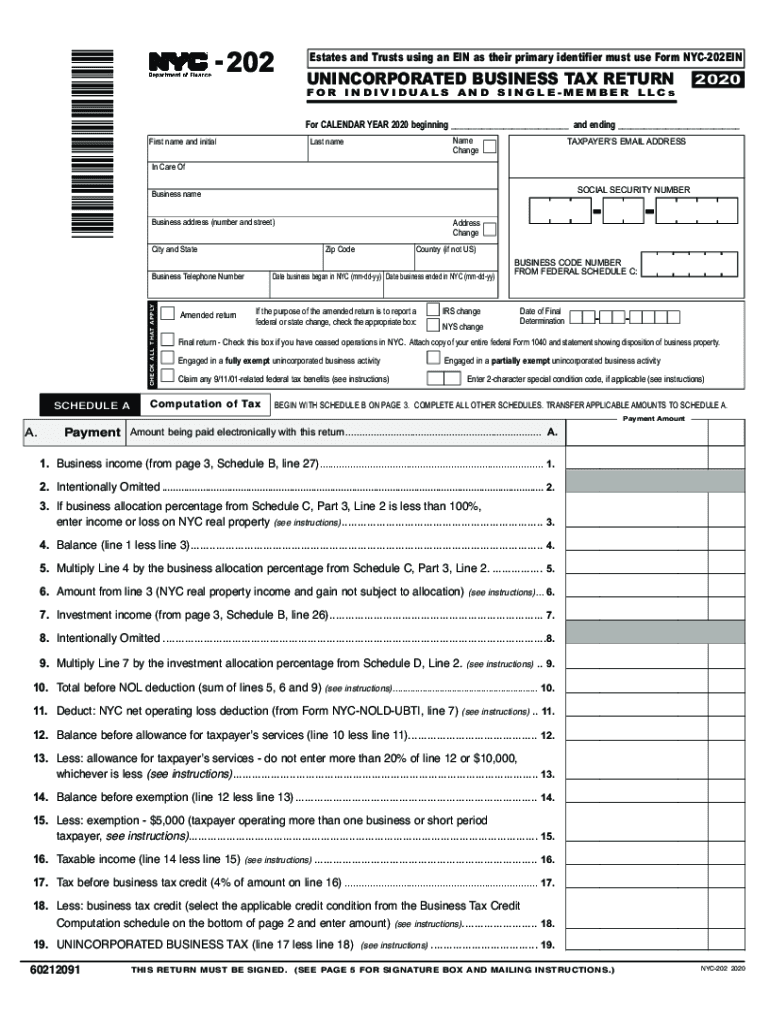

for CALENDAR YEAR Beginning and Ending 2020

What is the For CALENDAR YEAR Beginning And Ending

The "For CALENDAR YEAR Beginning And Ending" section of the NYC 202 form specifies the timeframe for which the income and expenses are reported. This section is crucial for determining the applicable tax year and ensuring compliance with local tax regulations. Typically, the calendar year runs from January first to December thirty-first, but certain businesses may choose a different fiscal year. Understanding this timeframe helps in accurately reporting income and calculating tax liabilities.

Steps to complete the For CALENDAR YEAR Beginning And Ending

Completing the "For CALENDAR YEAR Beginning And Ending" section involves a few straightforward steps:

- Identify the start date of the reporting period, which is usually January first for calendar year filers.

- Specify the end date, typically December thirty-first, unless a different fiscal year is elected.

- Ensure that the dates align with your business's accounting practices to maintain consistency.

- Double-check the dates for accuracy before submitting the form to avoid potential issues with tax authorities.

Legal use of the For CALENDAR YEAR Beginning And Ending

The legal use of the "For CALENDAR YEAR Beginning And Ending" section is essential for compliance with tax laws. Accurately reporting the correct dates ensures that your tax filings are valid and recognized by the IRS and local tax authorities. Misreporting these dates can lead to penalties or audits, making it crucial to adhere to the specified guidelines. This section also helps in determining eligibility for various tax credits and deductions based on the reporting period.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 202 form are critical for compliance. Typically, the form must be submitted by March fifteenth of the year following the end of the calendar year. For example, if reporting for the year ending December thirty-first, twenty-twenty-three, the form is due by March fifteenth, twenty-twenty-four. It is important to keep track of these dates to avoid late fees and ensure timely processing of your tax return.

Required Documents

To complete the NYC 202 form accurately, certain documents are necessary. These may include:

- Financial statements that reflect income and expenses for the reporting period.

- Previous year’s tax returns for reference and consistency.

- Documentation supporting any deductions or credits claimed.

- Records of any estimated tax payments made during the year.

Gathering these documents in advance can streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The NYC 202 form can be submitted through various methods, providing flexibility for filers:

- Online submission through the official tax portal, which is typically the fastest option.

- Mailing a printed version of the form to the designated tax office.

- In-person submission at local tax offices, which may be beneficial for those needing immediate assistance.

Choosing the right submission method can help ensure that your form is processed efficiently.

Quick guide on how to complete for calendar year 2020 beginning and ending

Prepare For CALENDAR YEAR Beginning And Ending seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents rapidly and without complications. Manage For CALENDAR YEAR Beginning And Ending on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign For CALENDAR YEAR Beginning And Ending without effort

- Obtain For CALENDAR YEAR Beginning And Ending and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers for this exact purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds exactly the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign For CALENDAR YEAR Beginning And Ending while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year 2020 beginning and ending

Create this form in 5 minutes!

How to create an eSignature for the for calendar year 2020 beginning and ending

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to nyc 202?

airSlate SignNow is a leading electronic signature solution that empowers businesses to send and eSign documents effortlessly. In the context of nyc 202, it provides a cost-effective way for New York City businesses to streamline their document workflows, ensuring timely and secure transactions.

-

How much does airSlate SignNow cost for businesses in nyc 202?

The pricing for airSlate SignNow is designed to be budget-friendly, especially for small to medium-sized businesses in nyc 202. We offer flexible plans that cater to different business needs, ranging from basic to advanced features, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for nyc 202 users?

airSlate SignNow boasts a variety of features tailored for nyc 202 users, including document templates, real-time collaboration, and advanced security measures. These capabilities help businesses increase efficiency and maintain compliance while managing their electronic documents with ease.

-

How can airSlate SignNow benefit businesses in nyc 202?

Businesses in nyc 202 can signNowly benefit from airSlate SignNow by reducing the time spent on document processing and enhancing productivity. Our easy-to-use platform allows for faster approvals, which is crucial for companies looking to stay competitive in the fast-paced New York market.

-

Is airSlate SignNow compatible with other software in nyc 202?

Yes, airSlate SignNow seamlessly integrates with popular software applications that businesses in nyc 202 already use, such as CRM systems and project management tools. This integration capability ensures a smooth workflow and helps businesses maintain their operational efficiency.

-

Does airSlate SignNow offer customer support for users in nyc 202?

Absolutely, airSlate SignNow provides dedicated customer support for all users, including those in nyc 202. Our support team is available to assist with any queries or issues, ensuring that your experience with our eSigning solution is smooth and satisfactory.

-

Can airSlate SignNow help reduce my company's carbon footprint in nyc 202?

Yes, by utilizing airSlate SignNow, businesses in nyc 202 can signNowly reduce their carbon footprint by minimizing paper usage. Transitioning to a digital signing solution not only enhances efficiency but also contributes to environmentally friendly practices.

Get more for For CALENDAR YEAR Beginning And Ending

- Ldss 486t 16832725 form

- Literature worksheets form

- Blank death certificate pdf form

- Lic boc full form

- Recovering couples anonymous book pdf form

- Philip morris coupon redemption form 387062561

- Fire truck visit request form mississauga ca

- The home renovations that will increase your property value form

Find out other For CALENDAR YEAR Beginning And Ending

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online