104 Form 2020

What is the 104 Form

The 104 Form, officially known as the IRS Form 1040, is an essential document used by U.S. taxpayers to file their annual income tax returns. This form is designed to report an individual's income, claim tax deductions, and calculate the amount of tax owed or the refund due. The 104 Form is crucial for ensuring compliance with federal tax laws and is utilized by various taxpayer categories, including employees, self-employed individuals, and retirees. Understanding its purpose and requirements is vital for accurate tax reporting.

How to use the 104 Form

Using the 104 Form involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and records of deductions. Next, fill out the form by entering personal information, income details, and applicable deductions. It is important to follow the IRS guidelines closely to avoid errors. After completing the form, review it for accuracy, sign it, and choose a submission method, whether online or by mail.

Steps to complete the 104 Form

Completing the 104 Form can be broken down into a series of clear steps:

- Gather all relevant financial documents, such as W-2s and 1099s.

- Provide personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your financial documents.

- Claim deductions and credits that apply to your situation.

- Calculate your total tax liability or refund amount.

- Sign and date the form, ensuring all information is accurate.

- Submit the form either electronically through IRS e-file or by mailing it to the appropriate address.

Legal use of the 104 Form

The 104 Form must be completed and submitted in accordance with U.S. tax laws to be considered legally valid. This includes accurate reporting of income and deductions, as well as adherence to filing deadlines. Failure to comply with these regulations can result in penalties, including fines or audits. It is essential for taxpayers to keep copies of their submitted forms and supporting documents for at least three years in case of future inquiries from the IRS.

Filing Deadlines / Important Dates

Timely filing of the 104 Form is crucial to avoid penalties. The typical deadline for submitting the 104 Form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can also request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these important dates is essential for compliance.

Required Documents

To accurately complete the 104 Form, taxpayers need to gather several key documents:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of deductible expenses, including receipts and invoices.

- Documentation for any tax credits being claimed, such as education credits.

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The 104 Form can be submitted through various methods to accommodate different preferences. Taxpayers can file electronically using IRS e-file, which is often faster and more secure. Alternatively, the form can be printed and mailed to the appropriate IRS address, depending on the state of residence. Some taxpayers may also choose to file in person at designated IRS offices, although this option may be less common. Each method has its own advantages, so selecting the best one based on individual circumstances is important.

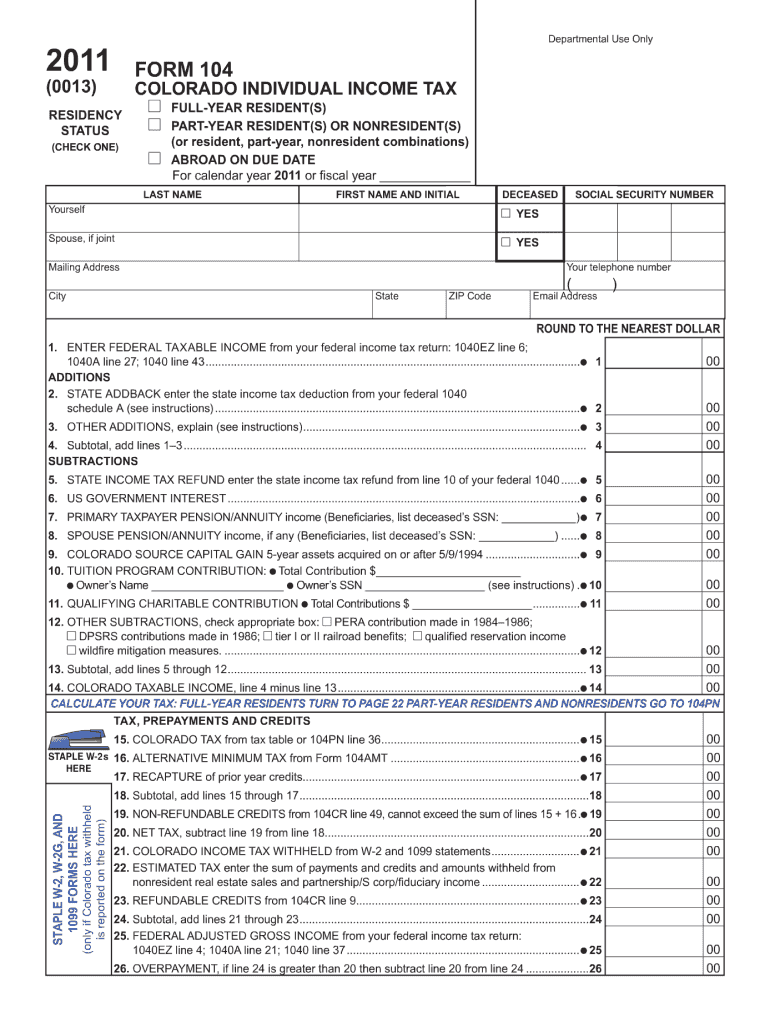

Quick guide on how to complete 2011 104 form

Conveniently Prepare 104 Form on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents promptly without any holdups. Manage 104 Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related workflow today.

How to Modify and Electronically Sign 104 Form Effortlessly

- Find 104 Form and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this function.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you’d like to share your form, via email, SMS, or a sharing link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and electronically sign 104 Form to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 104 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 104 form

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a 104 Form and how is it used?

The 104 Form is a tax document used by individuals to report their income to the IRS. It also allows taxpayers to claim various tax credits and deductions. Understanding the 104 Form is essential for proper tax filing and ensures compliance with tax regulations.

-

How does airSlate SignNow support 104 Form eSigning?

airSlate SignNow provides a user-friendly platform for electronically signing the 104 Form and other important documents. Our service ensures that your eSignature is legally binding and secure. This simplifies the process of submitting your tax documents digitally.

-

What are the pricing options for airSlate SignNow for handling 104 Forms?

airSlate SignNow offers various pricing plans to cater to different needs, starting with a free trial. Each plan provides features that ensure easy handling of the 104 Form, including bulk sending and templates. Assess your requirements and select a plan that best suits your business.

-

Can I integrate airSlate SignNow with other software to manage 104 Forms?

Yes, airSlate SignNow seamlessly integrates with several applications, allowing you to manage your 104 Forms efficiently. Whether you're using CRM systems or accounting software, our integrations enhance your workflow. This ensures all your documents are streamlined within your existing systems.

-

What features does airSlate SignNow offer for managing 104 Forms?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking for your 104 Form. These features help streamline the signing process, making it quick and hassle-free. With our platform, you can easily send reminders and track document status.

-

Is airSlate SignNow compliant with IRS regulations for the 104 Form?

Yes, airSlate SignNow adheres to all necessary compliance standards, including those required by the IRS for electronic filing of the 104 Form. Our digital signatures are legally recognized, ensuring that your submissions are acceptable. This compliance gives you peace of mind when filing your taxes.

-

How can airSlate SignNow help me streamline my 104 Form submission process?

By using airSlate SignNow, you can automate and streamline the submission of your 104 Form. Our platform allows for quick access and efficient eSigning, reducing the time spent on paper-based processes. This means less time worrying about tax filings and more time focusing on your business.

Get more for 104 Form

Find out other 104 Form

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation