California Form Tax 2020

What is the California Form Tax

The California Form Tax refers to the various tax forms required by the state of California for individuals and businesses to report their income, deductions, and credits. These forms are essential for ensuring compliance with state tax laws and regulations. The most common forms include the California Resident Income Tax Return (Form 540) and the Nonresident or Part-Year Resident Income Tax Return (Form 540NR). Each form serves a specific purpose and is designed to capture the necessary information for accurate tax assessment.

How to use the California Form Tax

Using the California Form Tax involves several steps, starting with determining which form is applicable based on your residency status and income type. Once you identify the correct form, you can obtain it from the California Franchise Tax Board website or through authorized tax preparation services. After filling out the form, ensure all information is accurate and complete to avoid delays or penalties. You can submit the form electronically or via mail, depending on your preference and the specific guidelines for the form you are using.

Steps to complete the California Form Tax

Completing the California Form Tax requires careful attention to detail. Here are the key steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Choose the appropriate form based on your residency status.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the specific submission guidelines.

Legal use of the California Form Tax

The California Form Tax is legally binding when completed and submitted according to state regulations. It is crucial to provide truthful and accurate information, as any discrepancies can lead to audits, penalties, or legal repercussions. Using eSignature solutions, such as signNow, can enhance the legal validity of your submissions by ensuring compliance with electronic signature laws, such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the California Form Tax vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April 15 each year. However, extensions may be available, allowing additional time for submission. It is essential to stay informed about any changes to deadlines, especially in response to natural disasters or other significant events that may affect tax filing.

Required Documents

To complete the California Form Tax, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as medical expenses or mortgage interest

- Proof of any tax credits claimed

Having these documents organized will streamline the filing process and help ensure accuracy in your tax return.

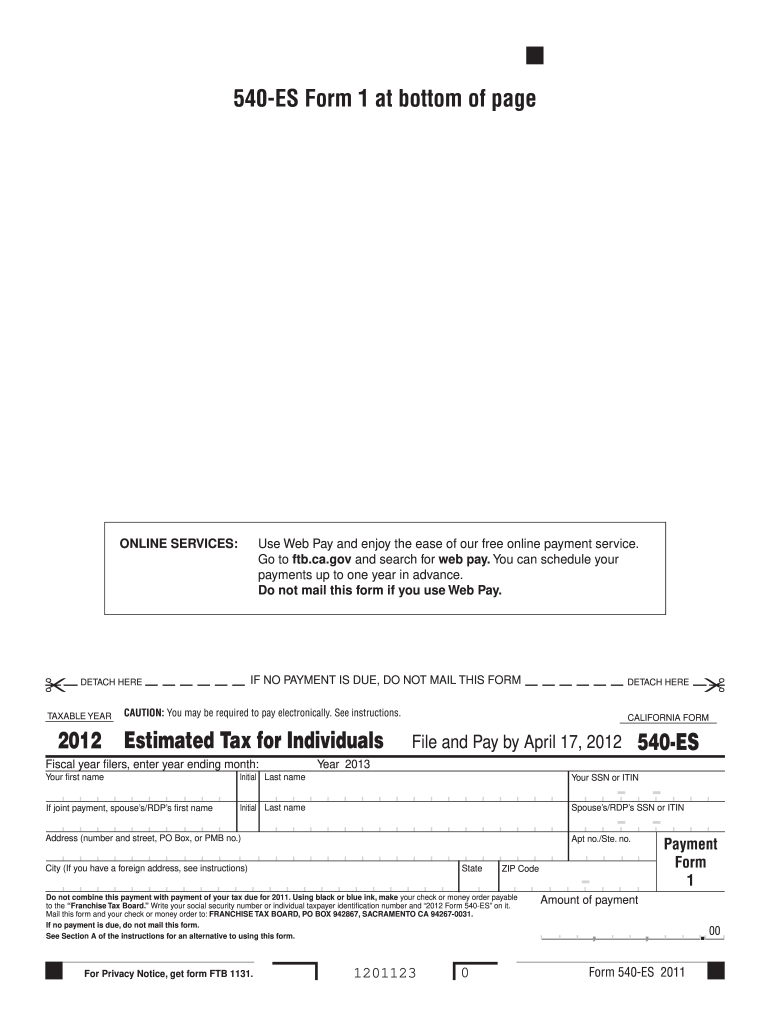

Quick guide on how to complete 2012 california form tax

Complete California Form Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an optimal eco-friendly alternative to conventional printed and signed documentation, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage California Form Tax on any platform using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to adjust and eSign California Form Tax with ease

- Obtain California Form Tax and click on Get Form to begin.

- Use the features we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign California Form Tax and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 california form tax

Create this form in 5 minutes!

How to create an eSignature for the 2012 california form tax

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to California Form Tax?

airSlate SignNow is a powerful eSignature solution that enables businesses to streamline their document signing process, including those related to California Form Tax. It allows users to send, sign, and manage essential tax documents electronically, ensuring compliance and efficiency.

-

How can airSlate SignNow help with completing California Form Tax?

Using airSlate SignNow simplifies the completion of California Form Tax by allowing users to fill out forms digitally and eSign them securely. This eliminates the need for manual paperwork and enhances collaboration among parties involved in the tax process.

-

Is airSlate SignNow cost-effective for managing California Form Tax?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective option for managing California Form Tax. By digitizing document workflows, businesses can save both time and resources typically spent on traditional methods.

-

What features does airSlate SignNow offer for California Form Tax documentation?

airSlate SignNow provides a variety of features for California Form Tax documentation, including customizable templates, sophisticated tracking, and real-time notifications. These features ensure that users can manage their tax documents with ease and stay compliant with California regulations.

-

Can airSlate SignNow integrate with other tax software for California Form Tax?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, facilitating the efficient handling of California Form Tax. These integrations help streamline workflows, making it easier to manage your tax-related documents in one place.

-

What are the benefits of using airSlate SignNow for California Form Tax submissions?

Using airSlate SignNow for California Form Tax submissions provides several benefits, including enhanced security, quick turnaround times, and improved accuracy. The platform's user-friendly interface simplifies the signing process for all parties involved, promoting a smoother tax filing experience.

-

How secure is airSlate SignNow when handling California Form Tax documents?

airSlate SignNow prioritizes security, ensuring that California Form Tax documents are protected with advanced encryption and compliance protocols. Users can trust that their sensitive tax information is safe throughout the signing process.

Get more for California Form Tax

Find out other California Form Tax

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe