M4np Form 2020

What is the M4np Form

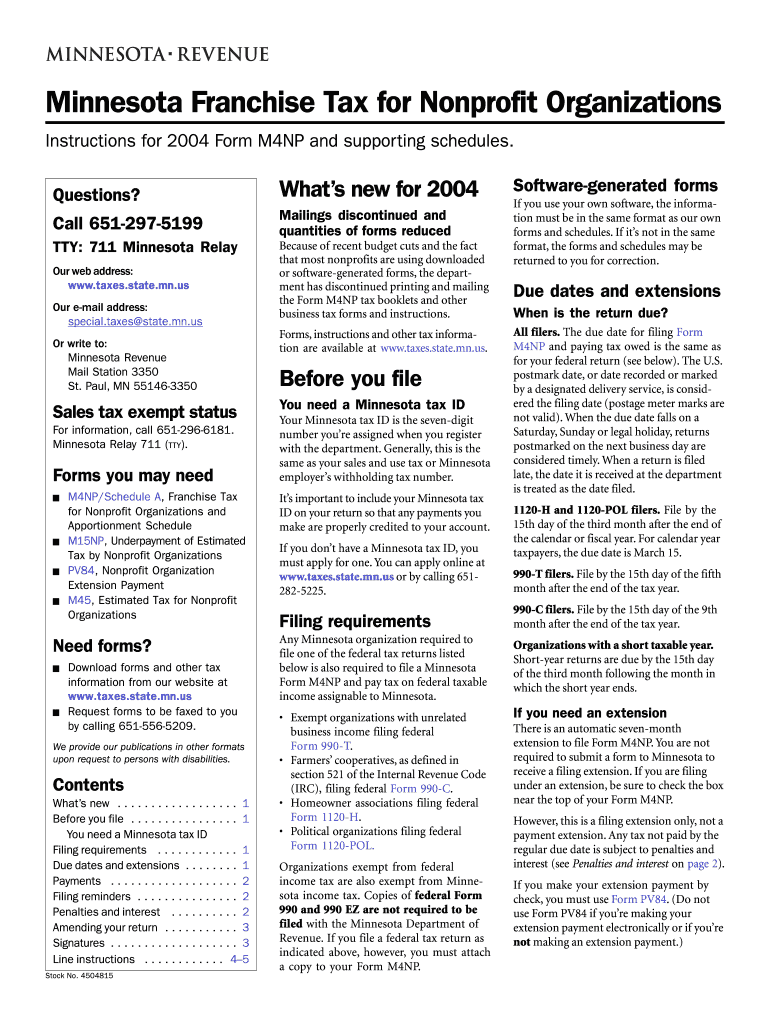

The M4np Form is a specific document used primarily for tax-related purposes in the United States. It serves as an essential tool for individuals and businesses to report certain financial information accurately. Understanding the purpose of this form is crucial for compliance with federal tax regulations, ensuring that all necessary data is submitted correctly to the IRS.

How to use the M4np Form

Using the M4np Form involves several steps to ensure that it is completed accurately. First, gather all relevant financial documents that pertain to the information required on the form. Next, fill out the form with the necessary details, ensuring that all entries are clear and legible. After completing the form, review it for accuracy before submission to avoid potential delays or issues with the IRS.

Steps to complete the M4np Form

Completing the M4np Form involves a systematic approach:

- Collect necessary financial records, including income statements and previous tax returns.

- Fill in personal identification information accurately, such as your name, address, and Social Security number.

- Provide detailed financial data as required by the form, ensuring all figures are correct.

- Review the completed form for errors or omissions.

- Sign and date the form to validate your submission.

Legal use of the M4np Form

The M4np Form is legally binding when filled out and submitted according to IRS guidelines. It is important to ensure compliance with all relevant tax laws to avoid penalties. Utilizing a reliable eSignature platform can enhance the legal standing of the form by providing a digital certificate and maintaining compliance with eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the M4np Form are critical to avoid late fees and penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, extensions may be available in certain circumstances. Keeping track of these important dates ensures that you remain compliant with IRS regulations.

Form Submission Methods

The M4np Form can be submitted through various methods:

- Online: Many taxpayers prefer to file electronically through authorized e-filing services.

- Mail: The form can also be printed and mailed to the appropriate IRS address.

- In-Person: Some individuals may choose to submit the form in person at designated IRS offices.

Quick guide on how to complete m4np 2004 form

Finalize M4np Form effortlessly on any gadget

Web-based document management has become prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage M4np Form on any gadget using airSlate SignNow's apps for Android or iOS and streamline any document-related task today.

The simplest method to modify and electronically sign M4np Form effortlessly

- Locate M4np Form and click Obtain Form to begin.

- Leverage the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Finish button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign M4np Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m4np 2004 form

Create this form in 5 minutes!

How to create an eSignature for the m4np 2004 form

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the M4np Form and how is it used?

The M4np Form is a customizable document template provided by airSlate SignNow, enabling users to easily create and send electronic forms for signing. This form streamlines the signing process, allowing businesses to collect approvals efficiently. Whether you need it for contracts, agreements, or other documents, the M4np Form helps organize and simplify your workflow.

-

How can I create an M4np Form using airSlate SignNow?

Creating an M4np Form with airSlate SignNow is straightforward. Simply log into your account, select 'Create Document,' and choose the M4np template. You can then customize it according to your needs, adding fields for signatures, text, and more, enabling a seamless signing experience.

-

Is there a cost associated with using the M4np Form?

Yes, there is a cost associated with using the M4np Form, but airSlate SignNow offers various pricing plans to fit different business needs. Each plan includes access to the M4np Form along with features such as unlimited eSignatures and document storage. For detailed pricing, visit our pricing page for more information.

-

What features does the M4np Form offer to enhance my workflow?

The M4np Form includes features like drag-and-drop field placement, automated reminders, and comprehensive tracking of document status. These features help streamline your document management processes and reduce turnaround times. With the M4np Form, your signing experience becomes efficient and organized.

-

Can the M4np Form be integrated with other applications?

Absolutely! The M4np Form can be easily integrated with various applications, including CRMs and cloud storage services. This allows for seamless data transfer and enhances productivity by enabling users to manage documents across platforms. Check our integration section for a full list of compatible applications.

-

What benefits does the M4np Form provide for businesses?

The M4np Form offers numerous benefits including increased efficiency, reduced paper usage, and improved organization of documents. By simplifying the signing process, it saves time and ensures that all necessary approvals are obtained quickly. Moreover, it enhances the overall security of document transactions.

-

Is the M4np Form secure for sensitive information?

Yes, the M4np Form is designed with security in mind. It utilizes encryption and secure access protocols to protect sensitive information throughout the signing process. This ensures that your data remains confidential and is only accessible to authorized signers.

Get more for M4np Form

Find out other M4np Form

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure