Property Tax Reimbursement Application State of New Jersey 2019

What is the Property Tax Reimbursement Application State Of New Jersey

The Property Tax Reimbursement Application in the State of New Jersey is designed to provide financial relief to eligible homeowners who meet specific criteria. This application allows qualified individuals to receive a reimbursement for a portion of their property taxes, helping to alleviate the financial burden associated with homeownership. The program aims to support senior citizens and disabled residents, ensuring they can maintain their homes despite rising property taxes.

Eligibility Criteria

To qualify for the Property Tax Reimbursement Application in New Jersey, applicants must meet several criteria:

- Applicants must be at least sixty-five years old or disabled.

- They must have lived in New Jersey for at least ten consecutive years.

- The property must be their primary residence.

- Applicants must meet specific income limits set by the state.

Steps to Complete the Property Tax Reimbursement Application State Of New Jersey

Completing the Property Tax Reimbursement Application involves several key steps:

- Gather necessary documents, including proof of age or disability, income statements, and property tax bills.

- Fill out the application form accurately, ensuring all information is complete.

- Review the application for any errors or missing information.

- Submit the application by the deadline, either online or via mail.

Required Documents

Applicants must provide specific documents to support their Property Tax Reimbursement Application. These documents typically include:

- A copy of the property tax bill for the year in question.

- Proof of age or disability, such as a birth certificate or disability certification.

- Income documentation, including tax returns or pay stubs, to verify eligibility.

Form Submission Methods

The Property Tax Reimbursement Application can be submitted through various methods, ensuring convenience for applicants:

- Online submission through the New Jersey Division of Taxation website.

- Mailing the completed application to the designated address provided on the form.

- In-person submission at local tax offices, if preferred.

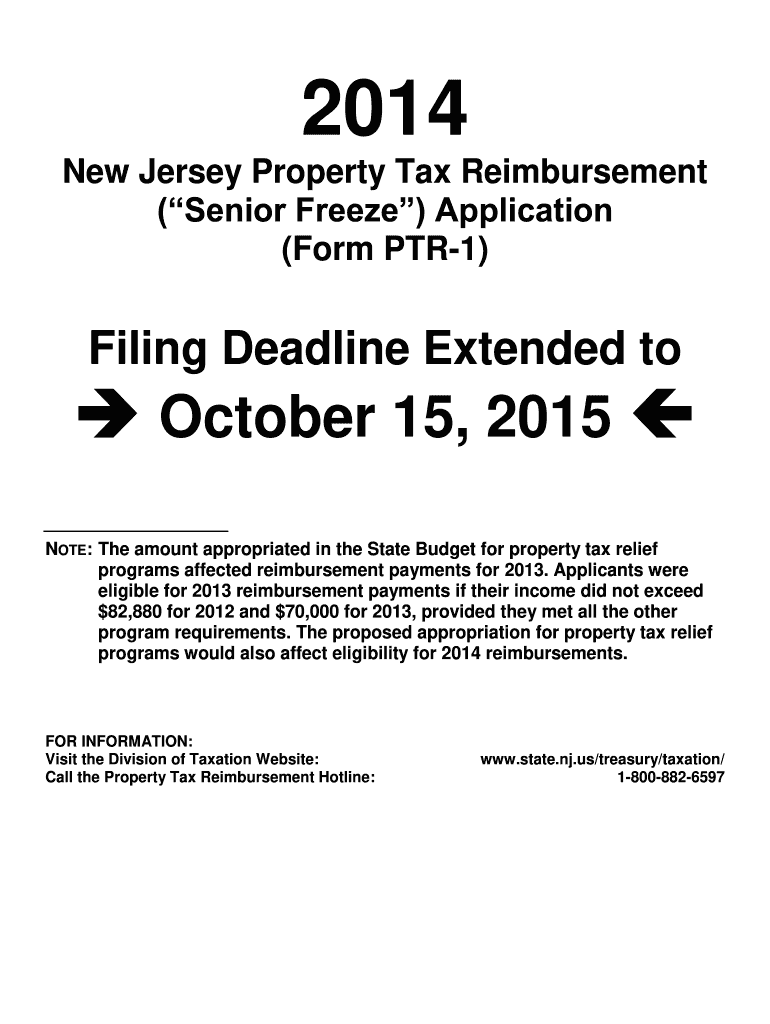

Filing Deadlines / Important Dates

It is crucial for applicants to be aware of the filing deadlines associated with the Property Tax Reimbursement Application. Typically, applications must be submitted by a specific date each year, often falling in the summer months. Keeping track of these dates ensures that applicants do not miss the opportunity for reimbursement.

Quick guide on how to complete 2014 property tax reimbursement application state of new jersey

Complete Property Tax Reimbursement Application State Of New Jersey effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without interruptions. Manage Property Tax Reimbursement Application State Of New Jersey on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Property Tax Reimbursement Application State Of New Jersey without hassle

- Locate Property Tax Reimbursement Application State Of New Jersey and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, either by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Property Tax Reimbursement Application State Of New Jersey and guarantee excellent communication at any stage of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 property tax reimbursement application state of new jersey

Create this form in 5 minutes!

How to create an eSignature for the 2014 property tax reimbursement application state of new jersey

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Property Tax Reimbursement Application State Of New Jersey?

The Property Tax Reimbursement Application State Of New Jersey is a program designed to reimburse eligible senior citizens, disabled persons, and certain low-income homeowners for property taxes paid. By applying through this program, residents can receive financial relief that signNowly reduces their tax burden.

-

How can I access the Property Tax Reimbursement Application State Of New Jersey?

You can access the Property Tax Reimbursement Application State Of New Jersey through the official New Jersey government website or by visiting your local tax office. Additionally, airSlate SignNow offers e-signature solutions that can streamline the application process, making it quick and efficient.

-

Are there any fees associated with the Property Tax Reimbursement Application State Of New Jersey?

There are no fees required to submit the Property Tax Reimbursement Application State Of New Jersey itself. However, if you choose to use third-party services or software to assist with your application, those may incur costs. Utilizing airSlate SignNow’s e-signature services offers a cost-effective solution to ease the application process.

-

What features does the airSlate SignNow platform offer for the Property Tax Reimbursement Application State Of New Jersey?

The airSlate SignNow platform offers features such as customizable templates, secure e-signature capabilities, document sharing, and tracking functionalities. These features enable users to efficiently manage their Property Tax Reimbursement Application State Of New Jersey, ensuring timely submissions and a smooth experience.

-

What are the benefits of using airSlate SignNow for my Property Tax Reimbursement Application State Of New Jersey?

Using airSlate SignNow for your Property Tax Reimbursement Application State Of New Jersey simplifies the process by providing a user-friendly interface for sending and signing documents. Additionally, it ensures that your application is securely processed, reducing the risk of errors and helping you meet important deadlines.

-

Is the Property Tax Reimbursement Application State Of New Jersey available for digital submission?

Yes, the Property Tax Reimbursement Application State Of New Jersey can be submitted digitally, which offers greater convenience for applicants. By utilizing airSlate SignNow, users can electronically fill out and sign their applications without needing to print or scan, saving time and resources.

-

How does airSlate SignNow integrate with other software for the Property Tax Reimbursement Application State Of New Jersey?

airSlate SignNow offers integrations with various popular software and tools, allowing for a seamless workflow when filing your Property Tax Reimbursement Application State Of New Jersey. You can connect it with document management systems, cloud storage, and business applications to enhance efficiency and organization.

Get more for Property Tax Reimbursement Application State Of New Jersey

- Exponent rules quiz pdf form

- Birth certificate pakistan sample form

- Fudge a mania comprehension questions form

- Solubility graph worksheet form

- Bargain and sale deed with covenant against grantors form

- Student bid card application formb unitar international university unitar

- Printable packing list a printable packing list to help you stay organized while you pack auto europes international travel form

- Sika warranty request form

Find out other Property Tax Reimbursement Application State Of New Jersey

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free