Form 11a Tax Form 2015

What is the Form 11a Tax Form

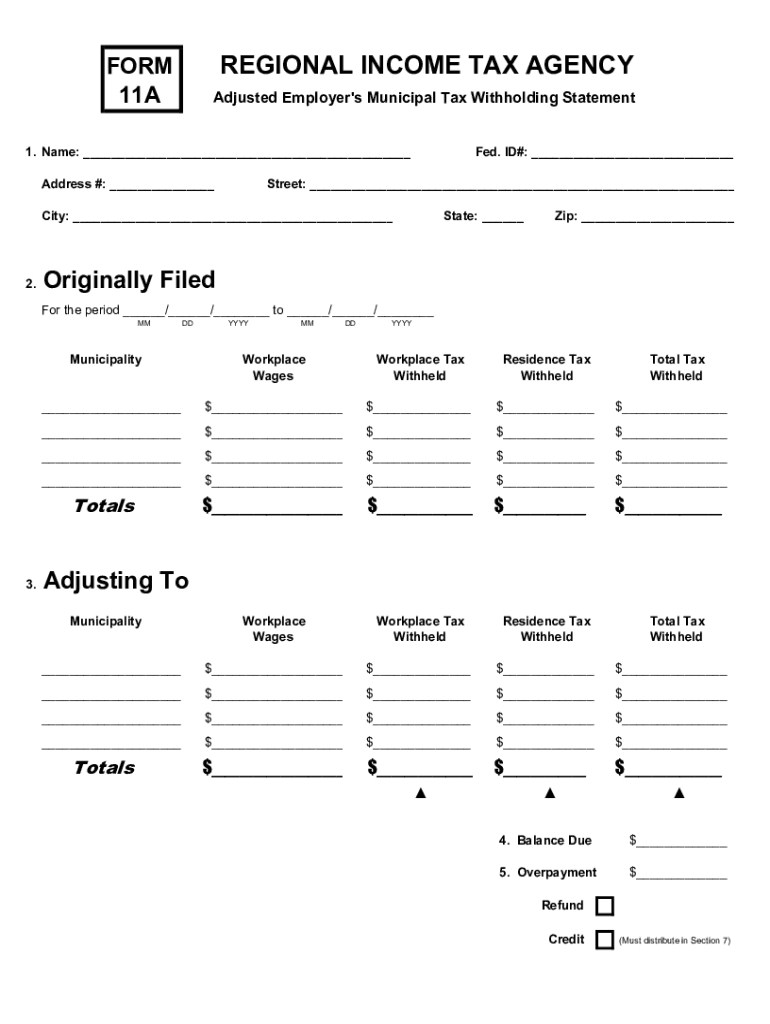

The Form 11a, also known as the RITA Form 11a, is a municipal income tax form used in Ohio. It is specifically designed for individuals and businesses to report income earned within municipalities that are part of the Regional Income Tax Agency (RITA). This form is essential for calculating and remitting local income taxes, ensuring compliance with local tax regulations.

How to use the Form 11a Tax Form

To effectively use the Form 11a, taxpayers must first gather necessary financial information, including income sources, deductions, and any applicable credits. The form requires users to input their total income, subtract any eligible deductions, and calculate the tax owed based on local tax rates. It is important to follow the instructions provided with the form to ensure accurate reporting.

Steps to complete the Form 11a Tax Form

Completing the Form 11a involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and records of any other income.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable income.

- Apply any deductions you may qualify for, such as business expenses or contributions to retirement accounts.

- Calculate the total tax owed based on the applicable municipal tax rate.

- Sign and date the form before submission.

Legal use of the Form 11a Tax Form

The legal use of the Form 11a is governed by Ohio tax laws, which require residents and businesses to report income earned within RITA municipalities. To ensure the form is legally binding, it must be filled out accurately and submitted by the designated deadline. Failure to comply with local tax laws can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines associated with the Form 11a. Generally, the form is due by April fifteenth for the previous calendar year's income. Extensions may be available, but it is crucial to check with RITA for specific guidelines. Failing to file by the deadline can lead to penalties, so timely submission is essential.

Who Issues the Form

The Form 11a is issued by the Regional Income Tax Agency (RITA), which administers municipal income tax for various communities in Ohio. RITA provides the necessary forms and guidelines to assist taxpayers in fulfilling their tax obligations. It is advisable to refer to RITA’s official resources for the most current version of the form and any updates regarding filing requirements.

Quick guide on how to complete form 11a tax form

Complete Form 11a Tax Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without hindrance. Handle Form 11a Tax Form on any system using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and eSign Form 11a Tax Form with ease

- Locate Form 11a Tax Form and click on Get Form to initiate the process.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 11a Tax Form and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 11a tax form

Create this form in 5 minutes!

How to create an eSignature for the form 11a tax form

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the rita form 11a?

The rita form 11a is a specific document used for compliance purposes within various business contexts. It allows users to collect necessary information quickly and efficiently. With airSlate SignNow, you can easily create, send, and eSign the rita form 11a, streamlining your workflow.

-

How does airSlate SignNow improve the rita form 11a process?

airSlate SignNow simplifies the creation and signing process of the rita form 11a by providing a user-friendly platform. Users can customize the form, set signing order, and track document status in real-time. This saves time and reduces the errors often associated with manual paperwork.

-

What are the pricing options for using airSlate SignNow with the rita form 11a?

airSlate SignNow offers several pricing plans to suit different business needs, including options for those who primarily use the rita form 11a. Each plan provides access to essential features like eSigning, document templates, and integrations. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications while using the rita form 11a?

Yes, airSlate SignNow supports integration with various applications that complement the use of the rita form 11a. This includes CRM systems, cloud storage solutions, and project management tools. Such integrations ensure a seamless workflow and better document management.

-

What security measures does airSlate SignNow offer for rita form 11a documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the rita form 11a. The platform uses advanced encryption and electronic signature security protocols to ensure your data is safe. Additionally, you can control access and authentication settings for added protection.

-

How quickly can I get started with airSlate SignNow for the rita form 11a?

Getting started with airSlate SignNow for the rita form 11a is quick and easy. You can sign up for an account, create your first form, and begin sending documents for eSigning within minutes. The intuitive interface requires no technical skills, making it accessible for everyone.

-

Can multiple users collaborate on the rita form 11a using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to collaborate on the rita form 11a, ensuring a smooth and efficient document flow. You can invite team members to contribute, review, and sign, which enhances teamwork and speeds up the approval process.

Get more for Form 11a Tax Form

Find out other Form 11a Tax Form

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template