Trade in Sales Tax Credit Calculation Worksheet Form

What is the Trade In Sales Tax Credit Calculation Worksheet

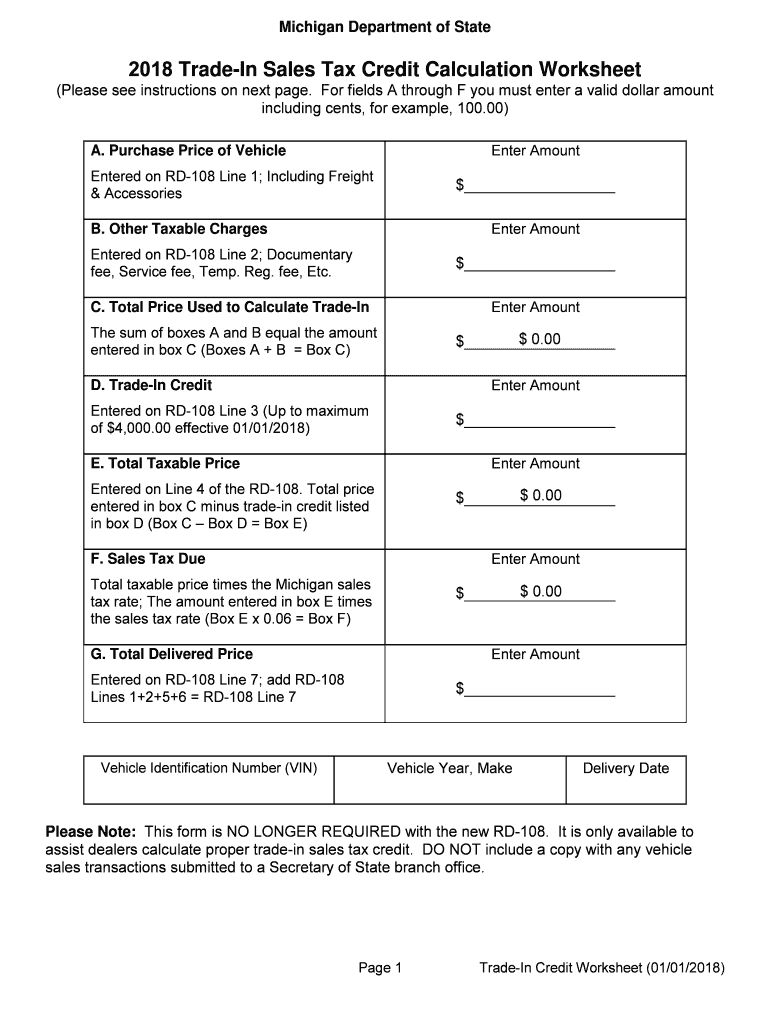

The Michigan trade in sales tax credit calculation worksheet is a specific form designed to help taxpayers calculate the sales tax credit they may receive when trading in a vehicle. This worksheet is essential for individuals and businesses looking to understand their tax obligations and potential credits related to vehicle transactions. By accurately completing this form, users can ensure they receive the appropriate credits, which can significantly reduce the overall tax burden associated with the purchase of a new vehicle.

How to use the Trade In Sales Tax Credit Calculation Worksheet

To effectively use the Michigan trade in sales tax credit calculation worksheet, begin by gathering all necessary information regarding the vehicle being traded in and the new vehicle being purchased. This includes the trade-in value, the purchase price of the new vehicle, and any applicable sales tax rates. Once you have this information, follow the worksheet's structured format to input the data accurately. The worksheet will guide you through the calculations needed to determine the sales tax credit you may qualify for, ensuring that all figures are accounted for correctly.

Steps to complete the Trade In Sales Tax Credit Calculation Worksheet

Completing the Michigan trade in sales tax credit calculation worksheet involves several key steps:

- Gather necessary documents, including the vehicle title, purchase agreement, and any previous tax documents.

- Determine the trade-in value of your vehicle, which is often found in appraisal or sales documents.

- Input the purchase price of the new vehicle into the designated area on the worksheet.

- Calculate the total sales tax based on the purchase price and applicable tax rate.

- Subtract the trade-in value from the purchase price to find the taxable amount.

- Complete the worksheet by following the calculations outlined, ensuring accuracy throughout.

Key elements of the Trade In Sales Tax Credit Calculation Worksheet

The Michigan trade in sales tax credit calculation worksheet includes several key elements that are critical for accurate completion:

- Trade-in Value: The assessed value of the vehicle being traded in.

- Purchase Price: The total cost of the new vehicle before tax credits.

- Sales Tax Rate: The applicable sales tax percentage for the transaction.

- Taxable Amount: The amount subject to sales tax after accounting for the trade-in value.

- Credit Calculation: The final calculation that determines the sales tax credit available to the taxpayer.

Eligibility Criteria

To qualify for the sales tax credit using the Michigan trade in sales tax credit calculation worksheet, certain eligibility criteria must be met. These typically include:

- The vehicle being traded in must be registered in the taxpayer's name.

- The trade-in must occur simultaneously with the purchase of a new vehicle.

- The new vehicle must be subject to Michigan sales tax.

- All documentation must be accurate and complete to support the calculations on the worksheet.

Legal use of the Trade In Sales Tax Credit Calculation Worksheet

The Michigan trade in sales tax credit calculation worksheet is legally recognized as a valid document for calculating tax credits related to vehicle transactions. To ensure its legal use, it is essential to follow all guidelines outlined by the Michigan Department of Treasury. This includes maintaining accurate records and ensuring that all calculations are performed correctly. Using a reliable digital solution, such as eSignature platforms, can help maintain the integrity and legality of the completed worksheet.

Quick guide on how to complete 2018 trade in sales tax credit calculation worksheet

Finalize Trade In Sales Tax Credit Calculation Worksheet seamlessly on any gadget

Managing documents online has surged in popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Trade In Sales Tax Credit Calculation Worksheet on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign Trade In Sales Tax Credit Calculation Worksheet effortlessly

- Locate Trade In Sales Tax Credit Calculation Worksheet and click Get Form to commence.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Trade In Sales Tax Credit Calculation Worksheet to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 trade in sales tax credit calculation worksheet

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Michigan trade in sales tax credit calculation worksheet?

The Michigan trade in sales tax credit calculation worksheet is a tool designed to help businesses calculate the sales tax credits they may be eligible for when trading in a vehicle. This worksheet simplifies the process, ensuring accurate calculations and compliance with Michigan tax regulations.

-

How can I use the Michigan trade in sales tax credit calculation worksheet with airSlate SignNow?

You can easily integrate the Michigan trade in sales tax credit calculation worksheet into your document processes with airSlate SignNow. Our platform allows you to upload the worksheet, eSign it, and securely send it to your clients, streamlining both the calculation and documentation process.

-

Is there a cost associated with using the Michigan trade in sales tax credit calculation worksheet in airSlate SignNow?

There are no additional costs associated with using the Michigan trade in sales tax credit calculation worksheet in airSlate SignNow beyond the standard subscription fee. Our platform offers cost-effective solutions that include access to various tools for document management, including tax credit calculations.

-

What features does airSlate SignNow offer for managing the Michigan trade in sales tax credit calculation worksheet?

airSlate SignNow offers several features for managing the Michigan trade in sales tax credit calculation worksheet, including customizable templates, eSignature capabilities, and secure document storage. These features enhance efficiency and ensure that your tax credit calculations are handled accurately.

-

Can I share the Michigan trade in sales tax credit calculation worksheet with clients using airSlate SignNow?

Yes, you can easily share the Michigan trade in sales tax credit calculation worksheet with clients using airSlate SignNow. Our platform allows you to send documents directly via email, ensuring that your clients receive the necessary information for their tax credit calculations in a timely manner.

-

What benefits does airSlate SignNow provide in relation to the Michigan trade in sales tax credit calculation worksheet?

Using airSlate SignNow for the Michigan trade in sales tax credit calculation worksheet provides several benefits, including increased accuracy in calculations, faster document turnaround times, and enhanced security for sensitive information. Our platform is designed to empower businesses with a seamless and efficient experience.

-

Does airSlate SignNow integrate with other software to manage the Michigan trade in sales tax credit calculation worksheet?

Yes, airSlate SignNow integrates with various accounting and tax software to facilitate the effective management of the Michigan trade in sales tax credit calculation worksheet. This integration eliminates data entry errors and improves efficiency, allowing for a smoother workflow overall.

Get more for Trade In Sales Tax Credit Calculation Worksheet

- Bharti axa form

- Telehealth encounter form

- Rd 108t trade in credit form state of michigan michigan

- State of connecticut criminal history record request form

- T4 summary fillable form

- Dealer authorization form

- Www pdffiller comencatalog20 printable puppy purchase agreement forms and pdffiller

- Download the order form augsburg fortress canada

Find out other Trade In Sales Tax Credit Calculation Worksheet

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation