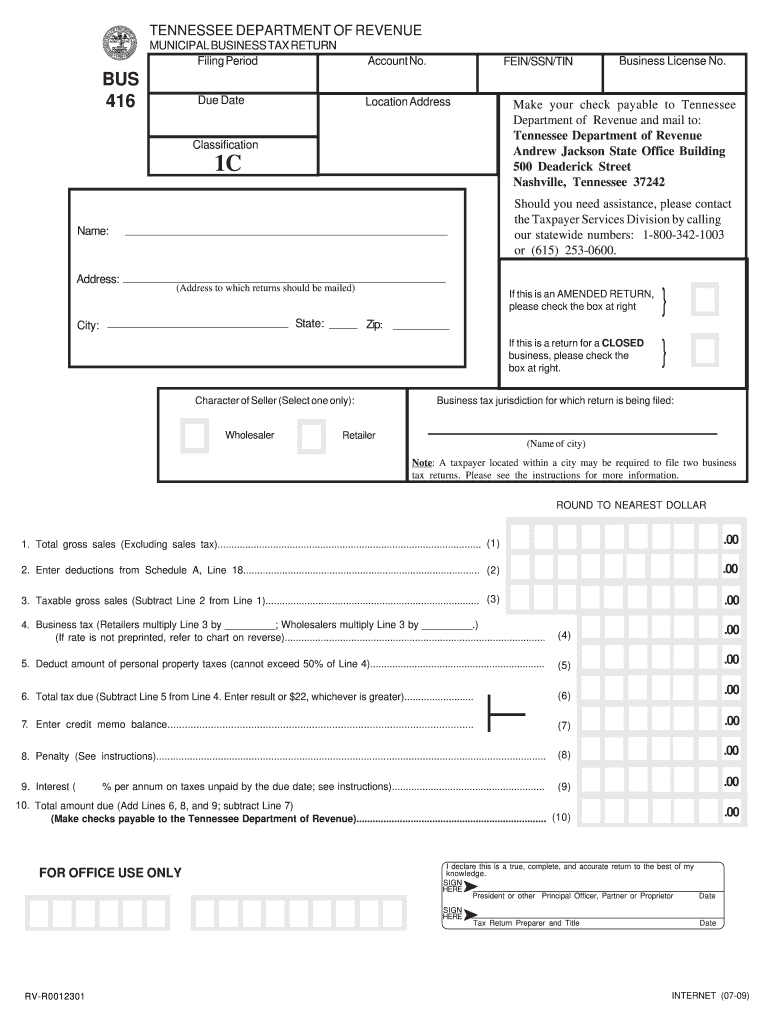

Minicipal Business Tax Return Classification 1C Tennessee 2009

What is the Minicipal Business Tax Return Classification 1C Tennessee

The Minicipal Business Tax Return Classification 1C Tennessee is a specific tax form required for businesses operating within certain municipalities in Tennessee. This classification is primarily designed for businesses that meet specific criteria set by local tax authorities. It serves as a declaration of the business's income and tax liability, ensuring compliance with local tax regulations. Understanding this form is essential for business owners to avoid penalties and ensure accurate tax reporting.

Steps to complete the Minicipal Business Tax Return Classification 1C Tennessee

Completing the Minicipal Business Tax Return Classification 1C Tennessee involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax liability based on the income reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Minicipal Business Tax Return Classification 1C Tennessee

The legal use of the Minicipal Business Tax Return Classification 1C Tennessee is crucial for maintaining compliance with local tax laws. This form must be filled out truthfully and submitted within the specified timeframe. Failure to do so can result in legal repercussions, including fines or audits. Additionally, the form must be signed by an authorized representative of the business to be considered valid.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with the Minicipal Business Tax Return Classification 1C Tennessee. Typically, the deadlines align with the end of the fiscal year for the municipality. Businesses should check with local tax authorities for specific dates, as late submissions may incur penalties or interest on unpaid taxes.

Required Documents

To successfully complete the Minicipal Business Tax Return Classification 1C Tennessee, businesses need to prepare several documents:

- Income statements detailing revenue generated during the tax year.

- Expense reports to outline costs incurred by the business.

- Any relevant supporting documentation that substantiates claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

The Minicipal Business Tax Return Classification 1C Tennessee can typically be submitted through various methods, depending on the municipality's regulations:

- Online submission through the municipality's tax portal.

- Mailing a physical copy of the completed form to the local tax office.

- In-person submission at designated tax offices.

Quick guide on how to complete minicipal business tax return classification 1c tennessee

Prepare Minicipal Business Tax Return Classification 1C Tennessee effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without hindrance. Manage Minicipal Business Tax Return Classification 1C Tennessee on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and electronically sign Minicipal Business Tax Return Classification 1C Tennessee with ease

- Find Minicipal Business Tax Return Classification 1C Tennessee and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and possesses the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Minicipal Business Tax Return Classification 1C Tennessee and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minicipal business tax return classification 1c tennessee

Create this form in 5 minutes!

How to create an eSignature for the minicipal business tax return classification 1c tennessee

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the Municipal Business Tax Return Classification 1C in Tennessee?

The Municipal Business Tax Return Classification 1C in Tennessee applies to businesses operating under specific parameters outlined by local tax authorities. Understanding this classification is vital for proper tax compliance and may affect your filing processes. By categorizing your business correctly, you can take advantage of potential deductions and incentives.

-

How can airSlate SignNow assist with Municipal Business Tax Return Classification 1C forms?

airSlate SignNow provides an efficient platform for electronically signing and sending your Municipal Business Tax Return Classification 1C forms. Our easy-to-use interface allows businesses to streamline their tax filing process, ensuring that necessary documents are executed promptly and securely. This reduces the time spent on paperwork and enhances overall compliance.

-

What are the pricing options for airSlate SignNow regarding Municipal Business Tax Return services?

airSlate SignNow offers flexible pricing plans that cater to different business needs while supporting features relevant to the Municipal Business Tax Return Classification 1C in Tennessee. Our cost-effective solutions enable businesses to choose a plan that fits their budget, ensuring accessibility for all. Moreover, our plans include essential tools for efficient document management.

-

What features does airSlate SignNow offer for Municipal Business Tax Return Classification 1C?

With airSlate SignNow, you receive features such as easy document eSigning, comprehensive templates for Municipal Business Tax Return Classification 1C, and secure storage for your files. Additionally, it allows for the tracking of document status, ensuring you know when forms are completed. This helps you maintain organized records and adhere to deadlines.

-

Are there any specific benefits of using airSlate SignNow for Municipal Business Tax Returns?

Using airSlate SignNow for your Municipal Business Tax Return Classification 1C can signNowly enhance your compliance and efficiency. Our platform simplifies the signing and management of tax documents, helping your business avoid penalties associated with late submissions. The digital process further reduces printing and mailing costs, contributing to overall savings.

-

How does airSlate SignNow ensure the security of my Municipal Business Tax Return documents?

airSlate SignNow prioritizes the security of your documents, especially for sensitive materials like the Municipal Business Tax Return Classification 1C. We employ advanced encryption methods and secure servers to protect your information. Additionally, users can set authentication options to restrict access to authorized personnel only.

-

Can I integrate airSlate SignNow with other financial software for tax purposes?

Yes, airSlate SignNow seamlessly integrates with various financial software solutions, making it easier to manage your Municipal Business Tax Return Classification 1C submissions. This integration allows for automatic data transfer, ensuring accuracy and reducing manual entry errors. It also allows you to maintain continuity across your financial processes.

Get more for Minicipal Business Tax Return Classification 1C Tennessee

Find out other Minicipal Business Tax Return Classification 1C Tennessee

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online