Ct 1065 Form 2019

What is the Ct 1065 Form

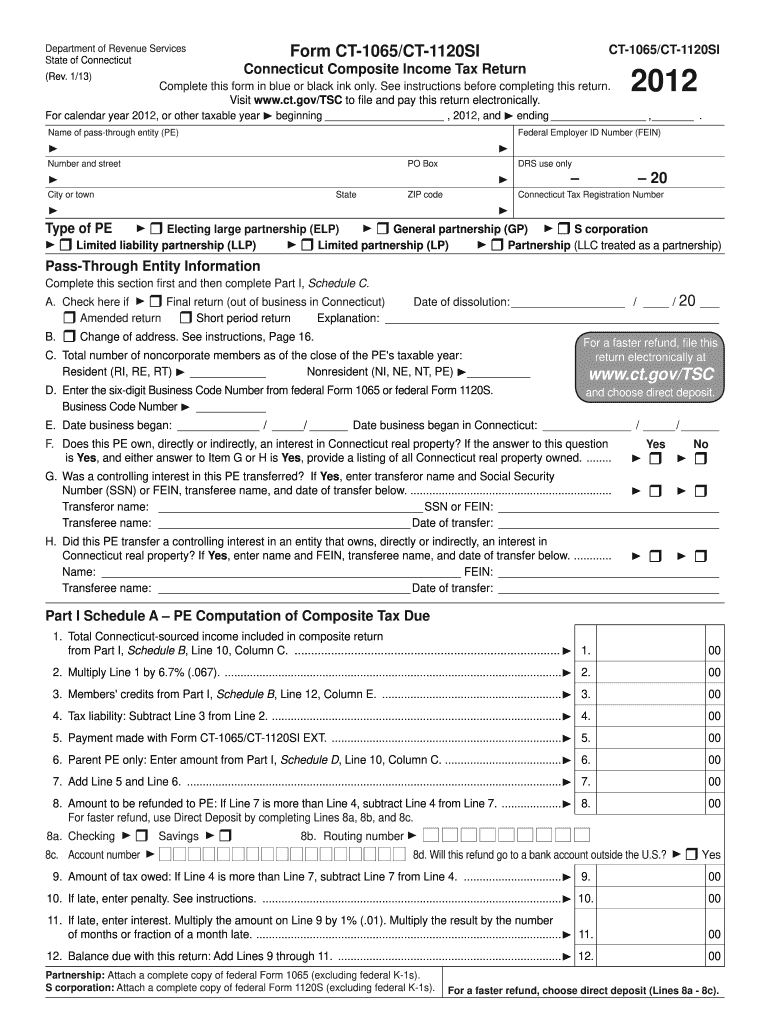

The Ct 1065 Form is a tax document used by partnerships in Connecticut to report income, gains, losses, deductions, and credits. It serves as an informational return that provides the state with details about the partnership's financial activities during the tax year. This form is essential for ensuring compliance with state tax laws and is required for partnerships operating within Connecticut.

How to use the Ct 1065 Form

To effectively use the Ct 1065 Form, partnerships must accurately fill out the required sections, including income, deductions, and partner information. Each partner's share of income and deductions must be reported on their respective Schedule K-1 forms. It is crucial to ensure that all entries are clear and precise, as inaccuracies can lead to delays or penalties. Partnerships should also keep thorough records to support the figures reported on the form.

Steps to complete the Ct 1065 Form

Completing the Ct 1065 Form involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the partnership information section, including the name, address, and federal employer identification number (EIN).

- Report total income and deductions in the appropriate sections of the form.

- Complete the Schedule K-1 for each partner, detailing their share of income, deductions, and credits.

- Review the form for accuracy and ensure all required signatures are included.

Legal use of the Ct 1065 Form

The Ct 1065 Form is legally binding when filed correctly and on time. It must adhere to the regulations set forth by the Connecticut Department of Revenue Services. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for partnerships to understand their legal obligations regarding this form to avoid any potential legal issues.

Filing Deadlines / Important Dates

The filing deadline for the Ct 1065 Form typically aligns with the federal tax deadline, which is usually on the fifteenth day of the third month following the end of the tax year. For partnerships operating on a calendar year, this means the form is due by March 15. Extensions may be available, but it is important to file any necessary extension requests on time to avoid penalties.

Required Documents

To complete the Ct 1065 Form, partnerships will need several key documents, including:

- Financial statements detailing income and expenses.

- Records of each partner's capital contributions and withdrawals.

- Previous year’s tax returns, if applicable.

- Any supporting documentation for deductions claimed.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1065 Form can be submitted through various methods. Partnerships may choose to file electronically using the Connecticut Department of Revenue Services online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided by the state. In-person submissions are also accepted at designated state offices. It is important to choose a method that ensures timely delivery to avoid late filing penalties.

Quick guide on how to complete ct 1065 2012 form

Complete Ct 1065 Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to generate, modify, and eSign your documents quickly and without interruptions. Handle Ct 1065 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Ct 1065 Form with ease

- Obtain Ct 1065 Form and click on Get Form to begin.

- Use the tools we offer to finalize your document.

- Mark pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and eSign Ct 1065 Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1065 2012 form

Create this form in 5 minutes!

How to create an eSignature for the ct 1065 2012 form

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Ct 1065 Form?

The Ct 1065 Form is a state tax return used by partnerships in Connecticut to report income, deductions, and other pertinent financial information. This form is essential for correct tax compliance and ensures that all partners report their shares of income accurately. Understanding the Ct 1065 Form is crucial for business owners engaging with partners in Connecticut.

-

How can airSlate SignNow help with the Ct 1065 Form?

airSlate SignNow provides a convenient platform for sending and electronically signing the Ct 1065 Form. Our user-friendly interface allows businesses to streamline the signing process, ensuring that all required partners can easily eSign the document. This not only saves time but also enhances accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for the Ct 1065 Form?

airSlate SignNow offers competitive pricing plans tailored to different business needs, making it cost-effective to manage documents like the Ct 1065 Form. Our pricing includes various features such as unlimited document signing and cloud storage. Check our website for detailed pricing plans that suit your requirements.

-

Is airSlate SignNow secure for signing the Ct 1065 Form?

Yes, airSlate SignNow is committed to providing a secure environment for signing the Ct 1065 Form and other sensitive documents. We use advanced encryption methods and comply with industry standards to protect your data. You can sign with confidence, knowing that your information is safe.

-

What features does airSlate SignNow offer for managing the Ct 1065 Form?

With airSlate SignNow, you can easily customize, send, and track the Ct 1065 Form. Features such as automated reminders, status tracking, and templates save you time and enhance the overall efficiency of the signing process. Our tools are designed to simplify document management for all your business needs.

-

Can I integrate airSlate SignNow with other applications for the Ct 1065 Form?

Absolutely! airSlate SignNow seamlessly integrates with various business applications to enhance your workflow when dealing with the Ct 1065 Form. Whether you're using CRM systems or accounting software, our integrations allow you to manage documents efficiently across different platforms.

-

How quickly can I get the Ct 1065 Form signed using airSlate SignNow?

airSlate SignNow streamlines the signing process for the Ct 1065 Form, enabling you to receive signatures in a matter of minutes. Our platform reduces delays associated with traditional signing methods, allowing you to complete your filings promptly. Say goodbye to paper-based processes!

Get more for Ct 1065 Form

- Wire transfer form bank of america

- Emedny 15003 form

- Dependable credit corp form

- Dppc reporting form

- Change of payer for medishield life cover form

- Timesheet template daily medical temp time sheet form

- Ringwood secondary collegebuilding an even better future form

- Retail bond numberretail bond lodgement office use form

Find out other Ct 1065 Form

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document