20 FORM 720 VI Virgin Islands Internal Revenue 2012

What is the 20 FORM 720 VI Virgin Islands Internal Revenue

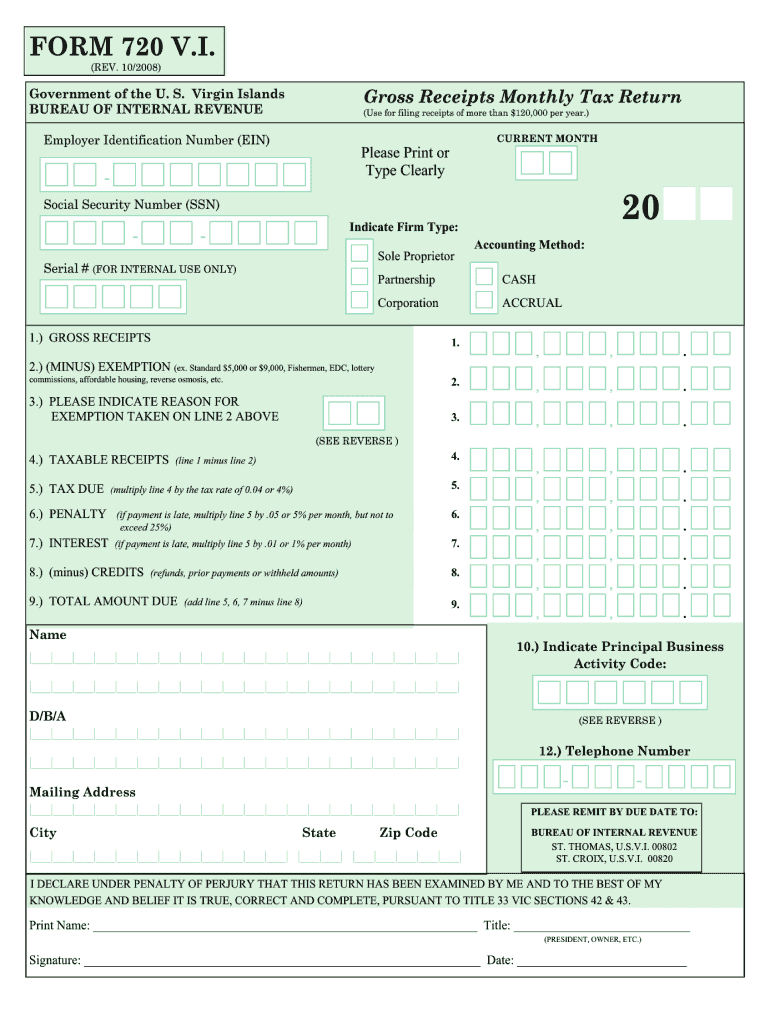

The 20 FORM 720 VI is a tax form used for reporting certain types of income and tax obligations specific to the Virgin Islands. This form is essential for individuals and businesses operating within the territory, as it helps ensure compliance with local tax regulations. It is primarily utilized by residents and entities that earn income sourced from the Virgin Islands, enabling them to report their earnings accurately to the Virgin Islands Internal Revenue. Understanding the purpose and requirements of this form is crucial for maintaining good standing with tax authorities.

Steps to complete the 20 FORM 720 VI Virgin Islands Internal Revenue

Completing the 20 FORM 720 VI involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, expense records, and any relevant tax documents. Follow these steps:

- Review the form instructions carefully to understand the information required.

- Fill out personal identification details, including your name, address, and taxpayer identification number.

- Report all sources of income, ensuring that you include any income earned in the Virgin Islands.

- Deduct any eligible expenses that may reduce your taxable income.

- Double-check all entries for accuracy before submission.

Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the Virgin Islands Internal Revenue.

Legal use of the 20 FORM 720 VI Virgin Islands Internal Revenue

The legal use of the 20 FORM 720 VI is governed by the tax laws of the Virgin Islands. To be considered valid, the form must be filled out accurately and submitted within the designated time frame. The information provided on this form must reflect true and complete financial data, as any discrepancies may lead to penalties or legal consequences. Utilizing electronic signatures through a reliable platform can enhance the legal standing of the form, ensuring compliance with electronic signature laws such as ESIGN and UETA.

Form Submission Methods

Submitting the 20 FORM 720 VI can be done through various methods, catering to different preferences and needs. The primary submission methods include:

- Online Submission: Many taxpayers prefer to file electronically for convenience and speed. This method often allows for immediate confirmation of receipt.

- Mail Submission: For those who prefer traditional methods, forms can be printed and mailed to the Virgin Islands Internal Revenue. Ensure that you send it to the correct address to avoid delays.

- In-Person Submission: Taxpayers may also choose to submit the form in person at designated tax offices, which can provide immediate assistance and confirmation.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial for avoiding penalties associated with late submissions. The deadlines for the 20 FORM 720 VI typically align with the federal tax deadlines, but it is essential to verify specific dates each tax year. Key dates to remember include:

- The annual filing deadline, usually falling on April 15.

- Extensions may be available, but must be requested prior to the deadline.

- Quarterly estimated tax payment deadlines, if applicable.

Staying informed about these dates can help ensure timely compliance with tax obligations.

Key elements of the 20 FORM 720 VI Virgin Islands Internal Revenue

The 20 FORM 720 VI contains several critical sections that taxpayers must complete accurately. Key elements include:

- Taxpayer Information: This section requires personal details, including name, address, and identification numbers.

- Income Reporting: Taxpayers must disclose all sources of income, including wages, dividends, and other earnings.

- Deductions and Credits: Eligible deductions can significantly impact the overall tax liability, so it is important to identify and report them accurately.

- Signature Section: A valid signature is required to authenticate the form, which can be done electronically for added convenience.

Quick guide on how to complete 20 form 720 vi virgin islands internal revenue

Prepare 20 FORM 720 VI Virgin Islands Internal Revenue effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents quickly and without interruptions. Manage 20 FORM 720 VI Virgin Islands Internal Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to edit and electronically sign 20 FORM 720 VI Virgin Islands Internal Revenue with ease

- Obtain 20 FORM 720 VI Virgin Islands Internal Revenue and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require reprinting new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 20 FORM 720 VI Virgin Islands Internal Revenue and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 20 form 720 vi virgin islands internal revenue

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is the 20 FORM 720 VI Virgin Islands Internal Revenue used for?

The 20 FORM 720 VI Virgin Islands Internal Revenue is primarily used for filing tax returns for businesses operating in the Virgin Islands. It helps ensure compliance with local tax regulations while providing a structured format to report income and expenses.

-

How can airSlate SignNow simplify the 20 FORM 720 VI Virgin Islands Internal Revenue submission process?

airSlate SignNow streamlines the 20 FORM 720 VI Virgin Islands Internal Revenue submission by allowing users to electronically sign and send documents securely. With its easy-to-use interface, businesses can ensure their tax forms are submitted accurately and on time.

-

What are the benefits of using airSlate SignNow for the 20 FORM 720 VI Virgin Islands Internal Revenue?

Using airSlate SignNow for the 20 FORM 720 VI Virgin Islands Internal Revenue offers several benefits, including enhanced security for sensitive information, faster turnaround times, and reduced paper usage. This digital solution helps businesses stay organized and compliant.

-

Is it cost-effective to use airSlate SignNow for filing the 20 FORM 720 VI Virgin Islands Internal Revenue?

Yes, airSlate SignNow is a cost-effective solution for filing the 20 FORM 720 VI Virgin Islands Internal Revenue. By reducing the need for physical paperwork and postage, businesses can save money while ensuring timely filings.

-

Can airSlate SignNow integrate with other tax software for the 20 FORM 720 VI Virgin Islands Internal Revenue?

Absolutely! airSlate SignNow offers various integrations with popular tax software, making it easier to manage and file the 20 FORM 720 VI Virgin Islands Internal Revenue seamlessly. This interoperability helps streamline your workflow.

-

How secure is airSlate SignNow when handling the 20 FORM 720 VI Virgin Islands Internal Revenue documents?

airSlate SignNow prioritizes security by employing advanced encryption methods and secure access controls. When dealing with the 20 FORM 720 VI Virgin Islands Internal Revenue, you can trust that your sensitive information is protected.

-

What features does airSlate SignNow provide for managing the 20 FORM 720 VI Virgin Islands Internal Revenue?

airSlate SignNow comes with features designed to simplify the management of the 20 FORM 720 VI Virgin Islands Internal Revenue, including customizable templates, electronic signatures, and tracking options. These tools help ensure a smooth filing process.

Get more for 20 FORM 720 VI Virgin Islands Internal Revenue

Find out other 20 FORM 720 VI Virgin Islands Internal Revenue

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now