Delnqtaxwisconsingov Form 2018

What is the Delnqtaxwisconsingov Form

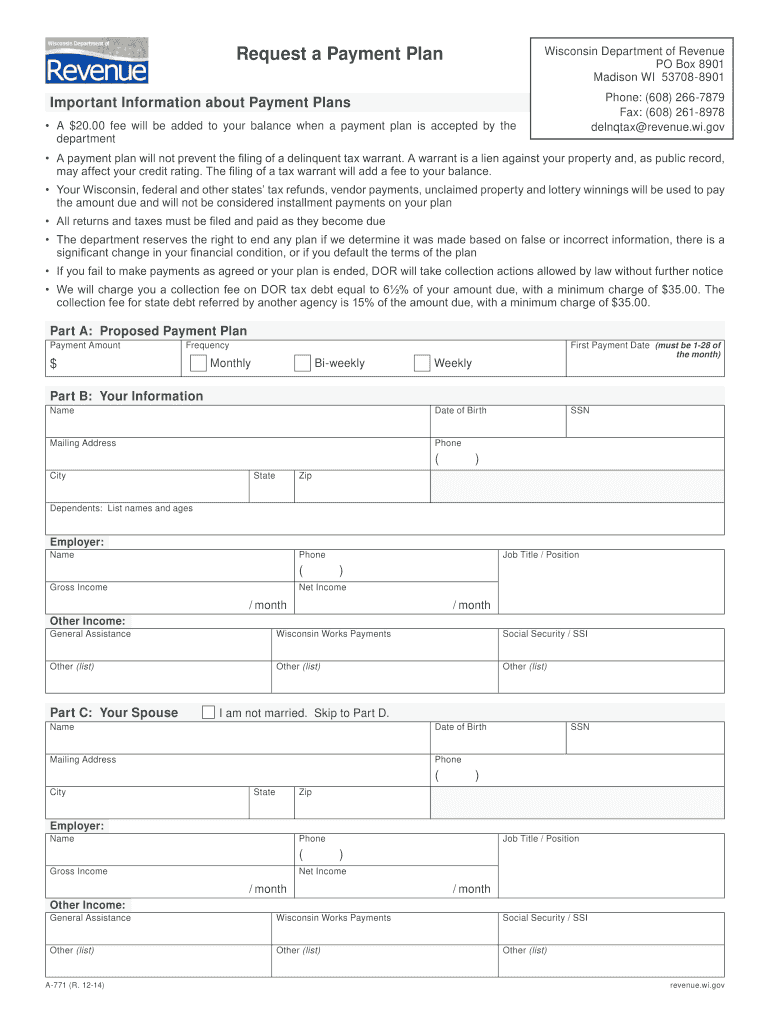

The Delnqtaxwisconsingov Form is an official document used in the state of Wisconsin for various tax-related purposes. This form is essential for individuals and businesses to report their income, deductions, and tax liabilities accurately. It ensures compliance with state tax regulations and facilitates the proper assessment of taxes owed. Understanding the purpose and requirements of this form is crucial for anyone engaging in financial activities within Wisconsin.

How to use the Delnqtaxwisconsingov Form

Using the Delnqtaxwisconsingov Form involves several key steps. First, gather all necessary information, including income details, deductions, and any applicable credits. Next, carefully fill out each section of the form, ensuring accuracy to avoid issues with tax authorities. Once completed, review the form for any errors or omissions. Finally, submit the form according to the specified guidelines, whether electronically or via traditional mail.

Steps to complete the Delnqtaxwisconsingov Form

Completing the Delnqtaxwisconsingov Form requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Access the form through the official Wisconsin tax website or obtain a physical copy.

- Fill in personal information, including your name, address, and Social Security number.

- Input your income details in the designated sections, ensuring all figures are accurate.

- List any deductions and credits you qualify for, following the instructions provided.

- Double-check your entries for accuracy and completeness.

- Submit the form by the deadline, following the preferred submission method.

Legal use of the Delnqtaxwisconsingov Form

The Delnqtaxwisconsingov Form has legal significance as it serves as an official record of your tax obligations. To ensure its legal use, it must be completed accurately and submitted on time. Compliance with state tax laws is crucial, as failure to do so can result in penalties or legal repercussions. Utilizing reliable tools for digital signature and submission can enhance the form's legal validity.

Required Documents

To complete the Delnqtaxwisconsingov Form, several documents are typically required. These may include:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Proof of any tax credits you intend to claim.

Having these documents ready will streamline the completion process and help ensure accuracy.

Form Submission Methods

The Delnqtaxwisconsingov Form can be submitted through various methods, catering to different preferences and needs. The primary submission options include:

- Online: Many users prefer to submit the form electronically through the Wisconsin Department of Revenue's website, which often provides a faster processing time.

- Mail: For those who prefer traditional methods, the form can be printed and mailed to the appropriate tax office.

- In-Person: Some individuals may choose to deliver the form in person at local tax offices for direct assistance.

Choosing the right submission method can impact the efficiency of processing your tax return.

Quick guide on how to complete delnqtaxwisconsingov 2012 form

Effortlessly Prepare Delnqtaxwisconsingov Form on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage Delnqtaxwisconsingov Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign Delnqtaxwisconsingov Form with Ease

- Find Delnqtaxwisconsingov Form and click on Get Form to begin.

- Utilize the tools offered to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Delnqtaxwisconsingov Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delnqtaxwisconsingov 2012 form

Create this form in 5 minutes!

How to create an eSignature for the delnqtaxwisconsingov 2012 form

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Delnqtaxwisconsingov Form and how can airSlate SignNow help with it?

The Delnqtaxwisconsingov Form is a specific tax form required by the state of Wisconsin. airSlate SignNow allows users to easily eSign and send this form securely, ensuring a smooth workflow for your tax submissions. With our user-friendly platform, you can complete and manage the Delnqtaxwisconsingov Form efficiently.

-

Is there a cost associated with using airSlate SignNow for the Delnqtaxwisconsingov Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. While using our platform to complete the Delnqtaxwisconsingov Form, you can choose from our competitively priced options to ensure you get the best value for your electronic signature requirements.

-

What features does airSlate SignNow provide for managing the Delnqtaxwisconsingov Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage for managing the Delnqtaxwisconsingov Form. These tools help streamline the signing process and improve efficiency, allowing you to focus on other important tasks while we handle your document needs.

-

Can I integrate airSlate SignNow with other applications for working on the Delnqtaxwisconsingov Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and more. These integrations allow you to easily retrieve and manage your documents, including the Delnqtaxwisconsingov Form, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for the Delnqtaxwisconsingov Form?

Using airSlate SignNow for the Delnqtaxwisconsingov Form provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. Our eSignature solution ensures that your documents are signed securely and returned quickly, which can help you meet your tax deadlines with ease.

-

Is airSlate SignNow compliant with legal standards for the Delnqtaxwisconsingov Form?

Yes, airSlate SignNow complies with all legal standards for electronic signatures, ensuring that your Delnqtaxwisconsingov Form is valid and legally binding. Our platform provides an audit trail and secure encryption to protect your sensitive information throughout the signing process.

-

How do I get started with airSlate SignNow for the Delnqtaxwisconsingov Form?

To get started with airSlate SignNow for the Delnqtaxwisconsingov Form, simply visit our website and sign up for an account. Once you’re registered, you can easily upload and customize your form, send it for signatures, and manage the entire process from a single dashboard.

Get more for Delnqtaxwisconsingov Form

- Cdanet form

- Solve equations with rational coefficients answers form

- Ir a the infinitive form of the verb ir

- Obrazac 8a form

- Excavation site checklist and daily field report et 2 form

- Chrissies guide to the open water chrissiewellington form

- General inquiry form madawaska valley

- Declaration of spouse form 1152 declaration of spouseloans and bursaries program to be filled out by spouse

Find out other Delnqtaxwisconsingov Form

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now