540A Ftb Ca 2009

What is the 540A Ftb Ca

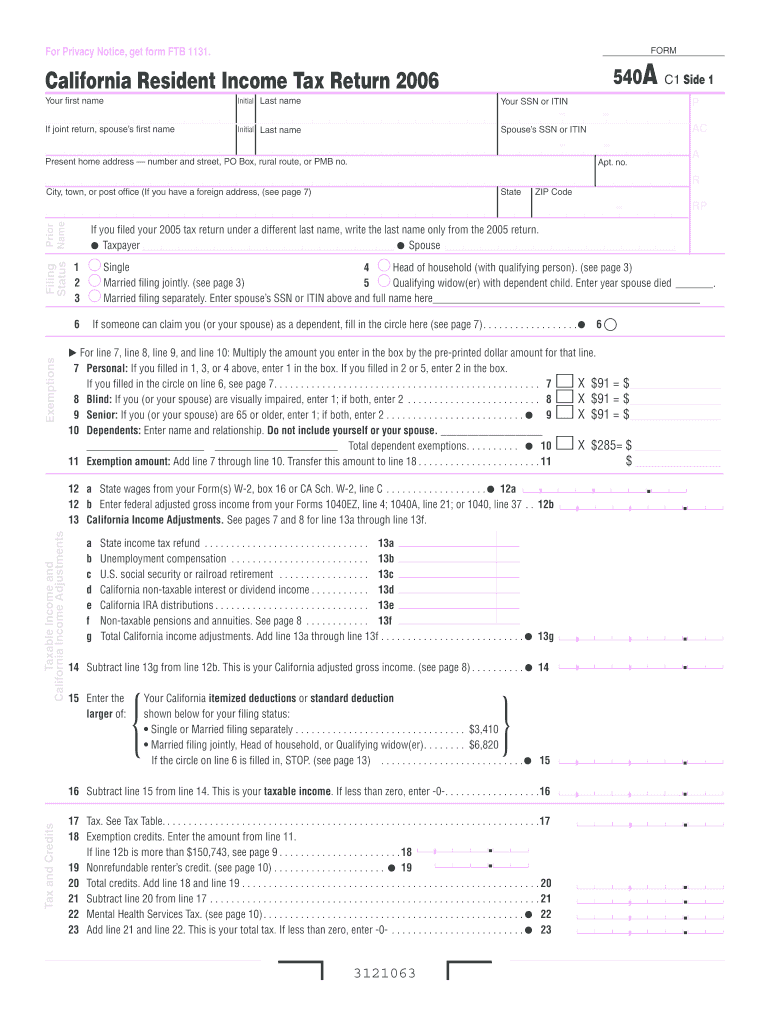

The 540A Ftb Ca form is a California state income tax return used by residents to report their income and calculate their tax liability. This simplified version of the standard 540 form is designed for taxpayers with straightforward financial situations, such as those who do not claim dependents or have complex deductions. It is essential for individuals to accurately complete this form to ensure compliance with state tax laws and to avoid potential penalties.

Steps to complete the 540A Ftb Ca

Completing the 540A Ftb Ca form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and any other earnings.

- Calculate your adjustments to income, such as contributions to retirement accounts.

- Determine your standard deduction or itemized deductions, if applicable.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submission.

Legal use of the 540A Ftb Ca

The 540A Ftb Ca form is legally binding once it is signed and submitted to the California Franchise Tax Board. It is important to ensure that all information provided is accurate and truthful, as providing false information can lead to legal repercussions, including fines or penalties. The form must be filed by the designated deadline to avoid additional charges or interest on any taxes owed.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the 540A Ftb Ca form to ensure timely filing. Typically, the deadline for filing this form is April 15 of each year, coinciding with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Who Issues the Form

The 540A Ftb Ca form is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensuring compliance among taxpayers. The FTB provides resources and support to assist individuals in understanding their tax obligations and completing the necessary forms accurately.

Required Documents

To successfully complete the 540A Ftb Ca form, taxpayers need to gather several key documents. These include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as interest or dividends.

- Documentation of adjustments to income, such as retirement contributions.

- Proof of any tax credits or deductions being claimed.

Quick guide on how to complete 540a ftb ca

Complete 540A Ftb Ca seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage 540A Ftb Ca on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to update and eSign 540A Ftb Ca effortlessly

- Find 540A Ftb Ca and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all entered information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 540A Ftb Ca and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 540a ftb ca

Create this form in 5 minutes!

How to create an eSignature for the 540a ftb ca

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the 540A Ftb Ca form?

The 540A Ftb Ca form is a California income tax return for individuals. It is designed for taxpayers with simple tax situations, allowing them to report their income and calculate their liability. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help with filing the 540A Ftb Ca?

AirSlate SignNow allows you to quickly complete and eSign your 540A Ftb Ca form online. Our platform streamlines the document signing process, making it easier and faster to submit your tax return. Accessibility across devices ensures you can manage your paperwork conveniently.

-

What features does airSlate SignNow offer for managing the 540A Ftb Ca?

The airSlate SignNow platform offers features like document templates, secure e-signing, and real-time tracking for your 540A Ftb Ca form. You can save time with automated reminders for signers and enjoy the simplicity of managing multiple tax documents in one place. This enhances your overall experience.

-

Is airSlate SignNow cost-effective for eSigning the 540A Ftb Ca?

Yes, airSlate SignNow provides an affordable solution for eSigning documents, including the 540A Ftb Ca. With flexible pricing plans that cater to different business needs, you can choose the best option without breaking the bank. Our cost-effective service enhances your efficiency while reducing paper waste.

-

Are there integrations available to assist with the 540A Ftb Ca?

Absolutely! airSlate SignNow integrates seamlessly with multiple business applications, enabling you to link your workflow with tax software that utilizes the 540A Ftb Ca form. This means you can automatically pull data and expedite the eSigning and submission process.

-

What are the benefits of eSigning the 540A Ftb Ca through airSlate SignNow?

ESigning the 540A Ftb Ca with airSlate SignNow offers enhanced security and compliance, ensuring that your documents are protected. Additionally, the convenience of digital signatures accelerates the filing process, helps to meet deadlines, and saves time. Experience a smooth workflow for your tax obligations.

-

How do I start using airSlate SignNow for my 540A Ftb Ca?

Getting started with airSlate SignNow for your 540A Ftb Ca form is simple. Just sign up for an account, create or upload your document, and utilize our intuitive interface for eSigning. Our support resources are available to guide you through any additional questions you may have.

Get more for 540A Ftb Ca

- Western union request community financial credit union form

- Med surg nursing worksheet pdf form

- De 429 edd form

- Edinburgh postpartum depression scale form

- Staar science tutorial 30 answer key form

- Emudhra form download

- Hospice intake form 422241911

- Pediatric immunization record alabama department of public adph form

Find out other 540A Ftb Ca

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament