Colorado Withholding Tax Form 2020

What is the Colorado Withholding Tax Form

The Colorado Withholding Tax Form is a critical document used by employers in Colorado to report and remit state income tax withheld from employees' wages. This form ensures that the state receives the appropriate tax revenue from employees throughout the year. Employers are required to complete and submit this form regularly, typically on a quarterly basis, depending on their withholding amounts. Understanding this form is essential for compliance with state tax laws and for maintaining accurate payroll records.

How to use the Colorado Withholding Tax Form

Using the Colorado Withholding Tax Form involves several key steps. First, employers must accurately calculate the amount of state income tax to withhold from each employee's paycheck based on their earnings and the applicable tax rates. Once the amounts are determined, employers fill out the form, providing necessary details such as the employer's identification number, employee information, and the total amount withheld. After completing the form, employers must submit it to the Colorado Department of Revenue by the designated deadlines to ensure compliance and avoid penalties.

Steps to complete the Colorado Withholding Tax Form

Completing the Colorado Withholding Tax Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather employee information, including names, Social Security numbers, and wages.

- Determine the withholding amounts based on the current tax rates and employee earnings.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the Colorado Department of Revenue by the specified deadline.

Legal use of the Colorado Withholding Tax Form

The Colorado Withholding Tax Form must be used in accordance with state laws and regulations. Employers are legally obligated to withhold the correct amount of state income tax from employee wages and report this information accurately. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to stay informed about any changes to tax laws that may affect their withholding practices.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Withholding Tax Form are crucial for employers to adhere to in order to avoid penalties. Typically, forms are due on a quarterly basis, with specific deadlines for each quarter. Employers should mark their calendars for these important dates:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

Employers have various options for submitting the Colorado Withholding Tax Form. The form can be submitted online through the Colorado Department of Revenue's website, which offers a convenient and efficient way to file. Alternatively, employers may choose to mail the form to the appropriate address provided by the state or submit it in person at a local tax office. Each submission method has its own benefits, and employers should select the one that best fits their needs.

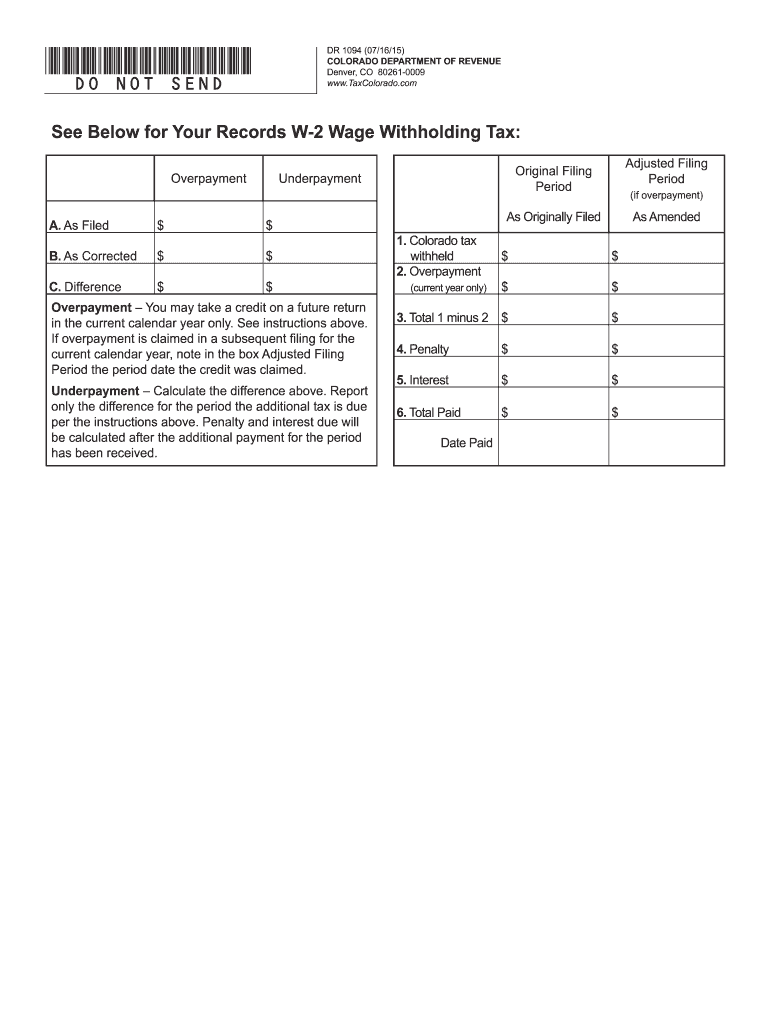

Quick guide on how to complete colorado withholding tax 2015 form

Prepare Colorado Withholding Tax Form effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Colorado Withholding Tax Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Colorado Withholding Tax Form with ease

- Locate Colorado Withholding Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would prefer to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Colorado Withholding Tax Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado withholding tax 2015 form

Create this form in 5 minutes!

How to create an eSignature for the colorado withholding tax 2015 form

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Colorado Withholding Tax Form and why is it important?

The Colorado Withholding Tax Form is a document used by employers to report and remit income tax withheld from employee wages to the state of Colorado. It is important because it ensures compliance with state tax laws and helps maintain accurate tax records for your business.

-

How can airSlate SignNow help me with the Colorado Withholding Tax Form?

airSlate SignNow provides a platform for businesses to easily create, send, and eSign the Colorado Withholding Tax Form. Our solution simplifies the process, ensuring all necessary signatures are obtained quickly while keeping documents secure and accessible.

-

Is there a cost for using airSlate SignNow for the Colorado Withholding Tax Form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Each plan includes features that facilitate the completion and submission of documents like the Colorado Withholding Tax Form, ensuring a cost-effective solution for managing tax-related paperwork.

-

What features does airSlate SignNow offer for eSigning the Colorado Withholding Tax Form?

airSlate SignNow includes features such as customizable templates, bulk sending, and secure eSigning specifically designed for documents like the Colorado Withholding Tax Form. These functionalities make it easy to manage multiple submissions efficiently while ensuring compliance and security.

-

Can I integrate airSlate SignNow with my existing software for filing the Colorado Withholding Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and payroll software, making it easy to incorporate the Colorado Withholding Tax Form into your existing workflow. This integration enhances efficiency and helps maintain organized records.

-

How does airSlate SignNow enhance the security of the Colorado Withholding Tax Form?

airSlate SignNow prioritizes security with features like encrypted document storage and secure user authentication to protect your Colorado Withholding Tax Form and other sensitive documents. This ensures your information remains confidential and compliant with regulations.

-

What are the benefits of using airSlate SignNow for the Colorado Withholding Tax Form?

Using airSlate SignNow for the Colorado Withholding Tax Form streamlines the eSigning process, reduces turnaround time, and enhances overall productivity. Additionally, it provides a secure way to manage compliance and keep track of all submissions in one place.

Get more for Colorado Withholding Tax Form

Find out other Colorado Withholding Tax Form

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form