Colorado Retail Sales Tax Form 2019

What is the Colorado Retail Sales Tax Form

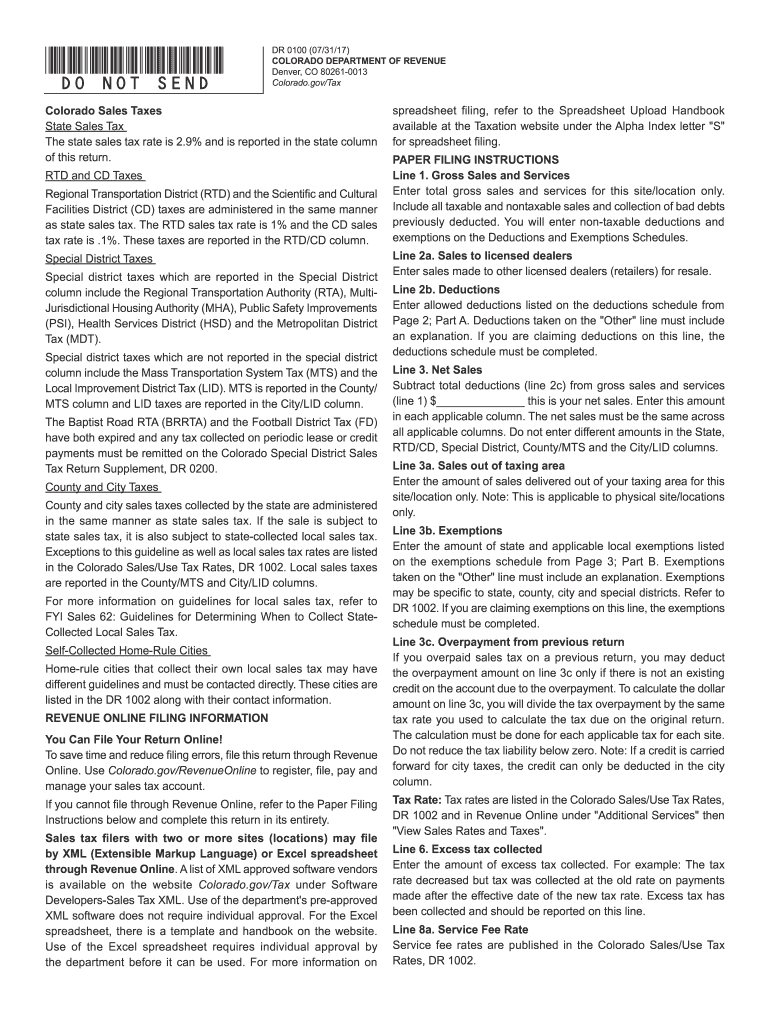

The Colorado Retail Sales Tax Form is a crucial document used by businesses to report sales tax collected from customers. This form is essential for compliance with state tax regulations, ensuring that the correct amount of sales tax is remitted to the Colorado Department of Revenue. It is typically used by retailers and service providers who make taxable sales within the state. Understanding the purpose and requirements of this form is vital for maintaining good standing with state tax authorities.

How to use the Colorado Retail Sales Tax Form

Using the Colorado Retail Sales Tax Form involves several steps to ensure accurate reporting. First, businesses must gather sales data for the reporting period, which includes total sales, taxable sales, and any exempt sales. Next, the form must be filled out with the appropriate figures, including the total sales tax collected. After completing the form, it must be submitted to the Colorado Department of Revenue by the designated deadline. Proper completion and timely submission are key to avoiding penalties.

Steps to complete the Colorado Retail Sales Tax Form

Completing the Colorado Retail Sales Tax Form requires careful attention to detail. Follow these steps for accurate completion:

- Collect sales records for the reporting period.

- Identify the total sales and the amount subject to sales tax.

- Calculate the total sales tax collected based on the applicable rate.

- Fill in the form with the required information, including business details and sales figures.

- Review the completed form for accuracy.

- Submit the form by the deadline set by the Colorado Department of Revenue.

Legal use of the Colorado Retail Sales Tax Form

The Colorado Retail Sales Tax Form is legally binding when filled out correctly and submitted on time. To ensure its legal standing, businesses must comply with state regulations regarding sales tax collection and reporting. This includes accurately reporting taxable sales and remitting the correct amount of tax. Failure to adhere to these regulations can result in penalties or legal action, making it essential for businesses to understand their responsibilities under Colorado tax law.

Form Submission Methods

The Colorado Retail Sales Tax Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Colorado Department of Revenue's website.

- Mailing a physical copy of the completed form to the appropriate address.

- In-person submission at designated state offices.

Choosing the right submission method can help ensure that the form is received on time and processed efficiently.

Penalties for Non-Compliance

Non-compliance with the requirements of the Colorado Retail Sales Tax Form can lead to significant penalties. Businesses that fail to file the form on time or report inaccurate information may face fines, interest on unpaid taxes, and potential legal consequences. It is crucial for businesses to stay informed about their filing obligations and ensure timely and accurate submissions to avoid these penalties.

Quick guide on how to complete colorado retail sales tax 2014 form

Complete Colorado Retail Sales Tax Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the proper form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Colorado Retail Sales Tax Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to adjust and eSign Colorado Retail Sales Tax Form effortlessly

- Obtain Colorado Retail Sales Tax Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or mask confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from a device of your selection. Modify and eSign Colorado Retail Sales Tax Form and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado retail sales tax 2014 form

Create this form in 5 minutes!

How to create an eSignature for the colorado retail sales tax 2014 form

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is a Colorado Retail Sales Tax Form?

The Colorado Retail Sales Tax Form is a document used by businesses in Colorado to report and pay sales tax collected from consumers. It is essential for compliance with state tax laws and helps streamline tax reporting. Using airSlate SignNow, you can easily fill out and eSign this form for quick submission.

-

How can airSlate SignNow help with the Colorado Retail Sales Tax Form?

airSlate SignNow simplifies the process of completing the Colorado Retail Sales Tax Form by providing a user-friendly interface for document management. You can fill out the form electronically and eSign it for authentication, ensuring a secure and efficient filing process. This saves time and reduces the risk of errors compared to paper forms.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that best fits your needs, whether you're a small business or a larger organization requiring extensive document management. All pricing options include access to tools for eSigning the Colorado Retail Sales Tax Form and other essential features.

-

Is airSlate SignNow secure for submitting tax forms?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure data storage, ensuring that your Colorado Retail Sales Tax Form and other documents are protected. Our platform complies with industry standards and regulations, giving you peace of mind while managing sensitive information.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software tools, enhancing your ability to manage the Colorado Retail Sales Tax Form and improving overall efficiency. These integrations allow for easier data transfer and reduce repetitive tasks, making your tax management process smoother.

-

What features does airSlate SignNow provide for the Colorado Retail Sales Tax Form?

airSlate SignNow provides essential features for managing the Colorado Retail Sales Tax Form, including customizable templates, eSignature capabilities, and automated reminders for filing deadlines. These tools streamline the process and ensure that you stay compliant with Colorado tax regulations. You can also track the status of your submissions easily.

-

How quickly can I complete and submit the Colorado Retail Sales Tax Form using airSlate SignNow?

With airSlate SignNow, you can complete and submit the Colorado Retail Sales Tax Form in minutes. The intuitive interface and eSigning features expedite the process, allowing you to focus on other important business matters. This quick turnaround is crucial during tax season when timely submissions are necessary.

Get more for Colorado Retail Sales Tax Form

- Vehicle record searchesdepartment of revenue colorado form

- Form vsa17a application for certificate of title and registration

- Certificate of service re notice of entry of confirmation o form

- Residential access modification program rampalberta ca form

- From landlords name form

- Form 13 1 financial statement property and support claims

- Guide form p standard form of lease residential

- Esa50 form

Find out other Colorado Retail Sales Tax Form

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online