Texas Franchise Tax Report Form 2018

What is the Texas Franchise Tax Report Form

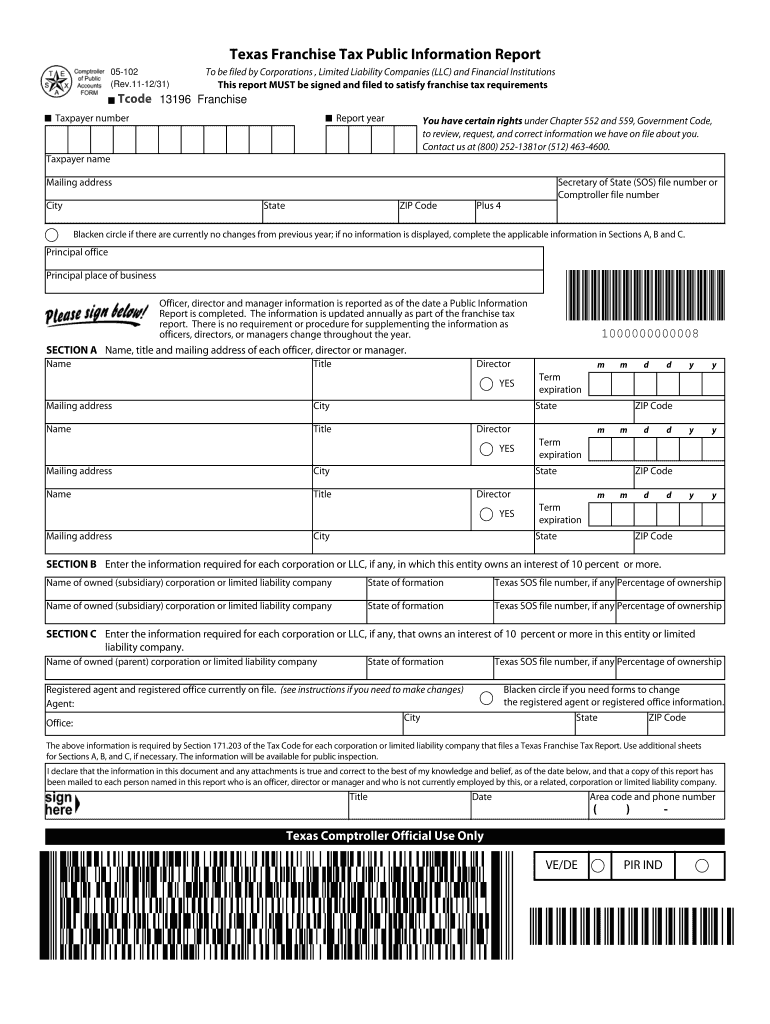

The Texas Franchise Tax Report Form is a state-mandated document that businesses operating in Texas must file annually. This form is used to report the revenue and financial status of a business entity, determining its franchise tax liability. It applies to various business structures, including corporations, limited liability companies (LLCs), and partnerships. The form ensures compliance with state tax regulations and helps maintain good standing with the Texas Comptroller of Public Accounts.

How to use the Texas Franchise Tax Report Form

Using the Texas Franchise Tax Report Form involves several steps. First, businesses must gather all relevant financial information, including gross receipts and expenses for the reporting period. Next, the form should be filled out accurately, reflecting the business's financial data. It is essential to review the completed form for errors before submission. Once finalized, the form can be submitted electronically or via mail, depending on the business's preference and compliance requirements.

Steps to complete the Texas Franchise Tax Report Form

Completing the Texas Franchise Tax Report Form requires careful attention to detail. Follow these steps to ensure accurate completion:

- Gather necessary financial documents, including income statements and balance sheets.

- Determine the appropriate reporting method based on your business's revenue.

- Fill out the form, entering all required information accurately.

- Review the form for completeness and accuracy, checking for any discrepancies.

- Submit the form electronically through the Texas Comptroller's website or mail it to the designated address.

Legal use of the Texas Franchise Tax Report Form

The legal use of the Texas Franchise Tax Report Form is critical for compliance with state tax laws. Filing this form is not only a requirement but also a legal obligation for businesses operating in Texas. Failure to submit the form on time can result in penalties, including fines and interest on unpaid taxes. Additionally, maintaining accurate records and ensuring timely submission helps protect the business's legal standing and avoids potential audits from the Texas Comptroller's office.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Texas Franchise Tax Report Form is essential for compliance. The report is typically due on May 15 of each year. However, if May 15 falls on a weekend or holiday, the deadline is extended to the next business day. Businesses should also be aware of any extensions that may be available and ensure they file within the specified time frame to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Texas Franchise Tax Report Form. The preferred method is electronic submission through the Texas Comptroller's online portal, which allows for quicker processing and confirmation of receipt. Alternatively, businesses can mail the completed form to the appropriate address listed on the form. In-person submission is also an option at designated Comptroller offices, but this method may require an appointment and is less commonly used.

Quick guide on how to complete 2012 texas franchise tax report form

Effortlessly prepare Texas Franchise Tax Report Form on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed papers, as it allows you to locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Texas Franchise Tax Report Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-centric tasks today.

The easiest method to alter and eSign Texas Franchise Tax Report Form effortlessly

- Obtain Texas Franchise Tax Report Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Texas Franchise Tax Report Form to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 texas franchise tax report form

Create this form in 5 minutes!

How to create an eSignature for the 2012 texas franchise tax report form

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Texas Franchise Tax Report Form?

The Texas Franchise Tax Report Form is a document required by the state of Texas for businesses to report their income and pay franchise taxes. It plays a crucial role in maintaining compliance with Texas tax laws and ensuring that your business is in good standing. Filing this form accurately is essential to avoid penalties from the state.

-

How can airSlate SignNow help with the Texas Franchise Tax Report Form?

airSlate SignNow streamlines the process of completing and submitting the Texas Franchise Tax Report Form by providing an easy-to-use eSignature solution. You can fill out the form electronically, send it to necessary parties for signatures, and submit it all from one platform. This saves you time and ensures that your submissions are secure and organized.

-

Is there a cost associated with using airSlate SignNow for the Texas Franchise Tax Report Form?

Yes, there is a pricing plan associated with airSlate SignNow that varies based on features and usage. However, investing in this service can save you money in the long run by reducing errors and streamlining your document workflow for the Texas Franchise Tax Report Form. Review our pricing page for detailed information on plans that suit your business needs.

-

What features does airSlate SignNow offer for managing the Texas Franchise Tax Report Form?

airSlate SignNow offers features like customizable templates, eSignature capabilities, and real-time tracking to manage the Texas Franchise Tax Report Form effectively. Users can collaborate on documents, track who has signed, and get notifications for any pending actions. These tools make the filing process more efficient and organized.

-

Can I integrate airSlate SignNow with other software for the Texas Franchise Tax Report Form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easy to incorporate it into your existing workflows for handling the Texas Franchise Tax Report Form. This flexibility allows you to enhance productivity and maintain consistency across your business processes.

-

What are the benefits of using airSlate SignNow for the Texas Franchise Tax Report Form?

The primary benefits of using airSlate SignNow for the Texas Franchise Tax Report Form include improved efficiency, reduced paperwork, and enhanced compliance. By digitizing your document process, you minimize the risk of errors and ensure timely submissions. This solution ultimately allows your business to focus more on growth and less on administrative tasks.

-

Is airSlate SignNow suitable for small businesses filing the Texas Franchise Tax Report Form?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its affordable pricing and user-friendly interface make it an excellent choice for those unfamiliar with the tax filing process. By utilizing airSlate SignNow, small business owners can easily manage the Texas Franchise Tax Report Form without the need for extensive tax knowledge.

Get more for Texas Franchise Tax Report Form

Find out other Texas Franchise Tax Report Form

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online