Mn Form Exemption 2019

What is the Mn Form Exemption

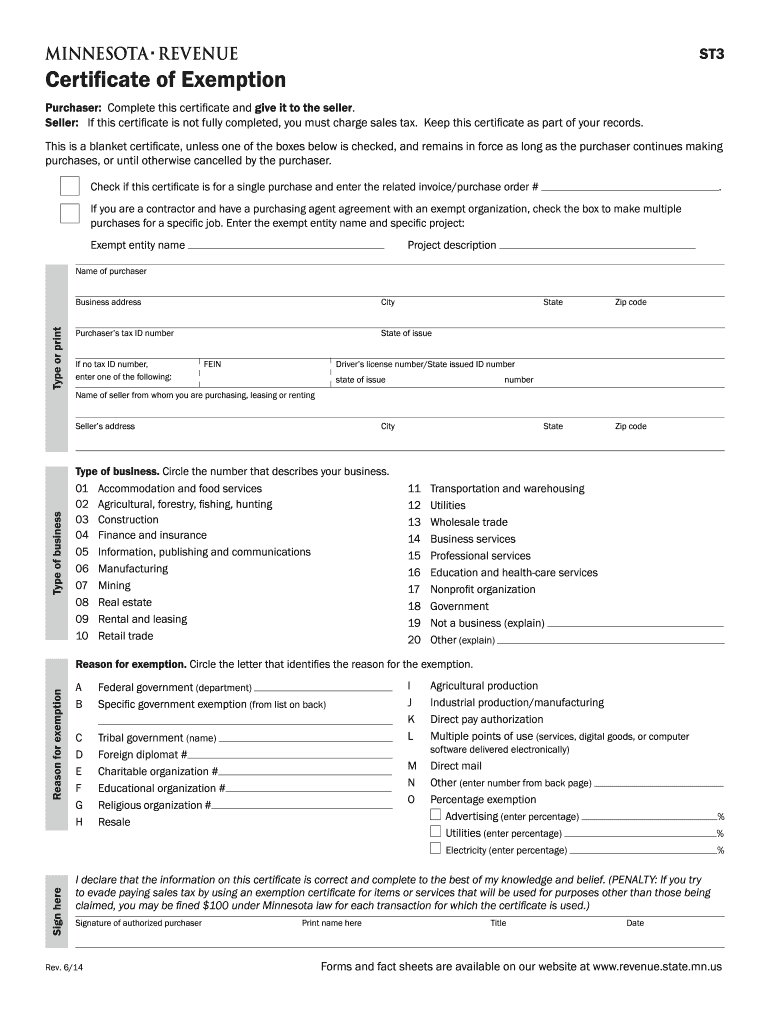

The Mn Form Exemption is a specific form used in Minnesota that allows certain taxpayers to be exempt from specific tax obligations. This exemption is particularly relevant for individuals or entities that meet certain criteria set forth by the state tax authority. Understanding the purpose of this form is crucial for those who qualify, as it can lead to significant tax savings and compliance benefits.

How to use the Mn Form Exemption

Using the Mn Form Exemption involves a straightforward process. Taxpayers must first determine their eligibility based on the criteria outlined by the Minnesota Department of Revenue. Once eligibility is confirmed, the form should be filled out accurately, ensuring all required information is included. After completing the form, it must be submitted according to the guidelines provided by the state, which may include online submission or mailing it to the appropriate office.

Steps to complete the Mn Form Exemption

Completing the Mn Form Exemption requires careful attention to detail. Here are the key steps:

- Review eligibility requirements to ensure you qualify for the exemption.

- Gather necessary documentation that supports your claim for exemption.

- Fill out the form with accurate and complete information.

- Double-check the form for any errors or omissions.

- Submit the completed form as directed by the Minnesota Department of Revenue.

Key elements of the Mn Form Exemption

Several key elements are critical to the Mn Form Exemption. These include:

- Taxpayer Information: Accurate personal or business identification details.

- Exemption Criteria: Specific conditions that must be met to qualify for the exemption.

- Supporting Documentation: Required documents that validate the exemption claim.

- Signature: A signature is often required to certify the authenticity of the information provided.

Legal use of the Mn Form Exemption

The legal use of the Mn Form Exemption hinges on compliance with state tax laws. It is essential that taxpayers understand the legal implications of claiming the exemption. Misuse or fraudulent claims can lead to penalties, including fines or additional taxes owed. Therefore, it is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of the exemption.

Eligibility Criteria

Eligibility for the Mn Form Exemption is determined by specific criteria established by the Minnesota Department of Revenue. Generally, this may include factors such as income level, type of business entity, and the nature of the tax being exempted. Taxpayers must carefully review these criteria to ascertain their qualification for the exemption.

Filing Deadlines / Important Dates

Filing deadlines for the Mn Form Exemption are crucial for compliance. Taxpayers should be aware of the specific dates by which the form must be submitted to avoid penalties. Typically, these deadlines align with the tax filing season, but it is essential to check the Minnesota Department of Revenue's official calendar for the most accurate information.

Quick guide on how to complete 2012 mn form exemption

Prepare Mn Form Exemption effortlessly on any device

Online document management has become increasingly popular among organizations and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents promptly and without hassle. Manage Mn Form Exemption on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Mn Form Exemption with ease

- Find Mn Form Exemption and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred delivery method for your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Mn Form Exemption to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 mn form exemption

Create this form in 5 minutes!

How to create an eSignature for the 2012 mn form exemption

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Mn Form Exemption and why is it important?

The Mn Form Exemption refers to specific documentation that allows businesses in Minnesota to minimize their tax responsibilities. Understanding this exemption is crucial for business owners looking to optimize their financial strategies. airSlate SignNow provides a seamless platform for managing these forms electronically.

-

How can airSlate SignNow help with the Mn Form Exemption process?

airSlate SignNow simplifies the process of submitting and signing Mn Form Exemption documents. Our platform offers secure eSignature options and easy document management, ensuring you can efficiently handle all necessary paperwork related to the exemption. This efficiency saves businesses time and reduces the risk of manual errors.

-

Are there any costs associated with using airSlate SignNow for Mn Form Exemption?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to features essential for managing the Mn Form Exemption process efficiently. We ensure our solutions are cost-effective, providing great value for the services offered.

-

What features does airSlate SignNow offer for managing Mn Form Exemption documents?

airSlate SignNow includes features such as eSignature capabilities, template creation, and real-time tracking of document status. These tools are designed to streamline the management of Mn Form Exemption paperwork, making the process smoother for businesses. The easy-to-use interface enhances user experience, ensuring accessibility for all.

-

Can airSlate SignNow integrate with other business tools for Mn Form Exemption?

Absolutely! airSlate SignNow integrates with a variety of business applications, enabling you to manage your Mn Form Exemption seamlessly. Whether you use CRM systems, cloud storage, or accounting software, our integrations help create a cohesive workflow that enhances productivity.

-

How secure is the information shared through airSlate SignNow when handling Mn Form Exemption?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure data storage, ensuring that all documents related to Mn Form Exemption are safe and compliant with regulations. You can confidently manage sensitive information without the fear of data bsignNowes.

-

What are the benefits of using airSlate SignNow for the Mn Form Exemption?

Using airSlate SignNow for the Mn Form Exemption provides several benefits, including faster processing times, reduced paperwork, and increased accuracy. Our eSignature solution eliminates the hassle of printing, signing, and scanning, giving businesses more time to focus on growth. Additionally, our robust tracking feature allows you to monitor the progress of your forms.

Get more for Mn Form Exemption

Find out other Mn Form Exemption

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple