City of Philadelphia Annual Recon Form 2017

What is the City of Philadelphia Annual Recon Form

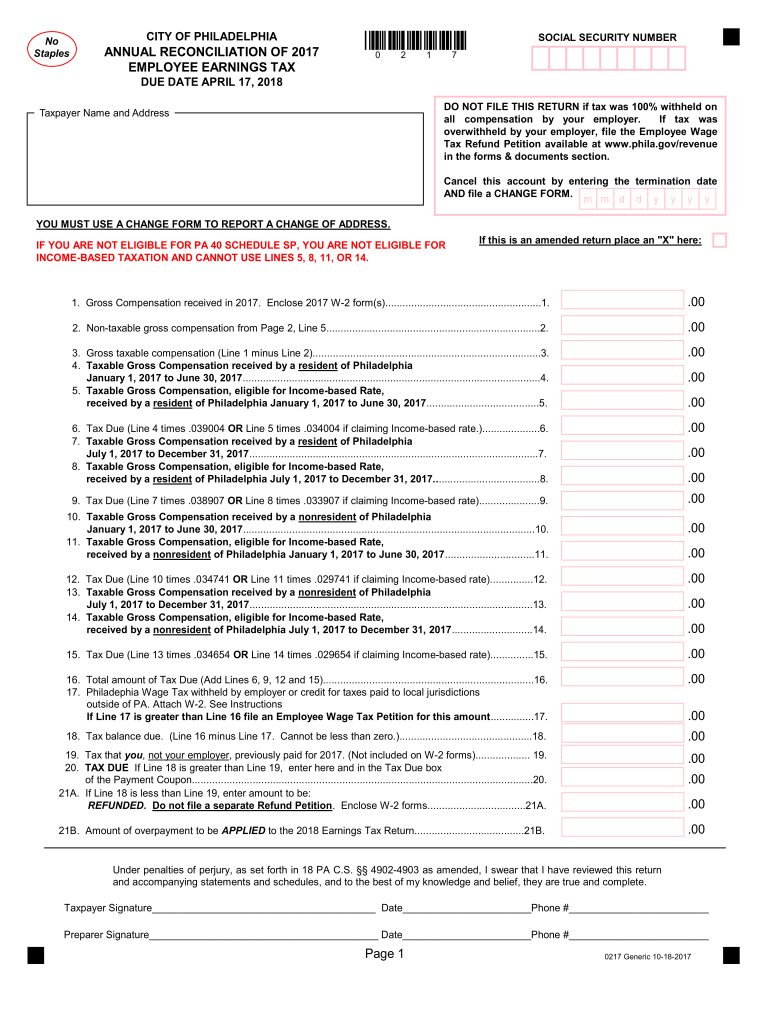

The City of Philadelphia Annual Recon Form is a crucial document used for reconciling employee earnings tax. This form is essential for individuals and businesses operating within the city, as it ensures that the correct amount of earnings tax has been reported and paid. The form captures various details, including total earnings, tax withheld, and any adjustments necessary for accurate reporting. Understanding this form is vital for compliance with local tax regulations and for avoiding potential penalties.

Steps to Complete the City of Philadelphia Annual Recon Form

Completing the City of Philadelphia Annual Recon Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms and records of any estimated payments made throughout the year. Next, accurately report total earnings and any tax withheld on the form. It is essential to double-check all figures to prevent discrepancies. Finally, review the completed form for completeness before submission. Utilizing electronic tools can streamline this process and enhance accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the City of Philadelphia Annual Recon Form are critical to avoid penalties. Typically, the form must be submitted by April 15 of the following year after the tax year ends. For instance, the 2023 form would be due on April 15, 2024. It is important to stay informed of any changes to these dates, as they can vary based on local regulations or specific circumstances. Marking these deadlines on your calendar can help ensure timely compliance.

Required Documents

To complete the City of Philadelphia Annual Recon Form, several documents are required. These typically include:

- W-2 forms from employers

- Records of estimated payments made during the year

- Any relevant tax documents that reflect income and withholdings

Having these documents readily available will facilitate a smoother filing process and help ensure that all information reported is accurate and complete.

Legal Use of the City of Philadelphia Annual Recon Form

The legal use of the City of Philadelphia Annual Recon Form is governed by local tax laws. This form must be filled out accurately to reflect the taxpayer's earnings and tax obligations. Failure to complete the form correctly can result in penalties or legal repercussions. It is essential to understand the legal requirements surrounding this form, including the need for proper signatures and the implications of submitting false information.

Form Submission Methods (Online / Mail / In-Person)

The City of Philadelphia Annual Recon Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online, which often provides a quicker and more efficient way to submit the form. Alternatively, forms can be mailed to the appropriate tax office or submitted in person. Each method has its own set of guidelines and timelines, so it is advisable to choose the one that best fits your needs and to ensure compliance with submission requirements.

Quick guide on how to complete do not file this return if tax was 100 withheld on

Effortlessly prepare City Of Philadelphia Annual Recon Form on any device

The management of online documents has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the instruments required to create, modify, and electronically sign your documents quickly and without delays. Manage City Of Philadelphia Annual Recon Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven procedure today.

Edit and electronically sign City Of Philadelphia Annual Recon Form with ease

- Find City Of Philadelphia Annual Recon Form and click Get Form to commence.

- Employ the tools we provide to complete your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to retain your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign City Of Philadelphia Annual Recon Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not file this return if tax was 100 withheld on

Create this form in 5 minutes!

How to create an eSignature for the do not file this return if tax was 100 withheld on

How to create an electronic signature for the Do Not File This Return If Tax Was 100 Withheld On in the online mode

How to generate an electronic signature for your Do Not File This Return If Tax Was 100 Withheld On in Google Chrome

How to generate an electronic signature for putting it on the Do Not File This Return If Tax Was 100 Withheld On in Gmail

How to make an eSignature for the Do Not File This Return If Tax Was 100 Withheld On from your mobile device

How to generate an electronic signature for the Do Not File This Return If Tax Was 100 Withheld On on iOS

How to create an electronic signature for the Do Not File This Return If Tax Was 100 Withheld On on Android OS

People also ask

-

What is the Philadelphia earnings tax and who needs to pay it?

The Philadelphia earnings tax is a tax imposed on individuals and businesses earning income within Philadelphia. If you're a resident or work in the city, you're required to file and pay this tax annually. Understanding this tax is crucial for compliance, especially for businesses operating in the area.

-

How does airSlate SignNow assist with managing Philadelphia earnings tax documents?

airSlate SignNow streamlines the process of sending and eSigning essential documents related to Philadelphia earnings tax. Our platform ensures that your tax forms, payroll documents, and other related paperwork are securely handled and quickly processed, which helps you stay compliant with your tax obligations.

-

Are there any costs associated with using airSlate SignNow for Philadelphia earnings tax management?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures you have access to tools that efficiently manage and eSign your Philadelphia earnings tax documents without breaking the bank.

-

What features of airSlate SignNow are beneficial for handling Philadelphia earnings tax?

Key features of airSlate SignNow that benefit businesses managing Philadelphia earnings tax include customizable templates, secure eSigning, and automated workflows. These features save time, enhance accuracy, and ensure all tax documents are processed efficiently, reducing the stress associated with tax season.

-

Can I integrate airSlate SignNow with my accounting software to assist with Philadelphia earnings tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software to help streamline the management of your Philadelphia earnings tax documents. This integration allows for easy retrieval of financial data and simplifies the tax filing process, making compliance easier.

-

How does airSlate SignNow ensure the security of my Philadelphia earnings tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures to protect your Philadelphia earnings tax documents, ensuring that sensitive information remains confidential and secure during the eSigning process.

-

Is there customer support available for questions related to Philadelphia earnings tax and airSlate SignNow?

Yes, airSlate SignNow provides robust customer support to assist with any questions regarding Philadelphia earnings tax and our platform. Our team is ready to help you navigate any issues you might encounter, ensuring that your experience is smooth and effective.

Get more for City Of Philadelphia Annual Recon Form

- Renewal entry level us coast guard uscg form

- Cg 1280 renewal of certificate of documentation us coast guard uscg form

- Arizona seasonal pass for livestock form

- Hr 0943 form

- Current use program form cu 301 formerly lu vermontgov state vt

- Vermont fg 601 pdf 2014 form

- Complete renewal application arkansas department of adeq state ar form

- Foc 88 2009 form

Find out other City Of Philadelphia Annual Recon Form

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed