Massachusettes Form 1 2019

What is the Massachusetts Form 1

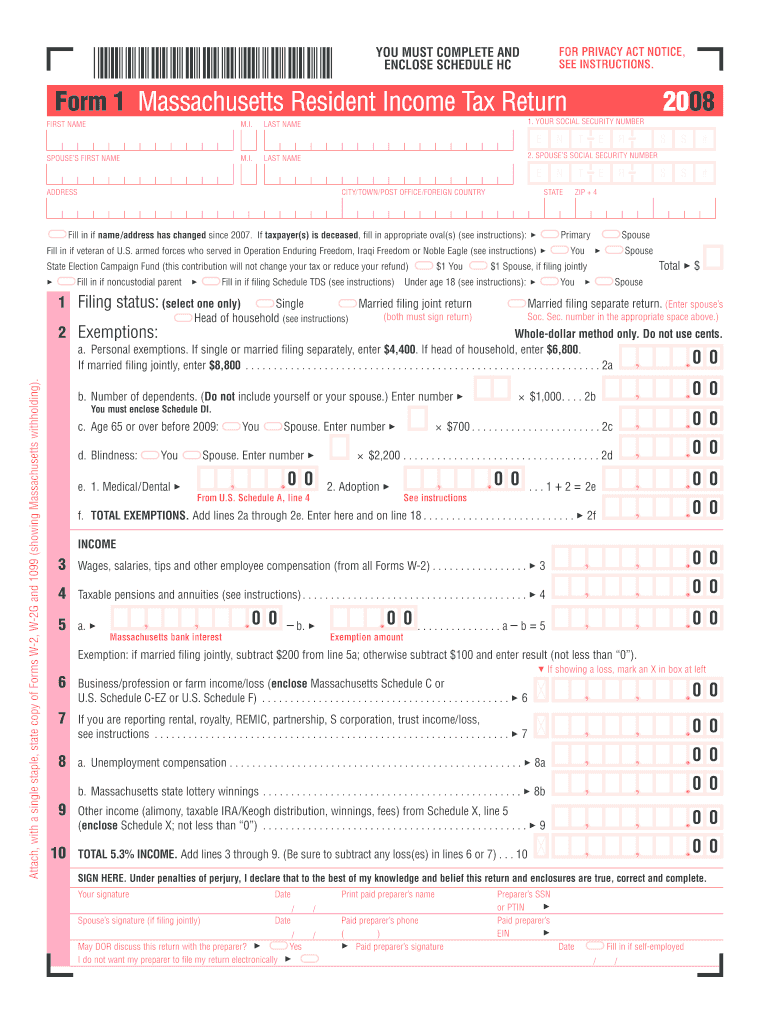

The Massachusetts Form 1 is the state’s individual income tax return form. This form is used by residents to report their income, claim deductions, and calculate their tax liability for the year. It is essential for individuals to accurately complete this form to ensure compliance with state tax regulations. The form captures various types of income, including wages, interest, dividends, and capital gains, while also allowing taxpayers to claim credits and deductions available under Massachusetts tax law.

How to use the Massachusetts Form 1

Using the Massachusetts Form 1 involves several steps to ensure that all necessary information is accurately reported. Taxpayers should start by gathering all relevant financial documents, such as W-2 forms, 1099s, and records of any other income. After collecting the documents, individuals can fill out the form, ensuring they complete all sections, including personal information, income details, and applicable deductions. Once completed, the form can be submitted either electronically or by mail, depending on the taxpayer’s preference.

Steps to complete the Massachusetts Form 1

Completing the Massachusetts Form 1 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and previous tax returns.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income in the appropriate sections.

- Claim any deductions or credits for which you are eligible.

- Review the completed form for accuracy.

- Submit the form electronically or by mailing it to the appropriate address.

Legal use of the Massachusetts Form 1

The Massachusetts Form 1 is legally binding and must be completed in accordance with state tax laws. Accurate reporting is crucial, as any discrepancies can lead to penalties or audits. The form must be signed and dated by the taxpayer, affirming that the information provided is true and correct to the best of their knowledge. Compliance with all filing requirements ensures that taxpayers avoid legal issues related to their income tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Form 1 are typically aligned with federal tax deadlines. Generally, the form must be submitted by April 15 of the tax year, unless an extension is filed. It is important for taxpayers to keep track of any changes to deadlines, as they can vary based on specific circumstances, such as weekends or holidays. Meeting these deadlines helps avoid late fees and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Massachusetts Form 1. The form can be filed electronically through approved e-filing services, which often provide a faster processing time and confirmation of receipt. Alternatively, individuals may choose to print the completed form and mail it to the appropriate state tax office. In-person submission is also an option at designated state tax offices, providing immediate confirmation of filing.

Quick guide on how to complete massachusettes 2007 form 1

Complete Massachusettes Form 1 effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Massachusettes Form 1 on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Massachusettes Form 1 effortlessly

- Locate Massachusettes Form 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Massachusettes Form 1 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusettes 2007 form 1

Create this form in 5 minutes!

How to create an eSignature for the massachusettes 2007 form 1

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Massachusetts 2007 Form 1 and why is it important?

The Massachusetts 2007 Form 1 is the state's individual income tax return form that residents must complete to report their income and calculate their tax liabilities. It's crucial for ensuring compliance with state tax laws and for claiming any deductions or credits available to you as a taxpayer.

-

Can I electronically sign the Massachusetts 2007 Form 1 using airSlate SignNow?

Yes, airSlate SignNow allows you to electronically sign the Massachusetts 2007 Form 1 securely and conveniently. Our platform makes it easy to manage your documents, ensuring a smooth eSigning experience that complies with legal standards.

-

Is airSlate SignNow a cost-effective solution for submitting the Massachusetts 2007 Form 1?

Absolutely! airSlate SignNow offers a budget-friendly solution for businesses and individuals looking to simplify the process of handling the Massachusetts 2007 Form 1. With competitive pricing plans, you can benefit from our features without breaking the bank.

-

What features does airSlate SignNow offer for managing the Massachusetts 2007 Form 1?

airSlate SignNow provides a range of features for managing documents like the Massachusetts 2007 Form 1, including customizable templates, real-time tracking, and secure cloud storage. These tools help streamline your tax filing process and keep your documents organized.

-

How does airSlate SignNow enhance the filing process of the Massachusetts 2007 Form 1?

With airSlate SignNow, you can enhance your filing process for the Massachusetts 2007 Form 1 by automating document workflows and reducing manual errors. This leads to faster processing times and ensures that your forms are completed accurately.

-

Are there any integrations available with airSlate SignNow for tax preparation software related to the Massachusetts 2007 Form 1?

Yes, airSlate SignNow integrates seamlessly with several popular tax preparation software solutions, making it easier to fill out and submit the Massachusetts 2007 Form 1. This streamlines data transfer and ensures that you have the most up-to-date information.

-

What kind of customer support does airSlate SignNow provide for Massachusetts 2007 Form 1 queries?

airSlate SignNow offers comprehensive customer support to assist you with any questions or issues regarding the Massachusetts 2007 Form 1. Our support team is available through multiple channels to provide guidance and help you navigate the eSigning process.

Get more for Massachusettes Form 1

- Determiners exercises form

- Manitoba provincial nominee application form mapp fillable

- Spot check form template

- Imm 5488 100110650 form

- Hawaii doe elementary report card form

- Swift mt700 series pdf form

- How to fill out city of mesa form tpt 1 rev 06

- How refunds and returns work on a credit card chase form

Find out other Massachusettes Form 1

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free