1099me 2019

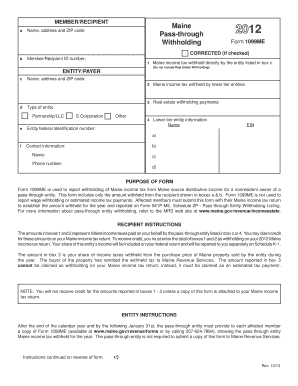

What is the 1099me?

The 1099me form is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is particularly important for freelancers, independent contractors, and other self-employed individuals who receive payments from businesses or clients. The 1099me serves as a record of income received throughout the year, ensuring that all earnings are reported to the Internal Revenue Service (IRS) for tax purposes.

How to use the 1099me

Using the 1099me form involves several key steps. First, gather all relevant information regarding the income received, including the total amount earned and the details of the payer. Next, accurately fill out the form, ensuring that all required fields are completed. This includes providing your name, address, and taxpayer identification number, as well as the payer's information. After completing the form, it must be submitted to the IRS and a copy provided to the payer. Utilizing an electronic signature platform can streamline this process, making it easier to complete and send the form securely.

Steps to complete the 1099me

Completing the 1099me form involves a straightforward process. Follow these steps:

- Collect all necessary information about your income and the payer.

- Obtain the 1099me form, which can be accessed online or through tax software.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Enter the payer's details, including their name, address, and taxpayer identification number.

- Report the total amount of income received in the appropriate box on the form.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS and provide a copy to the payer.

Legal use of the 1099me

The legal use of the 1099me form is essential for compliance with IRS regulations. It is required for reporting income that exceeds a certain threshold, typically $600, received from a single payer. Failure to issue or accurately report this form can result in penalties for both the payer and the recipient. Additionally, the use of a secure electronic signature solution can enhance the legitimacy of the document, ensuring that it meets legal standards for electronic submissions.

Filing Deadlines / Important Dates

Filing deadlines for the 1099me form are crucial for compliance. Generally, the form must be submitted to the IRS by January 31 of the year following the tax year in which the income was received. If filing electronically, the deadline may extend to March 31. It is important to keep track of these dates to avoid potential penalties. Additionally, recipients should ensure they receive their copy of the form from the payer by the same deadline to facilitate accurate tax reporting.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 1099me form. These guidelines outline the types of income that must be reported, the information required on the form, and the submission process. It is essential to familiarize oneself with these guidelines to ensure compliance and avoid errors. The IRS also offers resources and assistance for individuals who have questions regarding the 1099me form and its requirements.

Quick guide on how to complete 1099me 17770432

Complete 1099me effortlessly on any device

Digital document management has gained immense popularity with businesses and individuals. It offers a perfect environmentally-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage 1099me on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign 1099me smoothly

- Find 1099me and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure private information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Modify and eSign 1099me and ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099me 17770432

Create this form in 5 minutes!

How to create an eSignature for the 1099me 17770432

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is 1099me and how does it work?

1099me is a service offered by airSlate SignNow that simplifies the process of generating and sending 1099 forms. With 1099me, users can easily create, eSign, and distribute their 1099 documents electronically, ensuring compliance and reducing paperwork.

-

What features does 1099me offer?

1099me includes a range of features tailored for businesses, such as customizable templates, automated form filling, eSigning capabilities, and secure document storage. These features streamline the entire 1099 process, making it efficient and user-friendly.

-

How much does 1099me cost?

1099me offers competitive pricing plans tailored to different business needs. Users can benefit from a cost-effective solution that minimizes the overhead associated with traditional 1099 processing, allowing businesses to save on both time and expenses.

-

Is 1099me easy to integrate with existing software?

Yes, 1099me seamlessly integrates with various accounting and payroll software, enhancing its functionality. This integration allows users to simplify data transfer and maintain accurate records without additional manual entry.

-

What are the benefits of using 1099me for my business?

Using 1099me can greatly benefit your business by reducing the time spent on paperwork and increasing accuracy in document management. It also improves compliance with IRS regulations, ensuring that your 1099 forms are filed correctly and on time.

-

Can I send 1099 forms directly to recipients using 1099me?

Absolutely! 1099me allows you to send 1099 forms directly to recipients via email, making the process more efficient. Your recipients can then eSign and submit the documents electronically, saving time and resources.

-

How does 1099me ensure the security of my documents?

1099me prioritizes the security of your documents by employing industry-standard encryption and secure data storage. This ensures that your sensitive information remains protected throughout the eSigning and document management processes.

Get more for 1099me

Find out other 1099me

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself