Vt 8879 Form

What is the Vt 8879

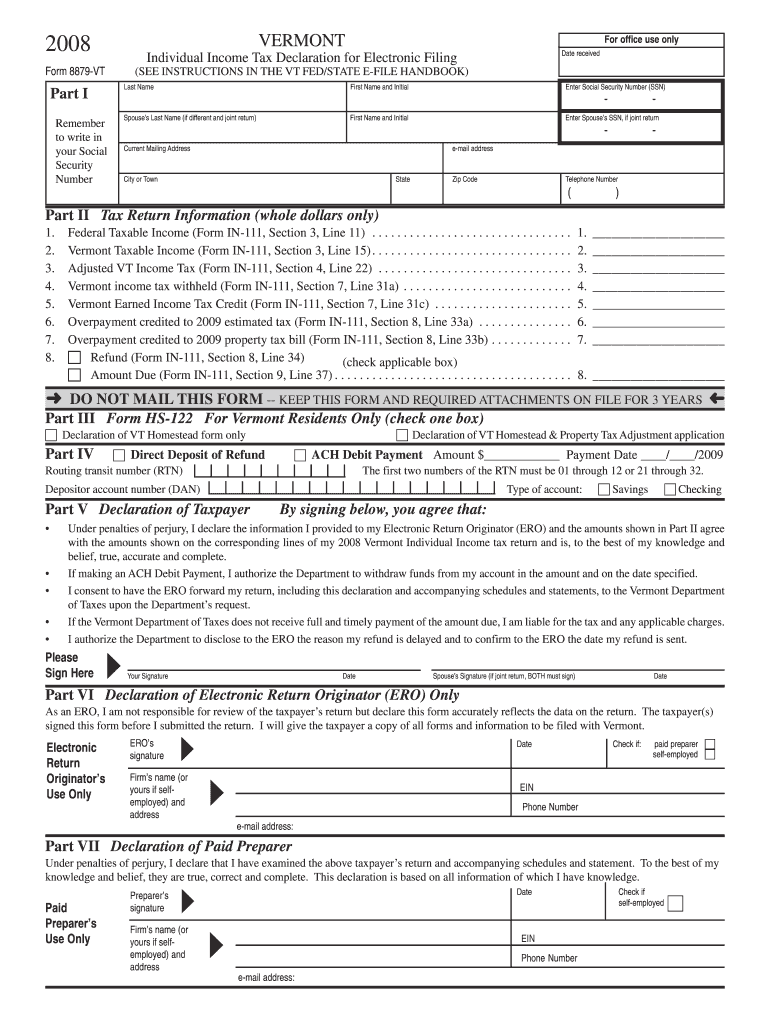

The Vt 8879 is a tax form used in Vermont, specifically designed for taxpayers to authorize their electronic filing of state income tax returns. This form serves as an electronic signature, ensuring that the taxpayer agrees to the information provided on their return. By signing the Vt 8879, individuals confirm that the details submitted are accurate and complete to the best of their knowledge. This form is essential for maintaining compliance with state tax regulations and facilitating the e-filing process.

How to use the Vt 8879

Using the Vt 8879 involves a straightforward process. First, taxpayers must complete their Vermont income tax return using compatible tax preparation software. Once the return is ready for submission, the software will prompt the user to fill out the Vt 8879. The form requires the taxpayer's personal information, including their name, address, and Social Security number. After reviewing the information for accuracy, the taxpayer can electronically sign the Vt 8879, which will then allow the software to transmit the tax return to the Vermont Department of Taxes.

Steps to complete the Vt 8879

Completing the Vt 8879 involves several key steps:

- Prepare your Vermont income tax return using approved tax software.

- Access the Vt 8879 form through the software once your return is ready.

- Enter your personal information as required on the form.

- Review all entries to ensure accuracy and completeness.

- Sign the form electronically to authorize the e-filing of your return.

- Submit the Vt 8879 along with your tax return through the software.

Legal use of the Vt 8879

The Vt 8879 is legally recognized as an electronic signature, which means it holds the same validity as a handwritten signature under U.S. law. To ensure its legal standing, the form must be completed in accordance with Vermont's eSignature laws. This includes using secure software that complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). By adhering to these regulations, taxpayers can confidently use the Vt 8879 for their electronic filing needs.

Filing Deadlines / Important Dates

Taxpayers must be aware of the important deadlines associated with the Vt 8879 and Vermont state income tax returns. Typically, the filing deadline for individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to file their returns and submit the Vt 8879 by this deadline to avoid penalties and interest on any taxes owed. Additionally, taxpayers should check for any updates or changes to these dates each tax season.

Required Documents

Before filling out the Vt 8879, taxpayers should gather all necessary documents to ensure accurate reporting. Required documents typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions and credits

- Previous year’s tax return for reference

Having these documents on hand will facilitate the completion of the Vt 8879 and the overall tax return process.

Quick guide on how to complete vt 8879

Complete Vt 8879 seamlessly on any device

Online document administration has become widely accepted among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Vt 8879 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Vt 8879 effortlessly

- Obtain Vt 8879 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Vt 8879 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vt 8879

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the vt form 8879 and why is it important?

The vt form 8879 is a crucial document for e-filing your federal tax return in Vermont. It serves as an electronic signature authorization, confirming that the taxpayer agrees to the contents of the return. Utilizing airSlate SignNow for your vt form 8879 ensures a secure and efficient process for e-signing your tax documents.

-

How can airSlate SignNow help with vt form 8879 signing?

airSlate SignNow provides an intuitive platform to easily eSign your vt form 8879 online. With a user-friendly interface, you can quickly send, track, and store your signed documents securely. This simplifies your tax filing process and saves time compared to traditional methods.

-

Are there any costs associated with using airSlate SignNow for vt form 8879?

Yes, while airSlate SignNow offers various pricing plans that cater to different needs, there are affordable options available for businesses and individuals. You can assess the features of each plan to determine which best aligns with your requirements for managing vt form 8879 e-signatures.

-

Can airSlate SignNow integrate with other tax software for vt form 8879?

Absolutely! airSlate SignNow seamlessly integrates with various tax and accounting software applications, making it easier for users to manage their vt form 8879 alongside other financial documents. This integration streamlines your workflow, ensuring that all tasks are completed efficiently.

-

What features does airSlate SignNow offer for managing vt form 8879?

airSlate SignNow offers a suite of features for managing your vt form 8879, including secure e-signature capabilities, document tracking, and customizable templates. These tools enhance your efficiency in handling tax documents, ensuring that everything is processed quickly and legally.

-

How secure is the process of signing vt form 8879 with airSlate SignNow?

The security of your documents is a top priority for airSlate SignNow. The platform employs advanced encryption and authentication measures to protect your vt form 8879 and other sensitive data throughout the signing process. You can trust that your information is secure and compliant with industry standards.

-

Can I access my signed vt form 8879 documents anytime with airSlate SignNow?

Yes, with airSlate SignNow, you can access your signed vt form 8879 documents at any time. The platform provides cloud-based storage, allowing you to retrieve your documents securely from anywhere, which is particularly useful during tax season or for record-keeping purposes.

Get more for Vt 8879

- Bc300 form

- Cbs 1 instructions form

- Ojt application form

- Shaft alignment report sheet form

- Compassionate appointment application form for andhra pradesh

- Sp 232 form

- Form l3 application to end a tenancy tribunals ontarioform l3 application to end a tenancy tribunals ontarioform l3 application

- Aside ex parte order form

Find out other Vt 8879

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement