Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416 2015

What is the Municipal Business Tax Return BUS 416?

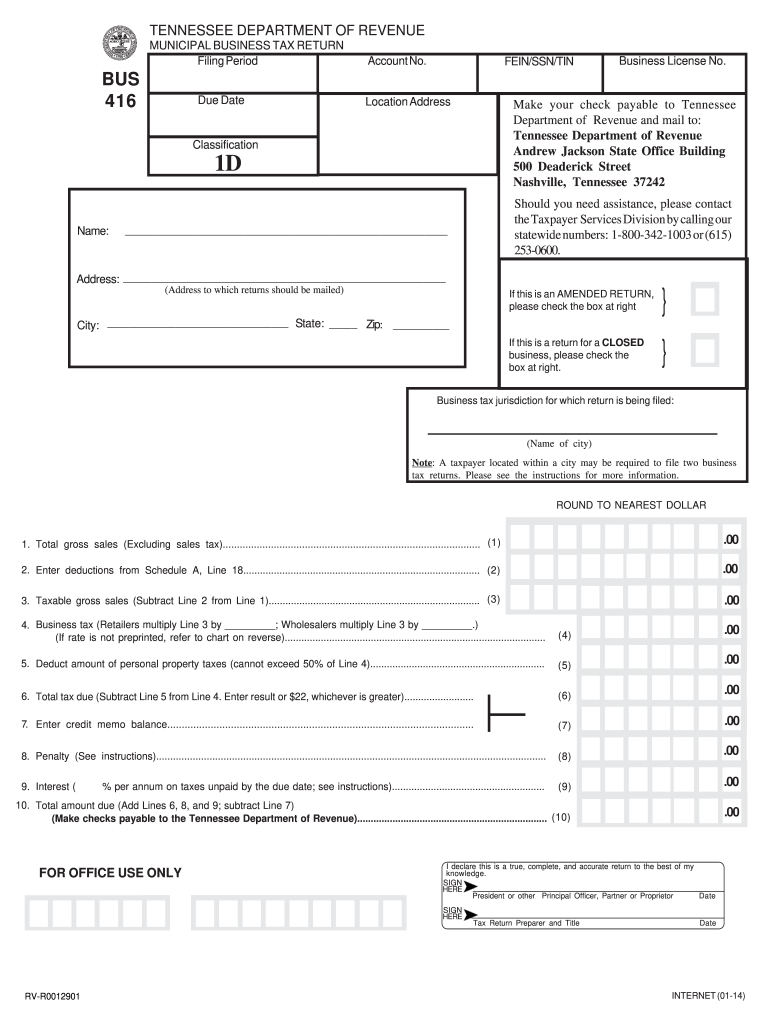

The Municipal Business Tax Return BUS 416 is a specific form used by businesses operating within certain municipalities to report their income and calculate the taxes owed to local governments. This form is essential for ensuring compliance with local tax regulations and helps municipalities collect revenue necessary for public services. The BUS 416 form typically requires businesses to provide detailed information about their earnings, expenses, and any applicable deductions. Understanding this form is crucial for business owners to fulfill their tax obligations accurately.

Steps to complete the Municipal Business Tax Return BUS 416

Completing the Municipal Business Tax Return BUS 416 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering your business details, including the legal name, address, and tax identification number. Be sure to accurately report your gross receipts and any deductions you may qualify for. After completing the form, review it carefully for errors before submitting it to the appropriate municipal tax authority. Finally, retain a copy of the completed form for your records.

Legal use of the Municipal Business Tax Return BUS 416

The Municipal Business Tax Return BUS 416 is legally binding when completed and submitted according to the guidelines set forth by the local tax authority. It is important to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be signed by an authorized representative of the business, and electronic signatures are permissible, provided they comply with relevant laws such as the ESIGN Act. This legal framework ensures that electronically signed documents hold the same weight as traditional paper signatures.

Filing Deadlines / Important Dates

Filing deadlines for the Municipal Business Tax Return BUS 416 can vary by municipality, so it is essential to check with your local tax authority for specific dates. Generally, businesses are required to submit their returns annually, with many municipalities setting deadlines at the end of the fiscal year. Late submissions may incur penalties, so staying informed about these important dates is crucial for compliance. Mark your calendar and set reminders to ensure timely filing.

Required Documents

To complete the Municipal Business Tax Return BUS 416, several documents are typically required. These include financial statements such as profit and loss statements, balance sheets, and any documentation supporting deductions claimed. Additionally, businesses may need to provide previous tax returns, payroll records, and receipts for expenses. Having these documents organized and readily available will streamline the completion process and help ensure that the return is accurate.

Penalties for Non-Compliance

Failure to file the Municipal Business Tax Return BUS 416 on time or inaccuracies in the submitted information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the municipality. It is important for business owners to understand the consequences of non-compliance and to take proactive steps to ensure that their tax returns are filed accurately and on time. Regular consultations with a tax professional can help mitigate these risks.

Quick guide on how to complete 2014 municipal business tax return bus 416 2014 municipal business tax return bus 416

Effortlessly Prepare Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416 on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and store it securely online. airSlate SignNow offers you all the necessary tools to create, alter, and electronically sign your documents quickly and without delays. Manage Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The Easiest Way to Alter and Electronically Sign Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416 Effortlessly

- Search for Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive details with the tools airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal standing as a conventional handwritten signature.

- Verify all details and click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Edit and electronically sign Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416 to ensure exceptional communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 municipal business tax return bus 416 2014 municipal business tax return bus 416

Create this form in 5 minutes!

How to create an eSignature for the 2014 municipal business tax return bus 416 2014 municipal business tax return bus 416

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Municipal Business Tax Return BUS 416?

The Municipal Business Tax Return BUS 416 is a tax form required by certain municipalities for businesses operating within their jurisdiction. This return helps local authorities assess various business activities and ensure compliance with tax regulations. Understanding the Municipal Business Tax Return BUS 416 is crucial for maintaining good standing with local tax offices.

-

How can airSlate SignNow assist with the Municipal Business Tax Return BUS 416?

airSlate SignNow offers an easy-to-use platform for businesses to complete, sign, and submit the Municipal Business Tax Return BUS 416. With our document management system, you can streamline the eSigning process, ensuring that your return is filed accurately and on time. Our solution empowers you to manage your tax returns with confidence.

-

What features does airSlate SignNow offer for managing Municipal Business Tax Return BUS 416?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSignature options tailored for the Municipal Business Tax Return BUS 416. These tools enhance efficiency and accuracy, allowing businesses to manage their tax documentation with ease. Our platform is designed to simplify the entire return process.

-

Is airSlate SignNow a cost-effective solution for handling the Municipal Business Tax Return BUS 416?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing the Municipal Business Tax Return BUS 416. Our pricing plans cater to businesses of all sizes, helping you reduce costs associated with document management and filing. By choosing airSlate SignNow, you can save both time and resources.

-

Are there integrations available for the Municipal Business Tax Return BUS 416?

airSlate SignNow offers seamless integrations with various accounting and financial software to facilitate the Municipal Business Tax Return BUS 416 process. This interoperability allows for easy data transfer and ensures that all relevant information is readily accessible. Integrating tools can improve your workflow and accuracy in filing.

-

What are the benefits of using airSlate SignNow for the Municipal Business Tax Return BUS 416?

Using airSlate SignNow for the Municipal Business Tax Return BUS 416 offers numerous benefits, including enhanced security, time-saving features, and ease of use. Our platform ensures that your returns are filed securely and efficiently, helping you stay compliant with local tax regulations. Plus, you can sign documents anytime, anywhere.

-

How does airSlate SignNow ensure the security of my Municipal Business Tax Return BUS 416?

airSlate SignNow employs industry-standard security measures, including encryption and secure cloud storage, to protect your Municipal Business Tax Return BUS 416. Our commitment to data security means that your sensitive tax information remains confidential and secure throughout the filing process. You can trust us to keep your documents safe.

Get more for Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416

- Application for burial allowance form

- Robbery description form 292156624

- Financial management prasanna chandra solutions form

- Surat pengesahan kesihatan form

- Drain output record sheet form

- Form 8880

- Self assessment guide for residence in new zealand 1003 form

- Asia pacific economic cooperation business travel card form

Find out other Municipal Business Tax Return BUS 416 Municipal Business Tax Return BUS 416

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT