Nevada Commerce Tax 2016

What is the Nevada Commerce Tax

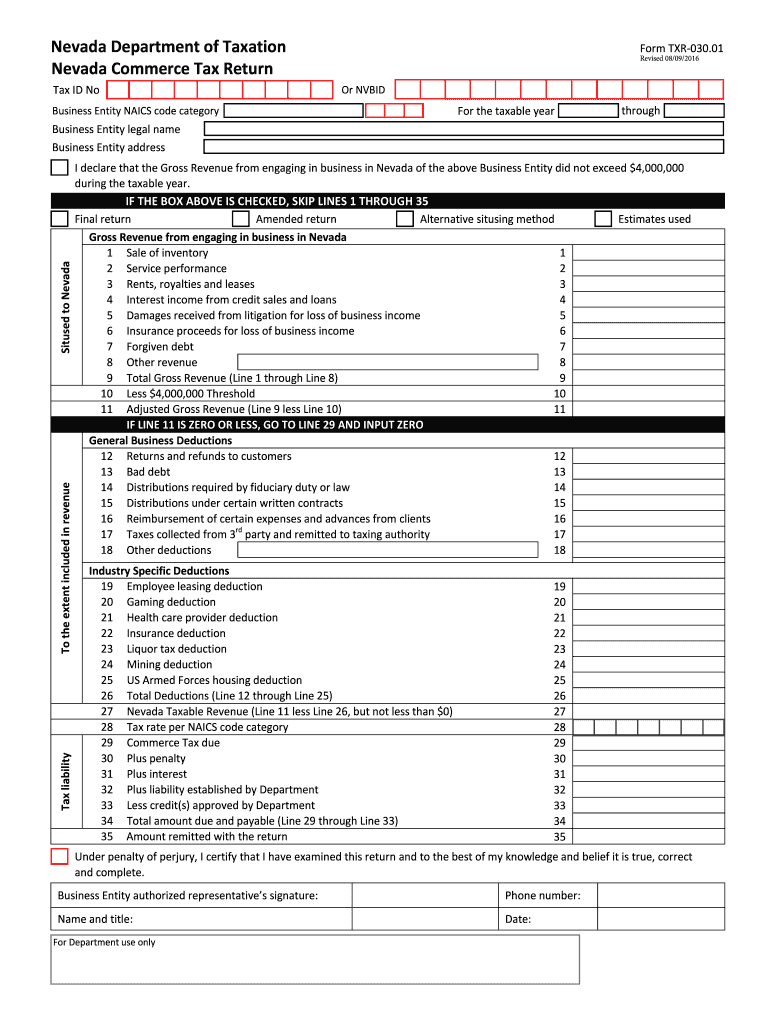

The Nevada Commerce Tax is a tax imposed on businesses operating in Nevada that have a gross revenue exceeding four hundred thousand dollars in a fiscal year. This tax applies to various business entities, including corporations and limited liability companies. The rate of the tax varies based on the industry classification of the business, which is determined by the North American Industry Classification System (NAICS). Understanding the Nevada Commerce Tax is crucial for compliance and financial planning for businesses operating within the state.

Steps to complete the Nevada Commerce Tax

Completing the Nevada Commerce Tax involves several key steps to ensure accurate reporting and compliance. First, businesses must determine their gross revenue for the fiscal year. Next, they need to classify their business according to the appropriate NAICS code. After determining the classification, businesses can calculate the tax owed based on their revenue and the applicable rate for their industry. Finally, the completed Nevada Commerce Tax form must be submitted to the Nevada Department of Taxation by the specified deadline.

Legal use of the Nevada Commerce Tax

To ensure the legal validity of the Nevada Commerce Tax, businesses must adhere to specific regulations outlined by the Nevada Department of Taxation. This includes using the official Nevada Commerce Tax form, accurately reporting gross revenues, and submitting the form by the deadline. Failure to comply with these regulations can result in penalties and interest charges. It is essential for businesses to maintain accurate records and documentation to support their tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada Commerce Tax are critical for compliance. Businesses must submit their tax returns annually, with the due date typically falling on the last day of the month following the end of the fiscal year. For example, if a business's fiscal year ends on June 30, the Nevada Commerce Tax return would be due by July 31. It is important for businesses to be aware of these deadlines to avoid penalties and ensure timely compliance.

Required Documents

When filing the Nevada Commerce Tax, businesses must prepare and submit several key documents. These typically include the completed Nevada Commerce Tax form, supporting documentation that verifies gross revenue, and any additional forms required for specific deductions or credits. Maintaining organized records is essential for substantiating the information reported on the tax form and for addressing any potential inquiries from the Nevada Department of Taxation.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit their Nevada Commerce Tax forms through various methods. The preferred method is online submission via the Nevada Department of Taxation's website, which allows for quicker processing and confirmation of receipt. Alternatively, businesses may choose to mail their completed forms to the department or deliver them in person. Each method has its own advantages, and businesses should select the one that best fits their operational needs.

Quick guide on how to complete nevada commerce tax

Complete Nevada Commerce Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Nevada Commerce Tax on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Nevada Commerce Tax with ease

- Obtain Nevada Commerce Tax and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Nevada Commerce Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nevada commerce tax

Create this form in 5 minutes!

How to create an eSignature for the nevada commerce tax

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is nv commerce tax and how does it affect my business?

NV commerce tax is a tax imposed on businesses in Nevada based on their gross revenue. It's essential for business owners to understand their obligations under this tax to ensure compliance and avoid penalties. Utilizing tools like airSlate SignNow can help streamline document signing related to nv commerce tax filings.

-

How can airSlate SignNow assist with nv commerce tax documentation?

AirSlate SignNow simplifies the process of signing and managing documents necessary for nv commerce tax compliance. With our platform, you can easily create, send, and eSign tax-related documents, ensuring that you meet all filing deadlines effortlessly. Our user-friendly interface makes managing these documents a breeze.

-

What are the pricing options for using airSlate SignNow in relation to nv commerce tax?

AirSlate SignNow offers flexible pricing plans tailored to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage your nv commerce tax documentation without breaking the bank. Check our pricing page to find a plan that best suits your business needs.

-

Does airSlate SignNow integrate with accounting software for nv commerce tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms, making it easier to manage your nv commerce tax obligations. By integrating our eSignature solutions, you can synchronize your financial documentation and ensure all tax forms are correctly completed and submitted on time.

-

What features does airSlate SignNow offer to simplify working with nv commerce tax?

AirSlate SignNow includes features like customizable templates, automated reminders, and secure cloud storage, which are invaluable for handling nv commerce tax documentation. These features help you streamline the signing process and keep all your tax-related documents organized and easily accessible.

-

Is airSlate SignNow secure for handling sensitive nv commerce tax documents?

Absolutely! AirSlate SignNow prioritizes security, utilizing advanced encryption and compliance with legal standards to protect your nv commerce tax documents. You can confidently manage and sign sensitive tax forms, knowing that your information is safeguarded at all times.

-

Can I access airSlate SignNow on mobile for nv commerce tax filings?

Yes, airSlate SignNow offers a mobile-friendly platform that allows you to manage your nv commerce tax filings on-the-go. With our mobile app, you can easily send documents for signature and review completed forms, ensuring that you stay compliant even while traveling or working remotely.

Get more for Nevada Commerce Tax

Find out other Nevada Commerce Tax

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract