Sc Tax Form Pt 401 Exemption 2012

What is the SC Tax Form PT 401 Exemption

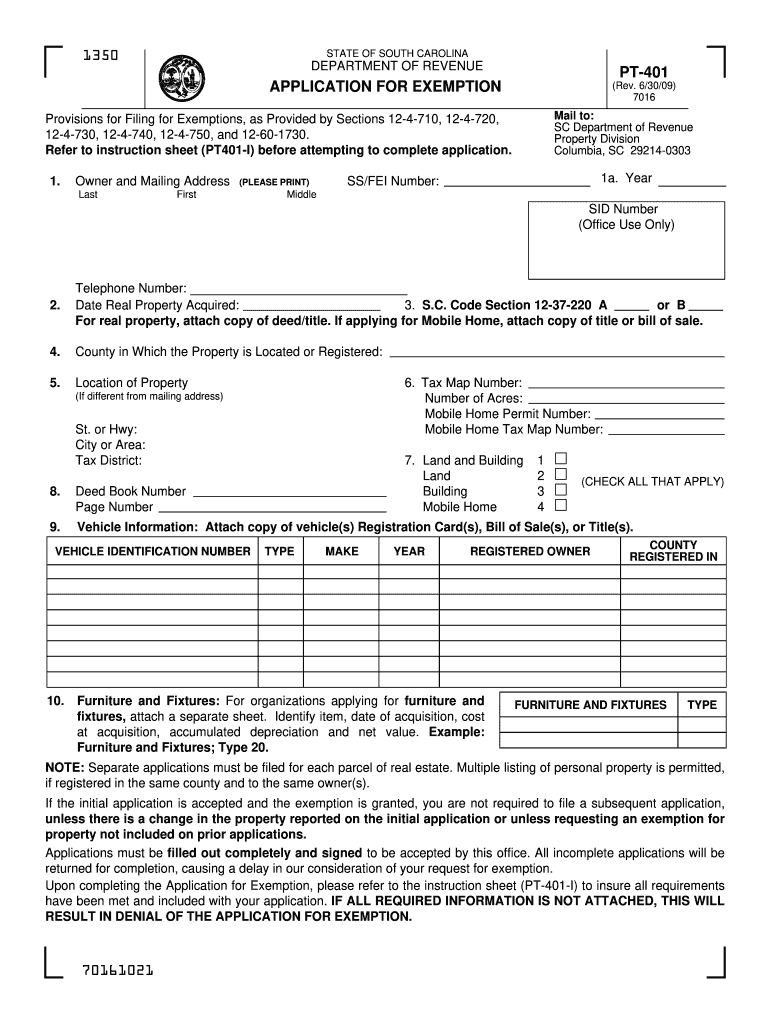

The SC Tax Form PT 401 Exemption is a document used by taxpayers in South Carolina to claim an exemption from property taxes. This form is specifically designed for certain entities, such as nonprofit organizations and government entities, that qualify for tax-exempt status under state law. By submitting this form, eligible organizations can reduce their property tax burden, allowing them to allocate more resources towards their mission-driven activities.

How to Use the SC Tax Form PT 401 Exemption

To effectively use the SC Tax Form PT 401 Exemption, organizations must first ensure they meet the eligibility criteria outlined by the South Carolina Department of Revenue. Once eligibility is confirmed, the form should be completed with accurate information regarding the organization’s status and the property in question. After filling out the form, it must be submitted to the appropriate local tax authority to initiate the exemption process.

Steps to Complete the SC Tax Form PT 401 Exemption

Completing the SC Tax Form PT 401 Exemption involves several key steps:

- Gather necessary documentation that proves the organization’s tax-exempt status.

- Fill out the form with accurate details, including the organization’s name, address, and the specific property for which the exemption is being claimed.

- Review the form to ensure all information is correct and complete.

- Submit the completed form to the local tax authority by the specified deadline.

Eligibility Criteria

To qualify for the SC Tax Form PT 401 Exemption, organizations must meet certain eligibility criteria. Generally, this includes being a nonprofit organization or a government entity that operates for charitable, educational, or religious purposes. Additionally, the property for which the exemption is sought must be used exclusively for these purposes. Organizations should consult the South Carolina Department of Revenue for specific requirements and guidelines.

Form Submission Methods

The SC Tax Form PT 401 Exemption can be submitted through various methods, depending on the local tax authority's preferences. Common submission methods include:

- Online submission through the local tax authority's website, if available.

- Mailing a physical copy of the completed form to the appropriate office.

- In-person submission at the local tax authority’s office during business hours.

Legal Use of the SC Tax Form PT 401 Exemption

The legal use of the SC Tax Form PT 401 Exemption is governed by state tax laws, which outline the criteria and procedures for claiming property tax exemptions. Organizations must ensure compliance with these laws to avoid penalties or denial of the exemption. It is important for organizations to maintain accurate records and documentation to support their claims, as these may be required for audits or reviews by tax authorities.

Quick guide on how to complete sc tax form pt 401 exemption 2009

Prepare Sc Tax Form Pt 401 Exemption effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the proper format and safely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Sc Tax Form Pt 401 Exemption on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The simplest way to modify and eSign Sc Tax Form Pt 401 Exemption without hassle

- Obtain Sc Tax Form Pt 401 Exemption and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize critical sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Sc Tax Form Pt 401 Exemption and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc tax form pt 401 exemption 2009

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the SC Tax Form Pt 401 Exemption?

The SC Tax Form Pt 401 Exemption is a document used by businesses to claim exemptions from certain state taxes in South Carolina. This form outlines specific criteria for qualifying entities to ensure compliance with state tax regulations. Proper understanding and usage of this form are essential for any business looking to take advantage of available exemptions.

-

How can airSlate SignNow help with SC Tax Form Pt 401 Exemption?

AirSlate SignNow simplifies the process of sending and signing the SC Tax Form Pt 401 Exemption electronically. Our platform provides a user-friendly interface, allowing users to eSign documents and ensure they are correctly completed and submitted. This efficiency reduces processing time and helps maintain compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for SC Tax Form Pt 401 Exemption?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Users can choose from various packages depending on their document volume and specific requirements. This cost-effective solution ensures that companies can manage their SC Tax Form Pt 401 Exemption with minimal expense.

-

What features does airSlate SignNow offer for managing SC Tax Form Pt 401 Exemption?

AirSlate SignNow includes features like customizable templates, robust security protocols, and cloud storage for easy access to your SC Tax Form Pt 401 Exemption and other documents. Additionally, real-time tracking and notifications ensure you stay informed throughout the signing process. These features enhance efficiency and accuracy in document management.

-

Can I integrate airSlate SignNow with other applications for SC Tax Form Pt 401 Exemption?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, such as CRM systems and accounting software, making it easier to handle the SC Tax Form Pt 401 Exemption. This interoperability allows businesses to streamline workflows and keep their documentation organized, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for SC Tax Form Pt 401 Exemption?

Using airSlate SignNow for the SC Tax Form Pt 401 Exemption provides numerous benefits, including enhanced efficiency, greater security, and easier access to documents. The electronic signature feature ensures that all necessary parties can sign swiftly from any device. Furthermore, it helps maintain compliance with tax regulations by keeping your documents organized and easily retrievable.

-

Is airSlate SignNow compliant with state and federal regulations regarding SC Tax Form Pt 401 Exemption?

Yes, airSlate SignNow complies with both state and federal regulations regarding electronic signatures and document management, including the SC Tax Form Pt 401 Exemption. Our software adheres to strict security protocols and best practices to ensure the integrity and legality of all signed documents. This compliance provides peace of mind for businesses relying on electronic documentation.

Get more for Sc Tax Form Pt 401 Exemption

Find out other Sc Tax Form Pt 401 Exemption

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form