or NVBID 2019-2026

Understanding the Nevada Commerce Tax

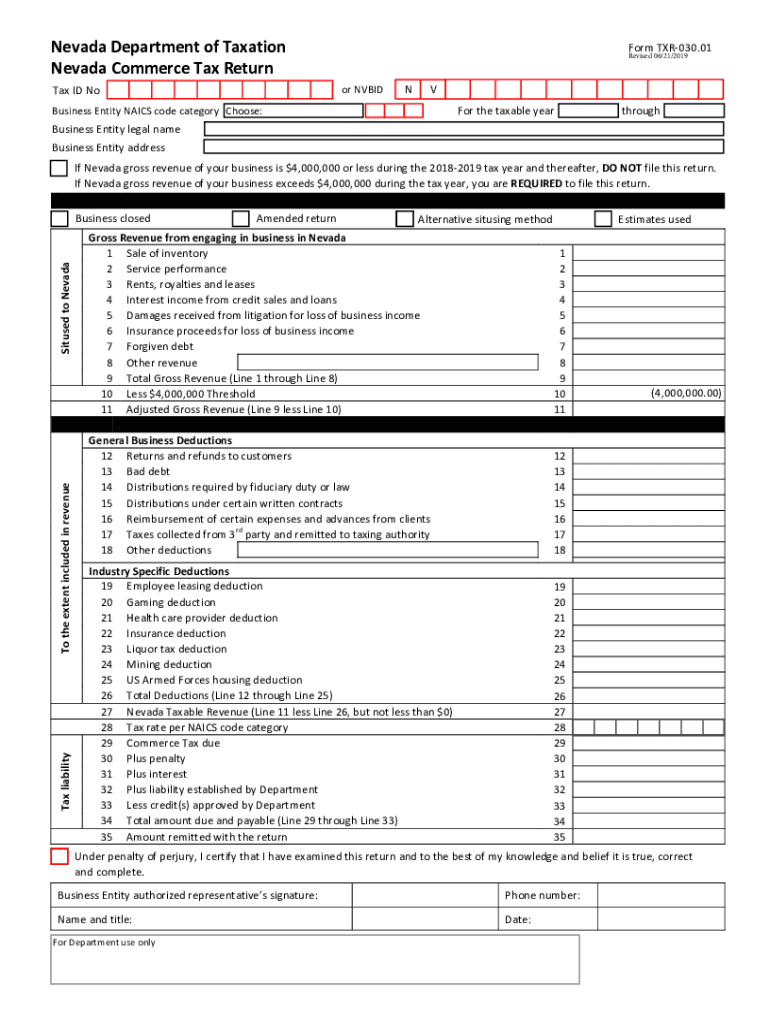

The Nevada Commerce Tax is a tax imposed on businesses operating in Nevada that have a gross revenue exceeding four hundred thousand dollars. This tax applies to various business types, including corporations, limited liability companies, and partnerships. It is essential for business owners to understand the tax structure, as it affects financial planning and compliance obligations.

Filing Deadlines for the Nevada Commerce Tax Return

Businesses must file their Nevada Commerce Tax return annually. The due date for filing is typically the last day of the month following the end of the fiscal year. For example, if a business operates on a calendar year, the return would be due by July thirty-first of the following year. Timely submission is crucial to avoid penalties and interest.

Required Documents for Filing

When preparing to file the Nevada Commerce Tax return, businesses need to gather specific documents, including:

- Financial statements showing gross revenue

- Records of any deductions or credits claimed

- Previous year's tax return for reference

Having these documents ready can streamline the filing process and ensure accuracy in reporting.

Steps to Complete the Nevada Commerce Tax Return

Completing the Nevada Commerce Tax return involves several steps:

- Determine your gross revenue for the tax year.

- Identify applicable deductions and credits.

- Fill out the Nevada Commerce Tax return form accurately.

- Submit the form electronically or by mail before the deadline.

Following these steps helps ensure compliance and reduces the risk of errors.

Penalties for Non-Compliance

Failure to file the Nevada Commerce Tax return on time can result in significant penalties. Businesses may face fines based on the amount of tax owed, as well as interest on unpaid taxes. Additionally, non-compliance can lead to increased scrutiny from tax authorities, which may result in further legal complications.

Digital vs. Paper Version of the Nevada Commerce Tax Form

Businesses have the option to file the Nevada Commerce Tax return electronically or via paper forms. The digital version offers benefits such as faster processing times and reduced chances of errors. Electronic filing is also more secure, as it often includes features like eSignature capabilities and automatic validation checks, ensuring that submissions meet legal requirements.

Eligibility Criteria for the Nevada Commerce Tax

Eligibility for the Nevada Commerce Tax is primarily based on the business's gross revenue. Any business entity with gross revenue exceeding four hundred thousand dollars during the taxable year is subject to this tax. Understanding these criteria is essential for business owners to determine their tax obligations accurately.

Quick guide on how to complete or nvbid

Easily Prepare Or NVBID on Any Device

Digital document management has become increasingly favored by organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork since you can locate the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents quickly without hesitation. Manage Or NVBID on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Or NVBID effortlessly

- Find Or NVBID and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether it’s via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Or NVBID to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct or nvbid

Create this form in 5 minutes!

How to create an eSignature for the or nvbid

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the Nevada commerce tax and who needs to pay it?

The Nevada commerce tax is a gross receipts tax imposed on businesses generating over $4 million in revenue. It applies to various types of businesses operating within Nevada. Understanding this tax is crucial for compliance and can impact your business planning.

-

How can airSlate SignNow help with managing Nevada commerce tax documentation?

airSlate SignNow provides a streamlined solution for managing documents related to the Nevada commerce tax. You can easily create, send, and sign important tax-related documents securely and efficiently, ensuring compliance and reducing manual processes.

-

What are the pricing options for airSlate SignNow for businesses dealing with Nevada commerce tax?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, including those managing Nevada commerce tax. You can choose a plan that suits your needs, ensuring you benefit from cost-effective document management solutions.

-

Can airSlate SignNow integrate with accounting software for Nevada commerce tax reporting?

Yes, airSlate SignNow can seamlessly integrate with popular accounting software to assist in Nevada commerce tax reporting. This ensures that your financial documents are efficiently handled and helps maintain accurate records for your tax obligations.

-

What features does airSlate SignNow offer to assist with compliance for the Nevada commerce tax?

airSlate SignNow offers features like automated workflows, templates, and secure e-signature capabilities, all of which aid compliance with Nevada commerce tax requirements. These tools help simplify the document submission process, reducing the risk of errors and improving accuracy.

-

How does using airSlate SignNow benefit businesses dealing with Nevada commerce tax?

Using airSlate SignNow enhances efficiency for businesses facing Nevada commerce tax obligations. The platform allows for quick and secure document processing, reducing turnaround times and ensuring that your business remains compliant with state tax laws.

-

Is airSlate SignNow user-friendly for handling Nevada commerce tax documents?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, even for those unfamiliar with handling Nevada commerce tax documents. Its easy navigation and helpful tools make it simple for any employee to manage tax-related documentation.

Get more for Or NVBID

Find out other Or NVBID

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile