How to File Annual Reconciliation Employee Earning Tax for 2021-2026

What is the paphir tax?

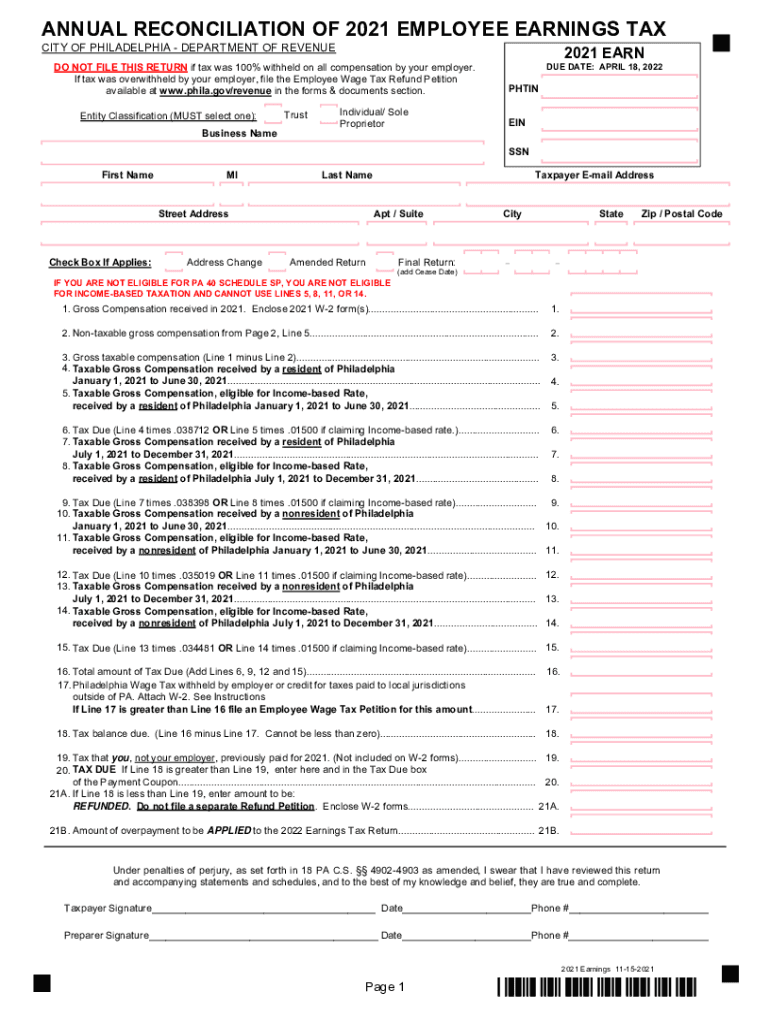

The paphir tax, formally known as the Philadelphia Annual Reconciliation of Employee Earnings Tax, is a tax form that individuals and businesses in Philadelphia must complete to reconcile their employee earnings tax. This form ensures that the appropriate amount of tax has been withheld from employees' wages throughout the year. The paphir tax is essential for both employers and employees, as it helps maintain compliance with local tax regulations.

Steps to complete the paphir tax

Completing the paphir tax involves several key steps to ensure accuracy and compliance. Follow these steps to successfully fill out the form:

- Gather necessary documents, including W-2 forms and payroll records.

- Calculate the total earnings for each employee for the year.

- Determine the amount of employee earnings tax that has been withheld.

- Fill out the paphir tax form, ensuring all information is accurate.

- Submit the completed form by the designated deadline.

Legal use of the paphir tax

The paphir tax is legally binding when completed correctly and submitted on time. Compliance with the regulations set forth by the Philadelphia Department of Revenue is crucial. The form must be signed by an authorized representative of the business, which adds a layer of legal validity to the document. Failure to file or inaccuracies in the form can lead to penalties and interest charges.

Filing deadlines / Important dates

It is important to be aware of the filing deadlines for the paphir tax to avoid penalties. Typically, the paphir tax must be filed annually by the last day of February following the tax year. Keeping track of these dates ensures that businesses remain compliant and can avoid unnecessary fines.

Required documents

To complete the paphir tax form, several documents are required. These include:

- W-2 forms for all employees.

- Payroll records that detail earnings and withholdings.

- Any relevant tax documentation that supports the calculations made on the form.

Form submission methods

The paphir tax can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Philadelphia Department of Revenue's website.

- Mailing a paper copy of the form to the appropriate tax office.

- In-person submission at designated city offices.

Penalties for non-compliance

Failure to file the paphir tax on time or inaccuracies in the form can result in significant penalties. These may include:

- Late filing fees.

- Interest on unpaid taxes.

- Potential legal action for continued non-compliance.

Quick guide on how to complete how to file annual reconciliation employee earning tax for

Complete How To File Annual Reconciliation Employee Earning Tax For smoothly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without any delays. Manage How To File Annual Reconciliation Employee Earning Tax For on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign How To File Annual Reconciliation Employee Earning Tax For effortlessly

- Obtain How To File Annual Reconciliation Employee Earning Tax For and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize key sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management within a few clicks from a device of your choice. Modify and eSign How To File Annual Reconciliation Employee Earning Tax For and ensure excellent communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to file annual reconciliation employee earning tax for

Create this form in 5 minutes!

People also ask

-

What is the Philadelphia annual reconciliation of employee earnings tax?

The Philadelphia annual reconciliation of employee earnings tax provides a process for employers to reconcile employee earnings and determine the appropriate tax amounts owed. Ensuring accurate reconciliation helps businesses comply with local tax laws and avoid penalties.

-

How does airSlate SignNow assist with the Philadelphia annual reconciliation of employee earnings tax?

airSlate SignNow streamlines the documentation process for the Philadelphia annual reconciliation of employee earnings tax. Our platform allows businesses to easily eSign and send required documents, ensuring that the reconciliation process is efficient and compliant.

-

What features does airSlate SignNow offer for handling employee earnings tax forms?

airSlate SignNow offers features such as templates for commonly used forms related to the Philadelphia annual reconciliation of employee earnings tax, real-time collaboration, and secure cloud storage. These tools simplify the management of necessary forms and ensure timely submissions.

-

Is there a pricing model for using airSlate SignNow for tax reconciliation?

Yes, airSlate SignNow offers flexible pricing models tailored to businesses of all sizes. You can choose a plan that meets your needs and budget while efficiently managing the Philadelphia annual reconciliation of employee earnings tax.

-

Can airSlate SignNow integrate with other accounting tools for employee earnings tax?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and payroll tools, enhancing your workflow for the Philadelphia annual reconciliation of employee earnings tax. This integration ensures that all your data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Philadelphia annual reconciliation of employee earnings tax, offers several benefits. These include increased efficiency in document management, enhanced security for sensitive information, and reduced paperwork, making the entire process smoother.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes the security of your documents, employing encryption and secure cloud storage to protect sensitive information related to the Philadelphia annual reconciliation of employee earnings tax. You can trust that your data remains confidential and secure.

Get more for How To File Annual Reconciliation Employee Earning Tax For

- Oklahoma pre lien form

- Quitclaim deed from husband and wife to corporation oklahoma form

- Warranty deed from husband and wife to corporation oklahoma form

- Oklahoma divorce contested form

- Business entity 497322996 form

- Oklahoma lien form

- Quitclaim deed from husband and wife to llc oklahoma form

- Warranty deed from husband and wife to llc oklahoma form

Find out other How To File Annual Reconciliation Employee Earning Tax For

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement