Form Ct 706 Nt 2020

What is the Form CT 706 NT

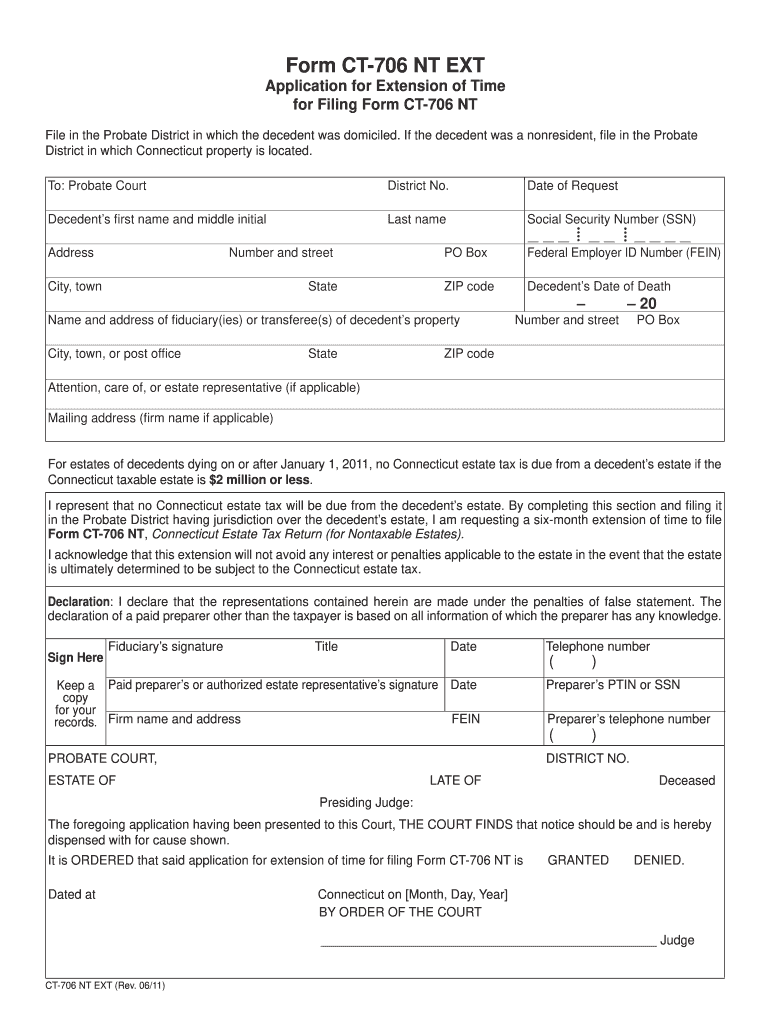

The Form CT 706 NT is a tax form used in the state of Connecticut for the purpose of reporting the estate tax of a decedent who passed away after January 1, 2010. This form is specifically designed for estates that do not exceed the federal estate tax exemption amount. It is essential for the executor or administrator of the estate to accurately complete this form to ensure compliance with state tax laws.

How to obtain the Form CT 706 NT

The Form CT 706 NT can be obtained from the Connecticut Department of Revenue Services (DRS) website. It is available for download in a PDF format, allowing users to print and fill it out manually. Additionally, the form may also be accessible through various tax preparation software that supports Connecticut estate tax filings.

Steps to complete the Form CT 706 NT

Completing the Form CT 706 NT involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including asset valuations, debts, and any previous tax returns.

- Fill out the form: Input the required information accurately, ensuring that all fields are completed as per the instructions provided on the form.

- Review the form: Double-check all entries for accuracy and completeness to avoid any potential issues.

- Sign and date: Ensure that the executor or administrator signs and dates the form before submission.

- Submit the form: Follow the appropriate submission method as outlined in the guidelines.

Legal use of the Form CT 706 NT

The Form CT 706 NT is legally binding and must be filed in accordance with Connecticut state law. It serves as a declaration of the estate's tax liability and must be submitted within the specified deadlines to avoid penalties. Proper use of this form ensures that the estate is compliant with state tax regulations, which can help in the smooth transfer of assets to beneficiaries.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form CT 706 NT. Generally, the form must be filed within six months of the decedent's date of death. However, extensions may be available under certain circumstances. Keeping track of these deadlines helps prevent late fees and additional penalties.

Required Documents

When preparing to file the Form CT 706 NT, several documents are typically required:

- Death certificate of the decedent

- Asset valuations, including real estate and financial accounts

- Documentation of debts and liabilities

- Previous tax returns, if applicable

Form Submission Methods (Online / Mail / In-Person)

The Form CT 706 NT can be submitted in various ways, depending on the preferences of the executor or administrator:

- Online: Some tax preparation software may allow for electronic filing.

- Mail: The completed form can be printed and mailed to the Connecticut Department of Revenue Services.

- In-Person: Individuals may also choose to submit the form in person at designated DRS offices.

Quick guide on how to complete 2011 form ct 706 nt

Handle Form Ct 706 Nt seamlessly on any device

Digital document management has become favored by businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form Ct 706 Nt on any platform using airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to modify and eSign Form Ct 706 Nt effortlessly

- Locate Form Ct 706 Nt and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form Ct 706 Nt and ensure clear communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form ct 706 nt

Create this form in 5 minutes!

How to create an eSignature for the 2011 form ct 706 nt

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form Ct 706 Nt and why is it important?

Form Ct 706 Nt is a vital document used for Connecticut Estate Tax purposes, specifically for estates that do not owe any estate tax. Completing this form correctly can help ensure compliance with state regulations and avoid potential penalties.

-

How can airSlate SignNow assist in signing Form Ct 706 Nt?

airSlate SignNow streamlines the signing process for Form Ct 706 Nt, allowing users to electronically sign documents securely and efficiently. With our platform, you can easily send, receive, and manage signatures, saving time and ensuring the document is executed properly.

-

What features does airSlate SignNow offer for handling Form Ct 706 Nt?

airSlate SignNow provides a range of features tailored for handling Form Ct 706 Nt, including customizable templates, automated workflows, and document tracking. These tools help users manage their documents more effectively and ensure timely submission.

-

Is airSlate SignNow a cost-effective solution for managing Form Ct 706 Nt?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring a cost-effective solution for managing Form Ct 706 Nt. Our platform eliminates the need for paper documents and the costs associated with traditional signing methods.

-

Can Form Ct 706 Nt be integrated with other applications using airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing users to fill out and manage Form Ct 706 Nt alongside their preferred tools. This integration enhances productivity by enabling easy access to all necessary documents within one ecosystem.

-

What are the benefits of using airSlate SignNow for Form Ct 706 Nt?

Using airSlate SignNow to manage Form Ct 706 Nt offers numerous benefits, including improved efficiency, enhanced security, and reduced paper clutter. The platform's user-friendly interface allows users to complete their forms quickly and with less hassle.

-

Is it easy to get started with airSlate SignNow for Form Ct 706 Nt?

Yes, getting started with airSlate SignNow for Form Ct 706 Nt is easy! Simply sign up for an account, choose a pricing plan that suits your needs, and start uploading and managing your documents within minutes.

Get more for Form Ct 706 Nt

Find out other Form Ct 706 Nt

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer