FTB 3601 TRANSMITTAL of ANNUAL 1098, 1099, 5498, W 2G INFORMATION for TAX YEAR 2002

What is the FTB 3601 Transmittal of Annual 1098, 1099, 5498, W-2G Information for Tax Year

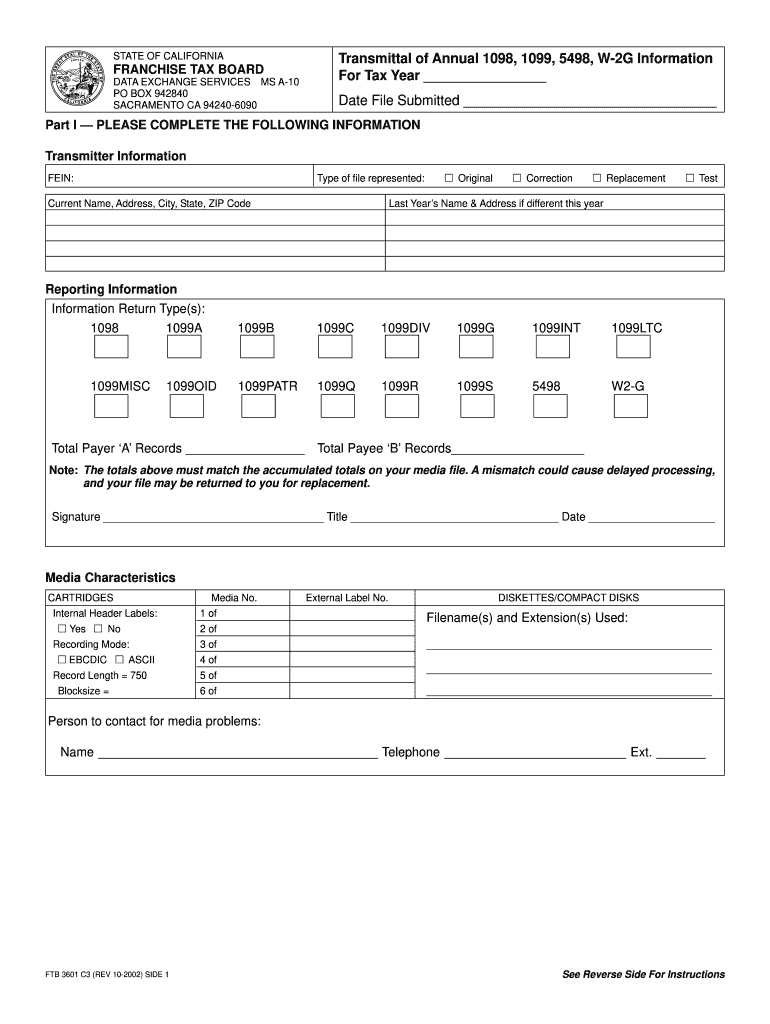

The FTB 3601 Transmittal of Annual 1098, 1099, 5498, W-2G Information for Tax Year is a crucial document used by businesses and financial institutions to report various types of income and tax information to the California Franchise Tax Board. This form consolidates information from several other forms, including the 1098, 1099, 5498, and W-2G, which detail income received by individuals and entities. The FTB 3601 ensures that the reported information is accurate, organized, and submitted in compliance with state tax regulations.

Steps to Complete the FTB 3601 Transmittal of Annual 1098, 1099, 5498, W-2G Information for Tax Year

Completing the FTB 3601 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information from the various forms that contribute to the FTB 3601. This includes details such as taxpayer identification numbers, amounts reported, and any other relevant data. Next, accurately fill out the FTB 3601 form, ensuring all entries are correct and match the supporting documents. Once completed, review the form for any errors or omissions before submission. Finally, submit the FTB 3601 to the appropriate tax authority by the designated deadline, either electronically or via mail.

Legal Use of the FTB 3601 Transmittal of Annual 1098, 1099, 5498, W-2G Information for Tax Year

The legal use of the FTB 3601 is governed by state tax laws that require accurate reporting of income and tax information. This form serves as a formal declaration to the California Franchise Tax Board, ensuring that taxpayers fulfill their reporting obligations. Proper completion and submission of the FTB 3601 can help avoid penalties or legal issues related to non-compliance. It is important to adhere to all guidelines and regulations to maintain the legal validity of the submitted information.

Filing Deadlines / Important Dates

Filing deadlines for the FTB 3601 are critical to ensure compliance with state tax regulations. Typically, the deadline for submitting the FTB 3601 coincides with the deadlines for the related forms, such as the 1099 and W-2G. It is essential to be aware of these dates to avoid late penalties. Generally, the forms must be submitted by January thirty-first of the year following the tax year in question. However, if filing electronically, there may be extended deadlines available.

Form Submission Methods (Online / Mail / In-Person)

The FTB 3601 can be submitted through various methods, providing flexibility for filers. The most efficient method is electronic submission, which allows for quicker processing and confirmation of receipt. Filers can also choose to mail the completed form to the designated address provided by the California Franchise Tax Board. In-person submissions are typically not common for this type of form, but it is advisable to check with local tax offices for any specific requirements or options available.

Required Documents

To successfully complete the FTB 3601, several documents are required. These include copies of all relevant 1098, 1099, 5498, and W-2G forms that report income and tax information for the tax year. Additionally, filers should have their taxpayer identification number and any supporting documentation that verifies the amounts reported. Ensuring that all required documents are gathered beforehand can streamline the completion process and reduce the likelihood of errors.

Quick guide on how to complete ftb 3601 transmittal of annual 1098 1099 5498 w 2g information for tax year

Complete FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR with ease

- Obtain FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 3601 transmittal of annual 1098 1099 5498 w 2g information for tax year

Create this form in 5 minutes!

How to create an eSignature for the ftb 3601 transmittal of annual 1098 1099 5498 w 2g information for tax year

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR form?

The FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR is a document used for reporting certain tax information to the California Franchise Tax Board. This form consolidates various tax documents and makes it easier for businesses to submit accurate annual tax information efficiently.

-

How does airSlate SignNow support the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR process?

airSlate SignNow streamlines the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR process by allowing users to eSign and manage documents digitally. This not only simplifies document handling but also reduces the time spent on manual processes, ensuring accuracy and compliance.

-

What pricing options are available for airSlate SignNow users preparing the FTB 3601 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Users can choose from individual, business, or enterprise plans that provide various features tailored for efficiently managing documents, including those related to the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR.

-

Can I integrate airSlate SignNow with other software for handling the FTB 3601 form?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software, enhancing the overall efficiency of managing the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR. This allows users to automate workflows and reduce the risk of errors, ensuring timely submissions.

-

What are the benefits of using airSlate SignNow for the FTB 3601 TRANSMITTAL?

Using airSlate SignNow provides signNow benefits, such as enhanced document security, improved workflow efficiency, and user-friendly features. These advantages enable businesses to handle the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR with ease, leading to better compliance and organization.

-

Is airSlate SignNow secure for handling sensitive FTB 3601 information?

Absolutely. airSlate SignNow prioritizes security through robust encryption protocols and compliance with industry standards. This ensures that all information related to the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR is kept safe and confidential.

-

How easy is it to learn and use airSlate SignNow for FTB 3601 preparation?

airSlate SignNow is designed with user-friendliness in mind, making it easy for individuals and businesses to learn how to prepare the FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR. The platform includes helpful resources and tutorials to guide users through the process quickly and efficiently.

Get more for FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR

- Investigative questions for couples experiencing infidelity form

- Zenith internet banking form

- Fema appeal letter example pdf form

- 1387 2 form

- Bill nye water cycle form

- Lesson 5 1 percent increase and decrease answer key form

- Scale factor worksheet 472907823 form

- Fraser heights chess club registration formpdf

Find out other FTB 3601 TRANSMITTAL OF ANNUAL 1098, 1099, 5498, W 2G INFORMATION FOR TAX YEAR

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo