4582 Form

The 4582 form is legally binding when completed correctly and submitted to the appropriate state authorities. It must adhere to the guidelines set forth by Michigan's tax laws. Compliance with these regulations ensures that businesses avoid additional penalties and maintain their good standing with the state.

Filing Deadlines for the 4582 Form

Timely submission of the 4582 form is crucial. The filing deadlines align with the state's estimated tax payment schedule. Businesses should be aware of these deadlines to avoid incurring penalties for late submissions. It is advisable to mark these dates on the calendar and prepare the necessary documentation well in advance.

Key Elements of the 4582 Form

Several key elements must be included in the 4582 form to ensure it is complete and accurate:

- Taxpayer identification information, including name and address.

- Details of estimated tax payments made throughout the year.

- Calculations for any penalties or interest owed.

- Signature of the authorized representative of the business.

Examples of Using the 4582 Form

Businesses may encounter various scenarios when using the 4582 form. For instance, a company that underestimated its tax obligations may use the form to calculate the penalties incurred due to underpayment. Another example could involve a business that has made multiple estimated payments but still owes additional tax, necessitating the completion of the 4582 form to determine the exact amount owed.

Quick guide on how to complete 4582 2019 michigan business tax penalty and interest computation for underpaid estimated tax 4582 2019 michigan business tax

Effortlessly Prepare 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without complications. Manage 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And effortlessly

- Locate 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Decide how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4582 2019 michigan business tax penalty and interest computation for underpaid estimated tax 4582 2019 michigan business tax

Create this form in 5 minutes!

How to create an eSignature for the 4582 2019 michigan business tax penalty and interest computation for underpaid estimated tax 4582 2019 michigan business tax

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the 4582 form, and why is it important?

The 4582 form is a crucial document used in various business transactions for compliance and record-keeping. Understanding how to properly fill out and utilize the 4582 form can streamline your processes and ensure legal adherence.

-

How can airSlate SignNow help with the 4582 form?

airSlate SignNow offers a streamlined process for creating, sending, and eSigning the 4582 form. Our platform makes it easy to manage document workflows, ensuring you can get your forms signed quickly and securely.

-

What are the pricing options for using airSlate SignNow for the 4582 form?

airSlate SignNow provides flexible pricing plans tailored to meet various business needs. You can choose a plan that allows you to efficiently manage the handling of the 4582 form while staying within your budget.

-

Are there any features specific to the 4582 form in airSlate SignNow?

Yes, airSlate SignNow includes features such as customizable templates, automatic reminders, and real-time tracking for the 4582 form. These tools enhance your efficiency, making it easier to manage essential documents.

-

Does airSlate SignNow integrate with other applications for managing the 4582 form?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Salesforce, and Microsoft Teams, allowing for efficient management of the 4582 form within your existing workflow.

-

What are the benefits of using airSlate SignNow for the 4582 form?

Using airSlate SignNow for the 4582 form enhances document security, reduces turnaround time, and simplifies collaboration. Our platform's user-friendly interface makes it accessible for all team members, ensuring a smooth signing process.

-

Is there a mobile app for airSlate SignNow to manage the 4582 form?

Yes, airSlate SignNow offers a mobile app that allows you to manage the 4582 form on the go. You can easily create, send, and sign documents anytime, ensuring you never miss an important deadline.

Get more for 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And

- Wisconsin agreement form

- Wisconsin postnuptial form

- Quitclaim deed from husband and wife to an individual wisconsin form

- Warranty deed from husband and wife to an individual wisconsin form

- Wi form

- Warranty deed two grantors to three grantees as joint tenants wisconsin form

- Wisconsin subpoena form

- Wi lien form

Find out other 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax 4582, Michigan Business Tax Penalty And

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form