Nyc 202 Form 2019

What is the Nyc 202 Form

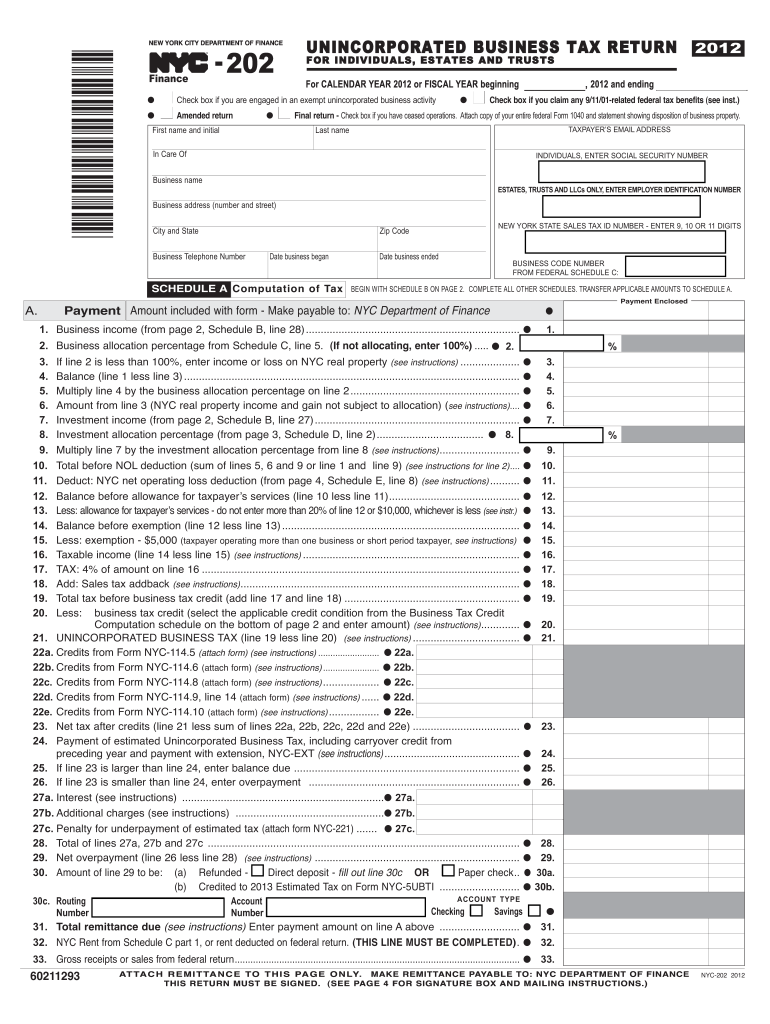

The Nyc 202 Form is a tax form used by businesses operating in New York City to report their income and calculate their tax obligations. This form is essential for entities such as corporations and partnerships that are subject to the city's business income tax. Understanding the purpose of the Nyc 202 Form helps ensure compliance with local tax regulations and facilitates accurate reporting of financial activities.

How to use the Nyc 202 Form

Using the Nyc 202 Form involves several steps to ensure that all required information is accurately reported. First, gather all relevant financial documents, including income statements and expense records. Next, fill out the form with precise details regarding your business income, deductions, and tax credits. After completing the form, review it for accuracy before submission. This careful approach helps avoid errors that could lead to penalties or audits.

Steps to complete the Nyc 202 Form

Completing the Nyc 202 Form requires a structured approach. Follow these steps:

- Collect necessary financial documents, including profit and loss statements.

- Fill in your business identification information, including your EIN.

- Report your total income and allowable deductions accurately.

- Calculate your total tax liability based on the provided tax rates.

- Sign and date the form, ensuring all information is complete.

Legal use of the Nyc 202 Form

The Nyc 202 Form is legally binding when completed and submitted according to the guidelines set by the New York City Department of Finance. To ensure its legal standing, it is crucial to provide accurate information and comply with all relevant tax laws. Proper use of the form helps protect against potential legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Nyc 202 Form are typically aligned with the federal tax deadlines. Businesses must submit their forms by the due date specified by the New York City Department of Finance to avoid penalties. It is important to stay informed about any changes to these deadlines, which can vary based on the fiscal year and specific business circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Nyc 202 Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the New York City Department of Finance website.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices for those who prefer direct interaction.

Choosing the right submission method can streamline the filing process and ensure timely compliance.

Key elements of the Nyc 202 Form

Key elements of the Nyc 202 Form include sections for reporting business income, deductions, and tax credits. Each section is designed to capture specific financial information relevant to the business's operations. Understanding these elements is crucial for accurate reporting and compliance with tax obligations.

Quick guide on how to complete nyc 202 2012 form

Effortlessly Prepare Nyc 202 Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Nyc 202 Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and electronically sign Nyc 202 Form with minimal effort

- Find Nyc 202 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Nyc 202 Form and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nyc 202 2012 form

Create this form in 5 minutes!

How to create an eSignature for the nyc 202 2012 form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the NYC 202 Form?

The NYC 202 Form is a document required for businesses operating in New York City to report their business income for tax purposes. airSlate SignNow simplifies the process of completing and signing the NYC 202 Form electronically, ensuring compliance and accuracy.

-

How can I eSign the NYC 202 Form using airSlate SignNow?

With airSlate SignNow, you can swiftly eSign the NYC 202 Form by uploading your document and inviting signers to add their signatures. The platform ensures its users can easily verify that the form has been signed and completed properly.

-

Is there a cost associated with using airSlate SignNow for the NYC 202 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans provide access to features that streamline the preparation and signing of forms like the NYC 202 Form at an affordable cost.

-

What features does airSlate SignNow offer for handling the NYC 202 Form?

airSlate SignNow provides features such as customizable templates for the NYC 202 Form, document tracking, and audit trail capabilities. These features enhance the efficiency and reliability of your document signing process.

-

Can airSlate SignNow integrate with other software for NYC 202 Form processing?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage the NYC 202 Form. This integration allows for a smoother workflow by connecting your existing systems with the SignNow platform.

-

How does airSlate SignNow ensure the security of the NYC 202 Form?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols and complies with industry standards to ensure that your NYC 202 Form and other documents remain secure throughout the signing process.

-

Can multiple users sign the NYC 202 Form using airSlate SignNow?

Yes, airSlate SignNow allows for multiple users to sign the NYC 202 Form. This functionality is ideal for businesses that require signatures from multiple stakeholders, streamlining collaboration and reducing delays.

Get more for Nyc 202 Form

Find out other Nyc 202 Form

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template