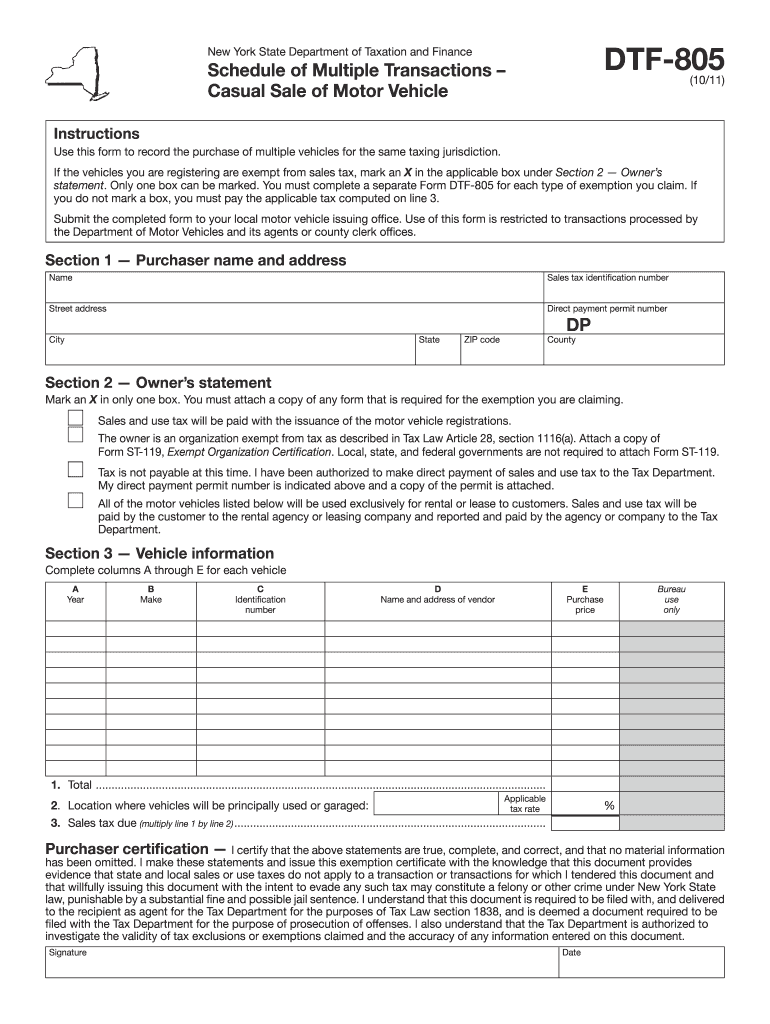

Dtf 805 Form

What is the DTF 802?

The DTF 802 is a form used in New York State for tax purposes, specifically related to the exemption of certain transactions from sales and use tax. This form is essential for businesses and individuals who qualify for tax exemptions under specific circumstances. It serves as a declaration that the purchaser is entitled to an exemption from sales tax on the purchase of goods or services. Understanding the purpose and requirements of the DTF 802 is crucial for compliance with state tax regulations.

Steps to Complete the DTF 802

Completing the DTF 802 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the purchaser's details and the nature of the exempt transaction. Fill out the form with accurate data, ensuring that all fields are completed. Pay particular attention to the exemption reason, as this must align with New York State tax laws. After completing the form, review it for any errors before submission to avoid delays or penalties.

Legal Use of the DTF 802

The DTF 802 must be used in accordance with New York State tax laws. It is legally binding when filled out correctly and submitted as required. Misuse of the form, such as claiming exemptions without proper justification, can lead to penalties and interest on unpaid taxes. It is important for users to understand the legal implications of submitting the DTF 802 and to ensure that they meet all eligibility criteria for the exemption claimed.

Who Issues the Form?

The DTF 802 is issued by the New York State Department of Taxation and Finance. This agency is responsible for managing tax-related forms and ensuring compliance with state tax laws. Users can obtain the DTF 802 directly from the department's official website or through authorized distribution channels. It is advisable to use the most current version of the form to ensure compliance with any updates to tax regulations.

Required Documents

When submitting the DTF 802, certain documents may be required to support the exemption claim. These documents can include proof of the purchaser's tax-exempt status, such as a certificate of exemption, and any relevant invoices or receipts related to the transaction. Ensuring that all supporting documentation is accurate and complete is vital for a successful exemption claim.

Filing Deadlines / Important Dates

Filing deadlines for the DTF 802 can vary based on the nature of the transaction and the specific tax period involved. It is essential for users to be aware of these deadlines to avoid any late filing penalties. Typically, forms should be submitted in conjunction with the related sales tax returns or as specified by the New York State Department of Taxation and Finance. Keeping track of important dates will help ensure compliance and avoid unnecessary complications.

Quick guide on how to complete dtf 805

Effortlessly Prepare Dtf 805 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as it allows you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents quickly and without issues. Handle Dtf 805 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign Dtf 805 with Ease

- Locate Dtf 805 and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Dtf 805 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 805

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the NYS tax exempt form ST 119?

The NYS tax exempt form ST 119 is a document used in New York State that certifies an organization's exemption from sales tax. It allows qualifying entities to make tax-exempt purchases for eligible goods and services. Understanding how to accurately fill out and submit this form is crucial for compliance.

-

How can airSlate SignNow help me with the NYS tax exempt form ST 119?

airSlate SignNow simplifies the process of completing the NYS tax exempt form ST 119 by providing an easy-to-use platform for electronic signatures and document management. Our solution enables you to securely sign and share the form, ensuring a smooth transaction process. Save time and resources with our efficient platform.

-

Is there a cost associated with using airSlate SignNow for the NYS tax exempt form ST 119?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose one that meets your needs for managing documents like the NYS tax exempt form ST 119. We provide a cost-effective solution without sacrificing features, and you can start with a free trial to see its value before committing. Please check our pricing page for detailed options.

-

Can I integrate airSlate SignNow with other software for managing the NYS tax exempt form ST 119?

Absolutely! airSlate SignNow offers robust integrations with popular platforms and software, making it easier for you to manage documents like the NYS tax exempt form ST 119. This allows for seamless workflows and enhances productivity by connecting data across different systems. Check our integration options for more details.

-

What are the benefits of using airSlate SignNow for the NYS tax exempt form ST 119?

Using airSlate SignNow for the NYS tax exempt form ST 119 offers a myriad of benefits, including reduced processing time, improved accuracy, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible, making tax-exempt transactions effortless. Plus, you can track your documents in real-time.

-

Can I access the NYS tax exempt form ST 119 on mobile devices?

Yes, airSlate SignNow is optimized for mobile use, allowing you to access and manage the NYS tax exempt form ST 119 from your smartphone or tablet. This flexibility ensures that you can complete and sign documents on the go, facilitating quick and easy submissions whenever necessary. Your documents remain accessible anytime, anywhere.

-

What security measures does airSlate SignNow employ for the NYS tax exempt form ST 119?

airSlate SignNow prioritizes security with advanced measures to protect documents, including the NYS tax exempt form ST 119. We use encryption and secure cloud storage to safeguard sensitive information and ensure compliance with industry standards. You can trust that your documents are safe with us throughout the signing process.

Get more for Dtf 805

Find out other Dtf 805

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast