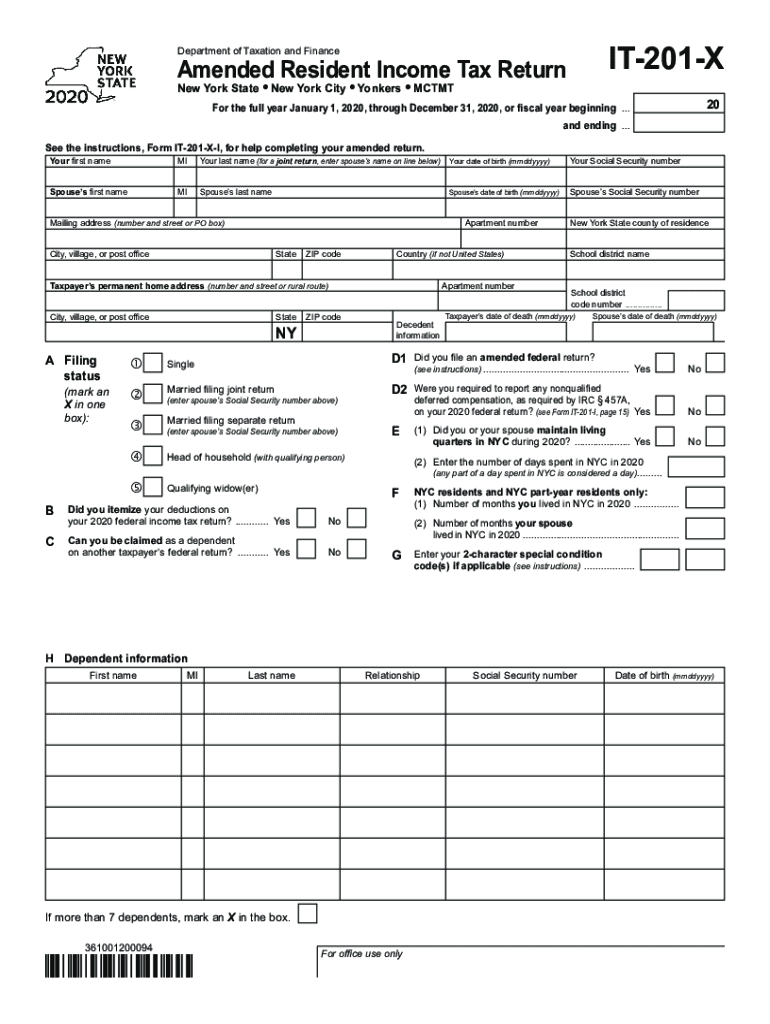

D2 Were You Required to Report Any Nonqualified 2020

Understanding the D2 Reporting Requirement

The D2 form, specifically related to nonqualified reporting, is used to disclose certain financial information to the IRS. This form is essential for taxpayers who have received nonqualified distributions, which may include income from various sources that do not meet the criteria for qualified distributions. Understanding what qualifies as nonqualified income is crucial for accurate reporting and compliance with IRS regulations.

Steps to Complete the D2 Form

Completing the D2 form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents that reflect your income sources. Next, carefully fill out the form, ensuring that each section is completed according to IRS guidelines. Pay special attention to the sections that require specific details about the nonqualified income. After completing the form, review it for any errors or omissions before submission.

Legal Use of the D2 Form

The D2 form serves a legal purpose by ensuring that taxpayers report their nonqualified income correctly. Compliance with this requirement is essential, as failure to report accurately can lead to penalties and interest on unpaid taxes. The legal framework surrounding the D2 form is designed to maintain transparency in financial reporting and uphold tax laws established by the IRS.

Filing Deadlines for the D2 Form

It is important to be aware of the filing deadlines associated with the D2 form to avoid penalties. Generally, the D2 form must be submitted by the tax return due date, which is typically April 15 for most taxpayers. If you are unable to meet this deadline, consider filing for an extension to ensure compliance and avoid late fees.

Required Documents for the D2 Form

When preparing to file the D2 form, certain documents are required to substantiate the reported nonqualified income. These documents may include W-2 forms, 1099 forms, and any other relevant financial statements that detail your income sources. Keeping organized records will facilitate the completion of the D2 form and help ensure that all necessary information is accurately reported.

Penalties for Non-Compliance with the D2 Form

Failure to comply with the D2 reporting requirements can result in significant penalties. The IRS may impose fines for late submissions or inaccuracies, which can accumulate over time. Understanding these potential penalties underscores the importance of timely and accurate reporting of nonqualified income to avoid unnecessary financial burdens.

Examples of Nonqualified Income Reporting

Examples of nonqualified income that may need to be reported on the D2 form include distributions from retirement accounts that do not meet the necessary criteria for qualified distributions, as well as certain types of bonuses or incentives from employers. By recognizing these examples, taxpayers can better understand their reporting obligations and ensure compliance with IRS regulations.

Quick guide on how to complete d2 were you required to report any nonqualified

Complete D2 Were You Required To Report Any Nonqualified effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage D2 Were You Required To Report Any Nonqualified on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest method to modify and eSign D2 Were You Required To Report Any Nonqualified effortlessly

- Locate D2 Were You Required To Report Any Nonqualified and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark important parts of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that task.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign D2 Were You Required To Report Any Nonqualified and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d2 were you required to report any nonqualified

Create this form in 5 minutes!

How to create an eSignature for the d2 were you required to report any nonqualified

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is form it 201 x and how does it benefit my business?

Form it 201 x is an innovative solution offered by airSlate SignNow that allows businesses to efficiently create, send, and electronically sign documents. This feature streamlines your document workflow, reduces delays, and enhances productivity. By adopting form it 201 x, you can enjoy a cost-effective and user-friendly approach to document management.

-

How much does form it 201 x cost?

The pricing for form it 201 x varies based on the features and number of users your business needs. airSlate SignNow offers flexible pricing plans designed to accommodate different budget levels. You can choose a plan that best suits your requirements and get started with an affordable solution.

-

Which features are included in form it 201 x?

Form it 201 x includes a range of features such as document creation, customizable templates, automated workflows, and secure electronic signatures. Additionally, it supports team collaboration, making it easier for multiple users to manage and sign documents efficiently. These features make form it 201 x a comprehensive solution for document management.

-

Can form it 201 x integrate with other applications?

Yes, form it 201 x can seamlessly integrate with numerous applications, enhancing your overall workflow. Whether you need to connect with CRM systems, cloud storage options, or project management tools, airSlate SignNow supports these integrations. This capability allows you to work within your existing ecosystem while utilizing the benefits of form it 201 x.

-

Is form it 201 x secure for my sensitive documents?

Absolutely, form it 201 x prioritizes the security of your sensitive documents. The platform employs advanced encryption protocols and complies with industry standards to ensure data protection. With airSlate SignNow, you can trust that your documents are safe while using form it 201 x for your signing and document management needs.

-

How easy is it to use form it 201 x?

Form it 201 x is designed to be user-friendly, allowing anyone to navigate its features without extensive training. The intuitive interface guides you through the process of creating, sending, and signing documents efficiently. Whether you're tech-savvy or not, you'll find it easy to make the most of form it 201 x.

-

Can I access form it 201 x on mobile devices?

Yes, form it 201 x is accessible on mobile devices, allowing you to manage your documents on the go. Whether you’re using a smartphone or tablet, you can create, send, and sign documents anytime, anywhere. This flexibility is one of the key benefits of using airSlate SignNow’s form it 201 x solution.

Get more for D2 Were You Required To Report Any Nonqualified

Find out other D2 Were You Required To Report Any Nonqualified

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe