Wage Withholding Tax NM Taxation and Revenue Department 2020

Understanding the Earnings Tax in Philadelphia

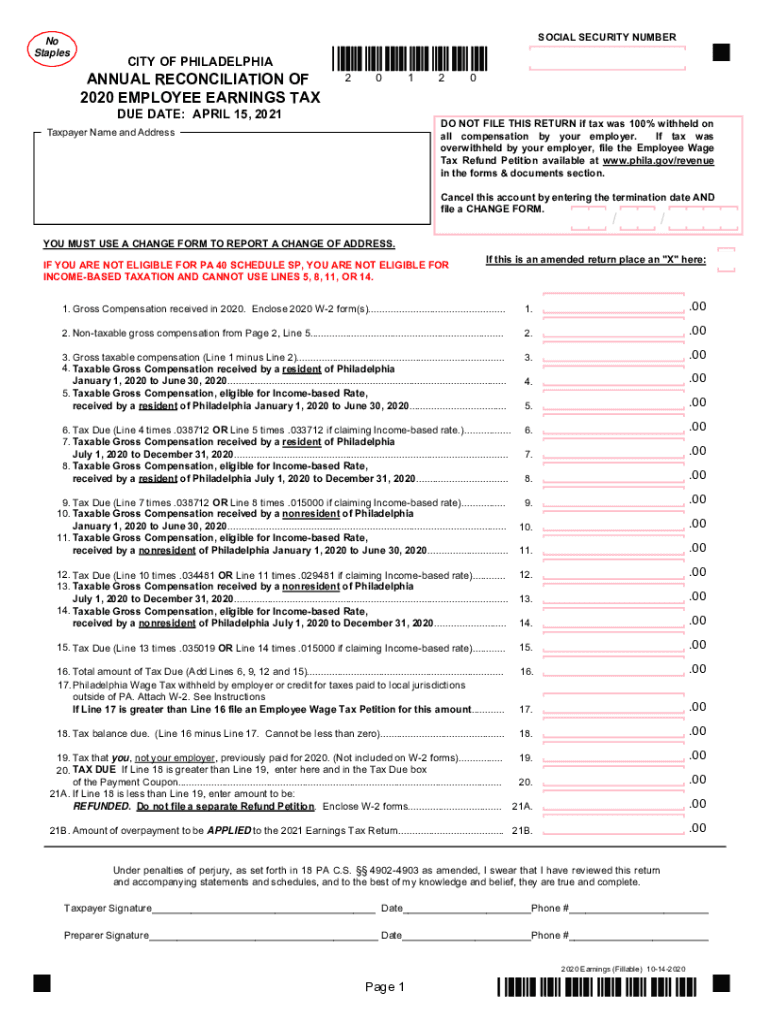

The earnings tax in Philadelphia is a local tax imposed on individuals who work or reside in the city. This tax is calculated as a percentage of an individual's gross earnings, including wages, salaries, and other forms of compensation. The current rate for residents is higher than for non-residents, reflecting the city's efforts to generate revenue from those who benefit from its services. Understanding this tax is crucial for both employees and employers to ensure compliance and accurate reporting.

Steps to Complete the Earnings Tax Philadelphia Form

Completing the earnings tax Philadelphia form involves several important steps. First, gather all necessary documents, including your W-2 forms and any other income statements. Next, accurately fill out the form, ensuring that all income sources are reported. Pay close attention to the residency status, as this affects the tax rate applied. After completing the form, review it for any errors before submitting it to the appropriate city department. Finally, keep a copy for your records as proof of compliance.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is essential to avoid penalties. The earnings tax form must typically be filed by April 15 of the following year for most taxpayers. If you are unable to meet this deadline, it is advisable to file for an extension. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Mark your calendar with these important dates to ensure timely compliance.

Penalties for Non-Compliance

Failing to file the earnings tax form or pay the tax owed can result in significant penalties. The city may impose fines for late submissions, and interest will accrue on any unpaid balance. Additionally, persistent non-compliance can lead to more severe consequences, such as wage garnishments or legal action. It is crucial to address any issues promptly to avoid these penalties and maintain good standing with the city.

Required Documents for Filing

When preparing to file the earnings tax Philadelphia form, certain documents are essential. These include your W-2 forms, which report your annual earnings, and any 1099 forms if you have additional income sources. You may also need proof of residency if you are claiming the resident tax rate. Having these documents organized will streamline the filing process and help ensure accuracy.

Legal Use of the Earnings Tax Form

The earnings tax form is a legally binding document that must be completed accurately. Misrepresentation or failure to report income can lead to legal consequences, including audits or fines. It is important to understand the legal implications of the information provided on the form, ensuring that all data is truthful and complete. Utilizing a reliable platform for electronic filing can enhance compliance and security.

Quick guide on how to complete wage withholding tax nm taxation and revenue department

Effortlessly Prepare Wage Withholding Tax NM Taxation And Revenue Department on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without any holdups. Handle Wage Withholding Tax NM Taxation And Revenue Department on any platform with airSlate SignNow's applications for Android or iOS and streamline your document processes today.

The Easiest Way to Edit and eSign Wage Withholding Tax NM Taxation And Revenue Department Without Hassle

- Obtain Wage Withholding Tax NM Taxation And Revenue Department and click Get Form to begin.

- Utilize our tools to fill out your document.

- Highlight important sections of your documents or conceal sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Wage Withholding Tax NM Taxation And Revenue Department to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wage withholding tax nm taxation and revenue department

Create this form in 5 minutes!

How to create an eSignature for the wage withholding tax nm taxation and revenue department

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the earnings tax in Philadelphia?

The earnings tax in Philadelphia is a tax imposed on individuals and businesses earning income within the city. This tax is levied on wages, salaries, and other forms of compensation. Understanding how this tax works is essential for compliance and proper tax planning in Philadelphia.

-

How does airSlate SignNow help with earnings tax documentation?

airSlate SignNow provides a seamless platform for managing and signing documents related to earnings tax in Philadelphia. By streamlining document workflows, businesses can easily collect signatures and ensure their tax filings are accurate and timely. This efficiency can lead to better compliance and less stress during tax season.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs, including options for handling earnings tax documentation effectively. Users can choose a plan that suits their budget while benefiting from our eSignature solution. The cost is a worthwhile investment to simplify your tax processes in Philadelphia.

-

What features make airSlate SignNow ideal for managing earnings tax forms?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking that are particularly useful for managing earnings tax forms in Philadelphia. These features help ensure that all documents are completed accurately and securely. Streamlining these processes can save businesses time and reduce the risk of errors in tax filing.

-

Can I integrate airSlate SignNow with my accounting software for earnings tax purposes?

Absolutely! airSlate SignNow offers integrations with popular accounting software that can help streamline your earnings tax processing in Philadelphia. This integration ensures that all your financial documents, including tax forms, work seamlessly together, making data transfer and management much easier.

-

What are the benefits of using airSlate SignNow over traditional methods for earnings tax?

Using airSlate SignNow provides signNow advantages over traditional methods for handling earnings tax documentation, such as enhanced security, faster processing times, and the ability to sign remotely. This not only simplifies the process of executing necessary documents but also ensures that you comply with Philadelphia's tax regulations efficiently.

-

How secure is airSlate SignNow for sensitive earnings tax documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive earnings tax documents in Philadelphia. The platform employs robust encryption and compliance measures to ensure that your documents are protected. This commitment to security helps businesses feel confident while managing their tax-related paperwork.

Get more for Wage Withholding Tax NM Taxation And Revenue Department

Find out other Wage Withholding Tax NM Taxation And Revenue Department

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure