Wi Sales Tax Exemption Formpdffillercom 2018

What is the Wi Sales Tax Exemption Formpdffillercom

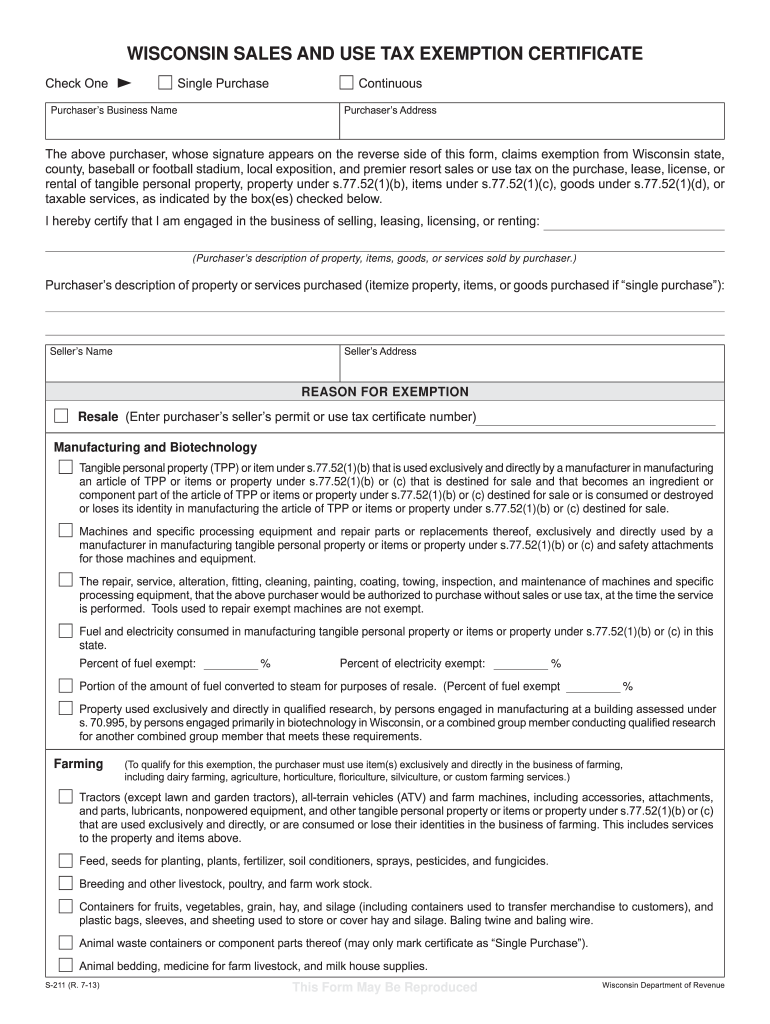

The Wi Sales Tax Exemption Formpdffillercom is a document used by businesses and individuals in Wisconsin to claim exemption from sales tax on certain purchases. This form is essential for qualifying organizations, such as non-profits or governmental entities, to avoid paying sales tax on items that are directly related to their exempt activities. It serves as proof of eligibility for sales tax exemption and must be presented to vendors at the time of purchase.

How to use the Wi Sales Tax Exemption Formpdffillercom

Using the Wi Sales Tax Exemption Formpdffillercom involves several straightforward steps. First, ensure that you meet the eligibility criteria for sales tax exemption. Next, complete the form by providing necessary information, including the name of the exempt organization, its tax identification number, and a description of the items being purchased. Once filled out, present the form to the vendor to validate your tax-exempt status during the transaction.

Steps to complete the Wi Sales Tax Exemption Formpdffillercom

Completing the Wi Sales Tax Exemption Formpdffillercom requires careful attention to detail. Follow these steps:

- Gather necessary information about your organization, including its legal name and tax ID number.

- Fill in the required fields on the form, ensuring accuracy to avoid delays.

- Include a detailed description of the items you intend to purchase tax-exempt.

- Sign and date the form to certify its accuracy.

- Provide the completed form to the vendor at the time of purchase.

Legal use of the Wi Sales Tax Exemption Formpdffillercom

The legal use of the Wi Sales Tax Exemption Formpdffillercom is governed by state tax laws. To be valid, the form must be completed accurately and used solely for eligible purchases. Misuse of the form, such as claiming exemption for ineligible items, can result in penalties. It is crucial to understand the specific regulations that apply to your organization to ensure compliance and avoid legal issues.

Eligibility Criteria

Eligibility for using the Wi Sales Tax Exemption Formpdffillercom is primarily based on the type of organization making the purchase. Generally, qualifying entities include:

- Non-profit organizations recognized under IRS regulations.

- Governmental units and agencies.

- Certain educational institutions.

It is important to verify that your organization meets these criteria before attempting to use the form for tax exemption.

Form Submission Methods

The Wi Sales Tax Exemption Formpdffillercom can be submitted in various ways, depending on the vendor's requirements. Common submission methods include:

- Presenting the completed form in person at the point of sale.

- Sending the form via email or fax if the vendor accepts electronic submissions.

- Providing a printed copy when making a purchase through mail order.

Always confirm with the vendor regarding their preferred submission method to ensure proper processing.

Quick guide on how to complete wi sales tax exemption formpdffillercom 2013

Easily Prepare Wi Sales Tax Exemption Formpdffillercom on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Manage Wi Sales Tax Exemption Formpdffillercom on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

The Easiest Way to Edit and eSign Wi Sales Tax Exemption Formpdffillercom Effortlessly

- Find Wi Sales Tax Exemption Formpdffillercom and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Wi Sales Tax Exemption Formpdffillercom and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wi sales tax exemption formpdffillercom 2013

Create this form in 5 minutes!

How to create an eSignature for the wi sales tax exemption formpdffillercom 2013

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Wi Sales Tax Exemption FormsignNowcom and how does it work?

The Wi Sales Tax Exemption FormsignNowcom is a digital document that allows individuals and businesses to claim exemption from sales tax in Wisconsin. Users can fill out the form online, ensuring accuracy and compliance with state regulations. By using airSlate SignNow, you can easily eSign this form and keep a record of your submission.

-

How much does it cost to use the Wi Sales Tax Exemption FormsignNowcom with airSlate SignNow?

Using the Wi Sales Tax Exemption FormsignNowcom through airSlate SignNow is a cost-effective solution designed for businesses of all sizes. Pricing plans are flexible, allowing you to choose a package that suits your needs while keeping costs manageable. You can even start with a free trial to assess the features before committing.

-

What features are included when using the Wi Sales Tax Exemption FormsignNowcom?

When you utilize the Wi Sales Tax Exemption FormsignNowcom with airSlate SignNow, you gain access to a suite of powerful features like document sharing, customizable templates, and secure eSignatures. Additionally, the platform allows for easy collaboration and tracking of document statuses, enhancing overall efficiency.

-

Is it easy to integrate the Wi Sales Tax Exemption FormsignNowcom with other software?

Yes, airSlate SignNow provides seamless integration options that allow you to connect the Wi Sales Tax Exemption FormsignNowcom with various software and platforms. This flexibility enables you to incorporate the form into your existing workflows and systems, improving your productivity and document management.

-

Can I save time by using the Wi Sales Tax Exemption FormsignNowcom?

Absolutely! Using the Wi Sales Tax Exemption FormsignNowcom with airSlate SignNow saves valuable time by streamlining the document signing and submission process. Digital workflows eliminate the need for printing and mailing, allowing you to complete transactions rapidly and focus on other important tasks.

-

What benefits does the Wi Sales Tax Exemption FormsignNowcom provide for my business?

The Wi Sales Tax Exemption FormsignNowcom can signNowly benefit your business by ensuring compliance with sales tax laws while reducing administrative burdens. Additionally, the electronic signing process enhances security and provides a clear audit trail, making it easier to maintain records for future reference.

-

How secure is my information when using the Wi Sales Tax Exemption FormsignNowcom?

Your security is a top priority when using the Wi Sales Tax Exemption FormsignNowcom with airSlate SignNow. The platform employs advanced encryption and security protocols to protect your data, ensuring that all transactions and document submissions remain confidential and safe from unauthorized access.

Get more for Wi Sales Tax Exemption Formpdffillercom

Find out other Wi Sales Tax Exemption Formpdffillercom

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe