Connecticut Schedule Form 2019

What is the Connecticut Schedule Form

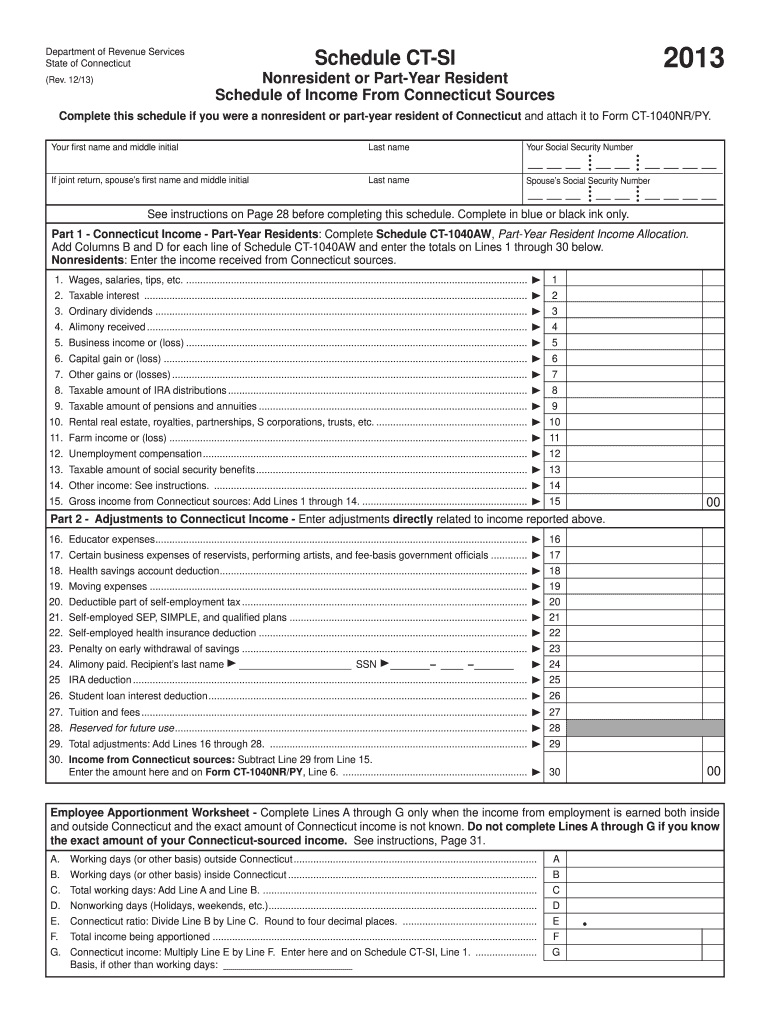

The Connecticut Schedule Form is a tax document used by residents of Connecticut to report various types of income and claim deductions. This form is essential for individuals and businesses to accurately calculate their state tax obligations. It is typically used in conjunction with the Connecticut income tax return and is designed to capture specific financial details that may affect tax liability. Understanding this form is crucial for ensuring compliance with state tax laws.

How to use the Connecticut Schedule Form

Using the Connecticut Schedule Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully read the instructions provided with the form to understand what information is required. Fill out the form by entering your income details, claiming applicable deductions, and ensuring all calculations are correct. Once completed, review the form for accuracy before submission.

Steps to complete the Connecticut Schedule Form

Completing the Connecticut Schedule Form requires a systematic approach:

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductible expenses.

- Read the instructions carefully to understand the requirements for each section of the form.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any taxable income.

- Claim deductions where applicable, providing necessary documentation to support your claims.

- Double-check all entries for accuracy and completeness before signing the form.

Legal use of the Connecticut Schedule Form

The Connecticut Schedule Form is legally binding when completed and submitted according to state regulations. It must be filled out truthfully and accurately to avoid penalties. The form is subject to review by the Connecticut Department of Revenue Services, which has the authority to audit submissions. Therefore, it is essential to retain copies of all documents submitted along with the form for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Schedule Form align with the state's tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates, as late submissions can result in penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Connecticut Schedule Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can e-file their forms through approved tax software, which often streamlines the process and reduces errors.

- Mail: Completed forms can be printed and mailed to the appropriate state tax office. Ensure to use the correct address as specified in the form instructions.

- In-Person: Some taxpayers may choose to submit their forms in person at designated state tax offices, where assistance may be available.

Quick guide on how to complete 2013 connecticut schedule form

Complete Connecticut Schedule Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly replacement for traditional printed and signed papers, allowing you to obtain the necessary format and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Connecticut Schedule Form on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Connecticut Schedule Form effortlessly

- Locate Connecticut Schedule Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere moments and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Alter and eSign Connecticut Schedule Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 connecticut schedule form

Create this form in 5 minutes!

How to create an eSignature for the 2013 connecticut schedule form

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Connecticut Schedule Form?

The Connecticut Schedule Form is a specific document used by businesses and individuals for reporting various tax-related information in Connecticut. This form streamlines the process of filing taxes by ensuring all necessary details are organized and submitted accurately.

-

How does airSlate SignNow facilitate completing the Connecticut Schedule Form?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out the Connecticut Schedule Form. Our solution allows users to easily enter their information, ensuring that all required fields are completed and ready for submission.

-

What are the pricing options for using airSlate SignNow for Connecticut Schedule Form?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. Whether you are a small business or a larger corporation, our plans offer cost-effective solutions for managing documents, including the Connecticut Schedule Form, with no hidden fees.

-

Can I integrate airSlate SignNow with other tools for managing the Connecticut Schedule Form?

Yes, airSlate SignNow integrates seamlessly with various software applications such as Google Drive, Dropbox, and CRM systems. This integration makes it easier for users to manage their Connecticut Schedule Form and other documents all in one place.

-

What features does airSlate SignNow offer for the Connecticut Schedule Form?

Our platform provides features like eSignature, document templates, and secure cloud storage, specifically tailored for the Connecticut Schedule Form. These features enable users to streamline their workflow and ensure compliance with state regulations.

-

Is airSlate SignNow secure for filing the Connecticut Schedule Form?

Absolutely! airSlate SignNow uses advanced encryption and compliance protocols to protect your data while completing the Connecticut Schedule Form. Our commitment to security ensures that your sensitive information remains confidential and safe.

-

What are the benefits of using airSlate SignNow for the Connecticut Schedule Form?

By using airSlate SignNow for the Connecticut Schedule Form, businesses can enhance efficiency, reduce paperwork, and save valuable time. Our user-friendly platform enables faster processing and better accuracy, making tax filing a hassle-free experience.

Get more for Connecticut Schedule Form

Find out other Connecticut Schedule Form

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile