Va Sales Tax Form 2020

What is the Va Sales Tax Form

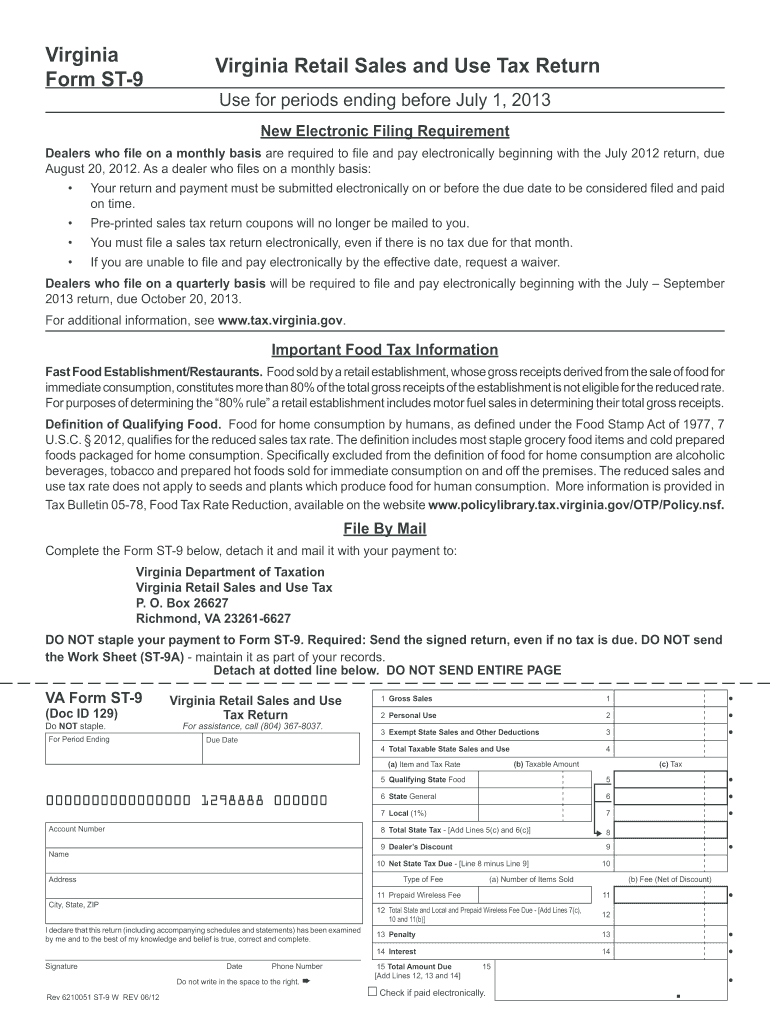

The Va Sales Tax Form is a document used by businesses and individuals in Virginia to report and remit sales tax collected on taxable sales. This form is essential for ensuring compliance with state tax regulations. It outlines the total sales, taxable sales, and the amount of sales tax due to the Virginia Department of Taxation. Understanding the purpose of this form is crucial for any entity engaged in selling goods or services within the state.

How to use the Va Sales Tax Form

Using the Va Sales Tax Form involves several steps. First, gather all necessary sales records for the reporting period. This includes invoices, receipts, and any other documentation that reflects sales activity. Next, accurately calculate the total sales and the corresponding sales tax collected. Once these figures are determined, fill out the form by entering the required information in the designated fields. Finally, review the completed form for accuracy before submitting it to the Virginia Department of Taxation.

Steps to complete the Va Sales Tax Form

Completing the Va Sales Tax Form requires careful attention to detail. Follow these steps to ensure proper submission:

- Gather all sales records for the reporting period.

- Calculate total sales and taxable sales.

- Determine the sales tax rate applicable to your sales.

- Fill in the form with the calculated figures.

- Double-check all entries for accuracy.

- Submit the form by the deadline, either online or via mail.

Key elements of the Va Sales Tax Form

The Va Sales Tax Form includes several key elements that must be completed accurately. These elements typically consist of:

- Your business name and address.

- The reporting period for which the tax is being filed.

- Total sales and taxable sales amounts.

- The amount of sales tax collected.

- Signature and date of submission.

Form Submission Methods (Online / Mail / In-Person)

The Va Sales Tax Form can be submitted through various methods, accommodating different preferences and needs. Options include:

- Online submission via the Virginia Department of Taxation's website, which provides a convenient and efficient way to file.

- Mailing a printed copy of the completed form to the appropriate address specified by the state.

- In-person submission at designated tax offices, which may be suitable for those who prefer face-to-face interactions.

Penalties for Non-Compliance

Failure to file the Va Sales Tax Form or remit the correct amount of sales tax can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, adding to the total amount owed.

- Potential legal action for continued non-compliance, which could lead to further financial repercussions.

Quick guide on how to complete 2012 va sales tax form

Complete Va Sales Tax Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly solution to traditional printed and signed documents, allowing you to access the correct form and confidentially save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Va Sales Tax Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Va Sales Tax Form with ease

- Obtain Va Sales Tax Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Va Sales Tax Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 va sales tax form

Create this form in 5 minutes!

How to create an eSignature for the 2012 va sales tax form

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a Va Sales Tax Form?

A Va Sales Tax Form is a document required by the Virginia Department of Taxation for reporting sales tax collected by businesses. It ensures compliance with state tax regulations. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring a smooth process for your business.

-

How can airSlate SignNow help with the Va Sales Tax Form?

airSlate SignNow streamlines the process of filling out and submitting your Va Sales Tax Form. Our platform allows for easy document management and eSignature capabilities, making the submission process simple and efficient. This means you can focus on running your business while we handle the tax paperwork.

-

Is there a cost associated with using airSlate SignNow for the Va Sales Tax Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that assist with the completion of the Va Sales Tax Form, making compliance easy and cost-effective. You can choose a plan that best suits your requirements and budget.

-

What features does airSlate SignNow offer for managing the Va Sales Tax Form?

airSlate SignNow provides features such as customizable templates, bulk sending, and secure eSignatures. These tools simplify the management of your Va Sales Tax Form, ensuring accuracy and speed. Additionally, integration with other software helps streamline your workflow.

-

Can I integrate airSlate SignNow with my existing accounting software for the Va Sales Tax Form?

Yes, airSlate SignNow seamlessly integrates with various accounting software to automate the process of completing the Va Sales Tax Form. This integration ensures that your data is synchronized, reducing the risk of errors and saving valuable time. Make your tax reporting more efficient with our tools.

-

What are the benefits of using airSlate SignNow for the Va Sales Tax Form?

Using airSlate SignNow for the Va Sales Tax Form offers numerous benefits, including enhanced accuracy, faster processing times, and improved collaboration among team members. Our user-friendly interface also ensures that all users can easily navigate the system. Save time and reduce stress with our efficient solutions.

-

Is it easy to eSign the Va Sales Tax Form with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign the Va Sales Tax Form. Users can sign documents securely from anywhere, using any device. This convenience helps ensure that your forms are completed and submitted on time.

Get more for Va Sales Tax Form

- Social developmental history form in spanish

- Aflac vision claim form

- Intermountain healthcare release of information form

- Medical examination report form

- Curtin college application form

- 42 writs in california state courts form

- Asn 1 deq project notification form

- Western pennsylvania electrical 5 hot metal street suite form

Find out other Va Sales Tax Form

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract