20 Nebraska Tax Application Nebraska Department of 2020-2026

What is the 20 Nebraska Tax Application?

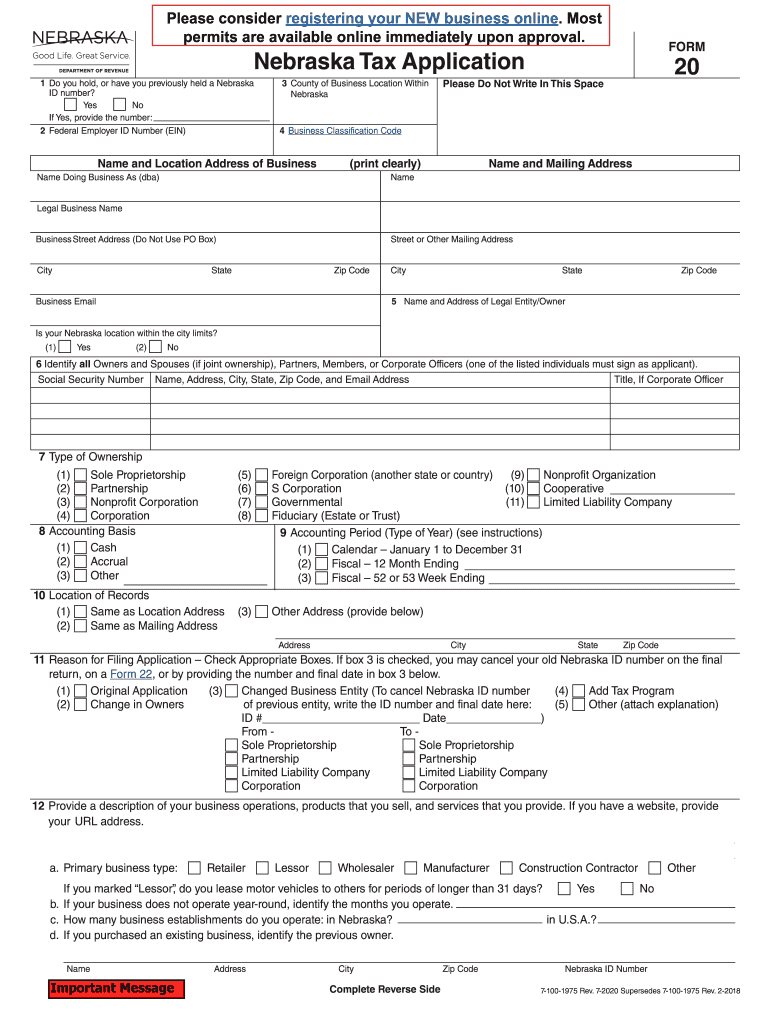

The 20 Nebraska Tax Application is a form used by residents of Nebraska to report their income and calculate their tax obligations. This form is essential for individuals and businesses to ensure compliance with state tax laws. The Nebraska Department of Revenue issues this application, which is part of the state's efforts to streamline tax reporting and collection. It includes various sections that require detailed information about income sources, deductions, and credits applicable to the taxpayer.

Steps to Complete the 20 Nebraska Tax Application

Completing the 20 Nebraska Tax Application involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including income statements, previous tax returns, and any relevant financial records. Follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Detail any deductions and credits you are eligible for, such as education expenses or business expenses.

- Calculate your total tax liability based on the information provided.

- Review the completed application for accuracy before submission.

How to Obtain the 20 Nebraska Tax Application

The 20 Nebraska Tax Application can be obtained through the Nebraska Department of Revenue's official website. It is available in a fillable PDF format, allowing taxpayers to complete the form digitally. Additionally, physical copies can be requested by contacting the department directly. Ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the 20 Nebraska Tax Application

The 20 Nebraska Tax Application is legally binding when completed and submitted in accordance with state regulations. It is important to understand that inaccuracies or omissions can lead to penalties or audits. To ensure legal compliance, taxpayers should familiarize themselves with the Nebraska Revised Statutes related to tax filings and maintain accurate records to support their claims.

Filing Deadlines / Important Dates

Filing deadlines for the 20 Nebraska Tax Application typically align with federal tax deadlines. Generally, individual taxpayers must file by April 15th of each year. However, it is advisable to check for any specific state extensions or changes to deadlines that may apply. Mark these important dates on your calendar to avoid late fees and penalties.

Required Documents

To complete the 20 Nebraska Tax Application accurately, several documents are required. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental properties or investments.

- Documentation for deductions, such as receipts for business expenses or education costs.

Having these documents ready will facilitate a smoother application process and help ensure accurate reporting.

Quick guide on how to complete 20 nebraska tax application nebraska department of

Complete 20 Nebraska Tax Application Nebraska Department Of effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and safely preserve it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your paperwork swiftly without interruptions. Handle 20 Nebraska Tax Application Nebraska Department Of on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to alter and eSign 20 Nebraska Tax Application Nebraska Department Of with ease

- Obtain 20 Nebraska Tax Application Nebraska Department Of and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to secure your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign 20 Nebraska Tax Application Nebraska Department Of and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 20 nebraska tax application nebraska department of

Create this form in 5 minutes!

How to create an eSignature for the 20 nebraska tax application nebraska department of

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the process for a form 20 download using airSlate SignNow?

To complete a form 20 download using airSlate SignNow, simply log into your account, navigate to the forms section, and select 'Download Form 20' from the available options. The process is user-friendly and designed to ensure that you have your documents ready in no time. With airSlate SignNow, you can easily manage your document workflow and access necessary forms seamlessly.

-

Are there any costs associated with downloading form 20 from airSlate SignNow?

Downloading a form 20 with airSlate SignNow is part of our cost-effective pricing plans. Depending on your subscription level, you may have unlimited access to downloadable forms, including form 20. Check our pricing page for detailed information on what's included in each plan.

-

What features come with the form 20 download option?

When you choose the form 20 download option with airSlate SignNow, you benefit from a host of features, including eSignature capability, document tracking, and secure storage. These features enhance your workflow, allowing for quick and reliable processing of documents. Plus, our intuitive interface makes it easy for anyone to use.

-

How can I integrate airSlate SignNow to automate form 20 downloads in my workflow?

airSlate SignNow offers various integrations with popular applications, allowing you to automate form 20 downloads and streamline your document management. By connecting our platform with tools like Google Drive or Salesforce, you can enhance productivity and reduce manual entry. Explore our integration options for a tailored solution for your needs.

-

What are the benefits of using airSlate SignNow for form 20 downloads?

Using airSlate SignNow for form 20 downloads provides signNow advantages such as increased efficiency, enhanced security, and ease of use. You can quickly send, sign, and manage documents while ensuring that your information remains protected. This means less time spent on paperwork and more time focusing on your business.

-

Can I access my form 20 download history in airSlate SignNow?

Yes, airSlate SignNow allows you to access your download history, including all form 20 downloads. This feature helps you keep track of your transactions and manage your documentation effectively. You can easily refer back to past downloads for records or auditing purposes.

-

Is technical support available for issues related to form 20 downloads?

Absolutely! airSlate SignNow provides comprehensive technical support for issues related to form 20 downloads. Our dedicated support team is available to assist you with any questions or challenges you may encounter, ensuring a smooth experience with our platform.

Get more for 20 Nebraska Tax Application Nebraska Department Of

Find out other 20 Nebraska Tax Application Nebraska Department Of

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online